A Guide to Valuing Stocks with Precision

In the world of finance and investment, understanding the metrics and methodologies for valuing stocks is crucial. Investors often rely on various rules and strategies to make informed decisions about their investments. One such rule that has garnered significant attention and respect is “Lynch’s Rule of 20,” named after the legendary investor Peter Lynch. So, let’s see the intricacies of Lynch’s Rule of 20, demystifying its concept and showcasing its relevance in today’s complex financial markets.

What is Lynch’s Rule of 20?

At its core, Lynch’s Rule of 20 is a straightforward yet powerful formula used to assess whether a stock is overvalued, undervalued, or priced just right. The rule combines two key factors: the Price-to-Earnings (P/E) ratio and the expected earnings growth rate of a stock.

Here’s the basic formula:

Fair Value P/E Ratio = Expected Earnings Growth Rate + 20

In essence, the fair value P/E ratio should equal the expected earnings growth rate plus 20. When the actual P/E ratio of a stock aligns with this fair value P/E, the stock is considered fairly valued. However, when the actual P/E ratio is lower than the fair value P/E, the stock may be undervalued, presenting a potential buying opportunity. Conversely, if the actual P/E ratio is higher than the fair value P/E, the stock may be overvalued, signaling caution for investors.

Why is Lynch’s Rule of 20 Significant?

Lynch’s Rule of 20 is significant for several reasons:

- Simplicity: The rule’s simplicity makes it accessible to both novice and experienced investors. It provides a quick and straightforward method for evaluating the relative value of a stock.

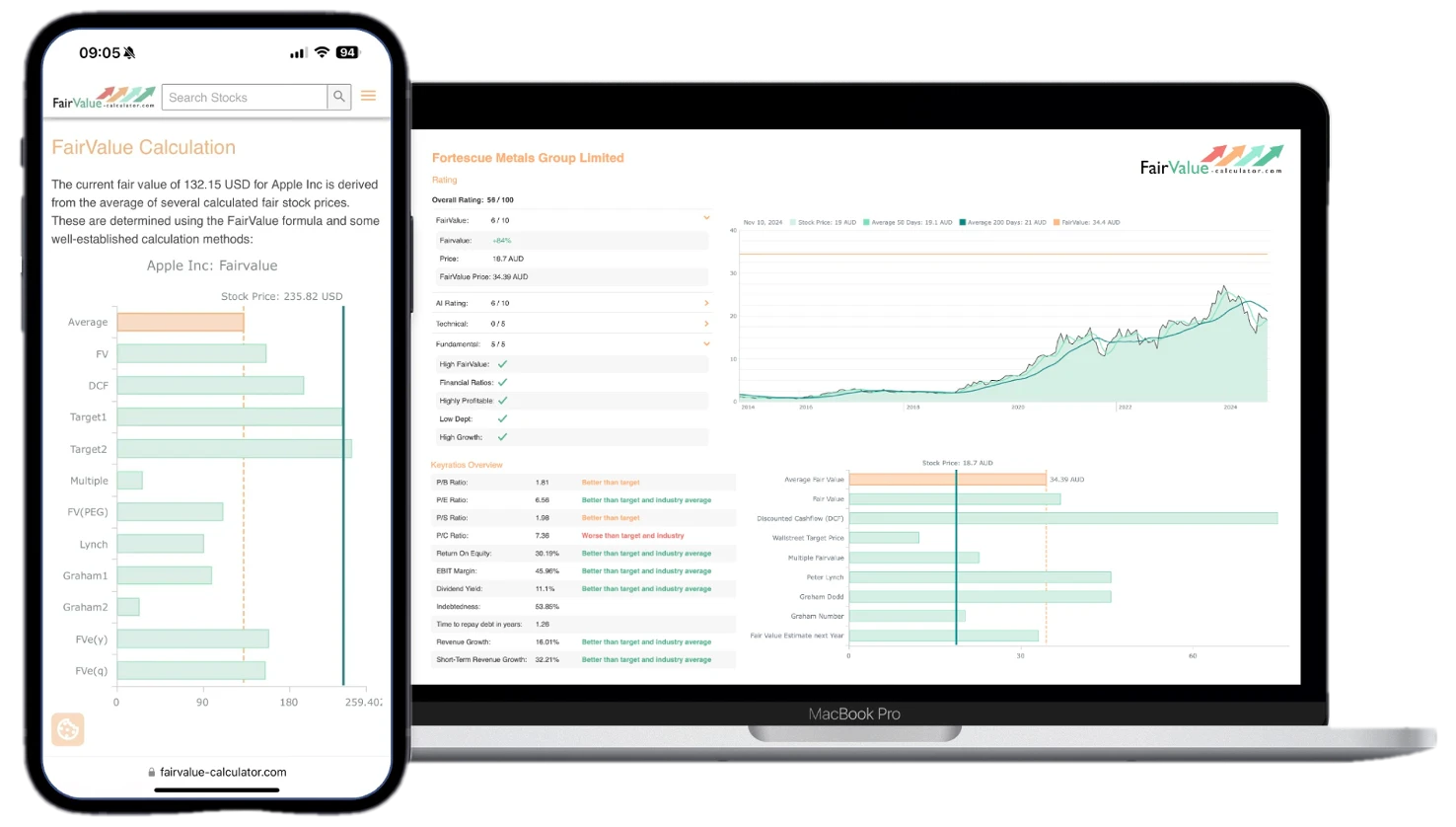

- Historical Track Record: Peter Lynch’s investment success speaks volumes about the rule’s effectiveness. Lynch managed the Fidelity Magellan Fund from 1977 to 1990, during which it averaged a remarkable annual return of 29%.

- Consideration of Growth: Unlike some valuation metrics that focus solely on current earnings, Lynch’s Rule of 20 incorporates future growth expectations. This makes it particularly relevant in evaluating growth stocks.

Putting Lynch’s Rule of 20 into Practice

Let’s walk through an example to illustrate how Lynch’s Rule of 20 works:

Suppose you’re interested in Company X, which is expected to have an earnings growth rate of 15% in the coming year. According to Lynch’s Rule of 20, the fair value P/E ratio would be:

Fair Value P/E Ratio = 15% (Expected Earnings Growth Rate) + 20 = 35

If Company X’s actual P/E ratio is 30, which is lower than the calculated fair value P/E of 35, it suggests that the stock may be undervalued based on Lynch’s Rule of 20. This could prompt further analysis and consideration for investment.

Limitations and Considerations

While Lynch’s Rule of 20 is a valuable tool, it’s essential to recognize its limitations:

- Simplified Assumptions: The rule simplifies complex market dynamics and may not account for all factors influencing stock prices.

- Varied Industries: Different industries may have different typical P/E ratios, making the rule less applicable in some sectors.

- Market Volatility: Rapid market fluctuations can affect the accuracy of the rule’s fair value calculation.

Lynch’s Rule of 20 is a valuable addition to an investor’s toolbox. It offers a straightforward approach to assessing the relative value of stocks, taking into account both current P/E ratios and expected earnings growth rates. While not a guarantee of investment success, understanding and applying this rule can help investors make more informed decisions in a complex and ever-changing financial landscape. By demystifying Lynch’s Rule of 20, investors can embark on a path toward greater precision in stock valuation and ultimately, potentially more profitable investment choices.