Benjamin Graham is considered one of the pioneers of value investing, a strategy that emphasizes buying stocks that are undervalued by the market. Graham’s investment philosophy has been a guiding principle for many investors over the years, and his methods are still widely followed today. In this article, we will explore the investment strategies of Benjamin Graham.

💡 Discover Powerful Investing Tools

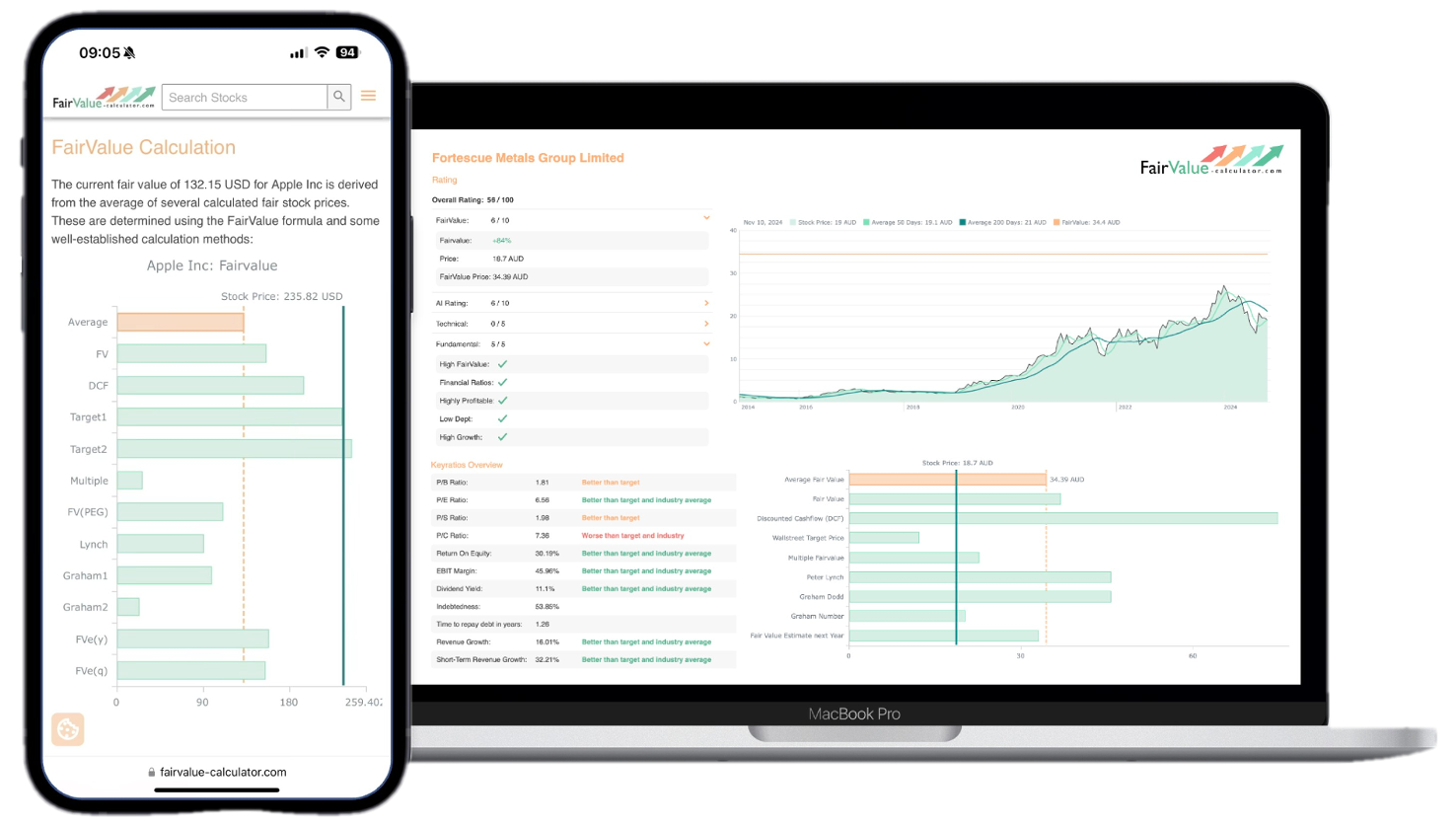

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Who was Benjamin Graham?

🚀 Test the Fair Value Calculator Now!

Find out in seconds whether your stock is truly undervalued or overpriced – based on fundamentals and future growth.

Try it for Free →Benjamin Graham was an American economist and investor born in London in 1894. He is widely considered the “Father of Value Investing“. Graham was a professor at Columbia Business School, where he taught value investing to some of the most successful investors of the 20th century, including Warren Buffett. Graham was also the author of several books, including “The Intelligent Investor” and “Security Analysis“.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

What are the investment strategies of Benjamin Graham?

- Invest in undervalued companies

Graham believed that a good investment was one in which the market price of the company’s stock was lower than its intrinsic value. He suggested that investors could find undervalued companies by using fundamental analysis, looking at a company’s financial statements and earnings reports, and comparing them to other similar companies in the same industry. By identifying companies that were trading below their true worth, investors could purchase the stocks at a discount and wait for the market to correct its mistake.

- Look for a margin of safety

Graham believed that investors should only purchase stocks with a margin of safety. This means that investors should only buy stocks when they are trading at a significant discount to their intrinsic value. Graham believed that a margin of safety would protect investors from the downside risk of the stock, even if the company’s performance did not improve.

- Invest for the long-term

Graham believed that investing was a long-term proposition. He suggested that investors should focus on the underlying value of the company and not the daily fluctuations in the stock price. Graham believed that by investing for the long term, investors could take advantage of the market’s tendency to correct itself over time.

- Diversify

Graham believed in the importance of diversification. He suggested that investors should not put all their money into one stock, but instead, spread their investments across multiple stocks in different industries. This would help to reduce the risk of a single stock or industry having a negative impact on the investor’s portfolio.

- Avoid speculation

Graham believed that investing was not the same as speculation. He suggested that investors should avoid speculative investments, such as stocks with high price-to-earnings ratios or new companies without a proven track record. Instead, Graham recommended that investors focus on established companies with a long history of profitability and stability.

Unveiling Benjamin Graham’s Timeless Investment Strategies

As a stock market consultant, I have analyzed the investment strategies of Benjamin Graham, the renowned pioneer of value investing. Graham’s philosophy has guided countless investors and continues to shape investment practices today. In this analysis, we will delve into the core strategies employed by Benjamin Graham and explore their applicability in the current market landscape.

Identifying Undervalued Companies

Utilizing advanced fair value calculators, we employ Graham’s approach to uncovering undervalued stocks. Through comprehensive fundamental analysis, we scrutinize financial statements, earnings reports, and industry comparisons. This allows us to identify companies trading below their intrinsic value, providing opportunities for investors to purchase stocks at discounted prices and capitalize on future market corrections.

Embracing the Margin of Safety

Implementing our analysis, we emphasize the significance of the margin of safety concept. By acquiring stocks that trade at significant discounts to their intrinsic value, investors can safeguard themselves against potential downside risks. Even if a company’s performance does not improve as anticipated, the margin of safety acts as a protective buffer.

The Power of Long-Term Investing

In alignment with Graham’s philosophy, we advocate for a long-term investment perspective. By focusing on a company’s underlying value rather than daily stock price fluctuations, investors can capitalize on the market’s inherent tendency to self-correct over time. Our analysis emphasizes the importance of patience and the advantages of maintaining a long-term investment horizon.

Achieving Balance through Diversification

Following Graham’s principles, we emphasize the necessity of diversification to mitigate risk. Our strategic guidance recommends spreading investments across multiple stocks in various industries. By doing so, investors can reduce exposure to any single stock or industry and achieve a well-balanced portfolio.

Shunning Speculation

Our analysis aligns with Graham’s belief that investing should not be driven by speculation. We advise investors to steer clear of high price-to-earnings ratio stocks and unproven companies lacking a stable track record. Instead, we encourage focusing on established companies with a history of profitability and stability, aligning with Graham’s preference for reliable investments.

A Disciplined Approach to Investing

Drawing from Graham’s wisdom, we stress the importance of a disciplined approach to investing. By avoiding impulsive decisions driven by market sentiment or short-term trends, investors can make informed choices. We advocate for comprehensive research, thorough analysis of financial statements, and reliance on relevant data when making investment decisions.

Additionally, Benjamin Graham believed that investors should have a disciplined approach to investing, and not let their emotions influence their decisions. He suggested that investors should avoid making impulsive decisions based on market sentiment or short-term trends. Instead, investors should conduct thorough research, analyze a company’s financial statements and other relevant information, and make informed decisions based on their findings.

Graham’s investment strategies have had a significant impact on the investing world, and his teachings have been studied and followed by some of the most successful investors of all time, including Warren Buffett. Buffett has often credited Graham as his mentor and role model and has said that Graham’s teachings have been the foundation of his own investment approach.

In conclusion, Benjamin Graham’s investment strategies have stood the test of time and continue to be relevant in today’s investing world. His emphasis on value investing, a margin of safety, long-term investing, diversification, and avoiding speculation, combined with a disciplined approach to investing, has proven to be a successful strategy for investors. Whether you are a novice or an experienced investor, following Graham’s investment principles can help you build a strong, diversified portfolio that will weather market fluctuations and deliver long-term returns.