Warren Buffett Fair Value Calculator

Warren Buffett Online Stock Fair Value Calculator

Insert earnings per share (EPS) and sales (revenue) growth with this calculator and get an estimate of the true value of the stock (fair value). Earnings per share and sales growth can be found via a Google search, in the annual report on the company’s website under “Investors Relations” or on financial websites.

Top Stocks: Warren Buffett Strategy

This list is updated daily by our Stock Screener Tool, covering more than 60,000 stocks worldwide. Discover this and many other Top-Lists inside the Fairvalue Calculator Premium Tool – try it now for free!

Warren Buffett' Approach to Valuing Stocks

Warren Buffett is widely considered one of the greatest investors of all time, and his investment philosophy and approach to stock valuation have been heavily studied and analyzed. In this article, we will discuss how Warren Buffett values a stock and what key factors he considers when making investment decisions.

- Business fundamentals: The first and most important factor that Warren Buffett considers is the underlying business itself. He looks for businesses with a strong competitive advantage, a durable business model, and a history of consistent earnings and cash flow. He also evaluates the management team, their track record, and their ability to run the business effectively.

- Intrinsic value: Buffett believes that a stock’s intrinsic value is what truly matters when it comes to determining its worth. He calculates intrinsic value by analyzing various financial metrics, including earnings, cash flow, and book value. He then compares the stock’s intrinsic value to its market price to determine whether it is undervalued or overvalued.

- Long-term horizon: Unlike many investors who focus on short-term market fluctuations, Warren Buffett takes a long-term view of his investments. He believes that a well-run business will provide consistent returns over time and that it is important to focus on the company’s overall growth trajectory rather than its current stock price. Avoid overpaying: One of Warren Buffett’s most famous quotes is “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” He believes that it is important to avoid overpaying for a stock, regardless of how strong the underlying business may be. He is patient and willing to wait for opportunities to buy high-quality stocks at a reasonable price.

- Diversification: While Warren Buffett is best known for his investments in a few large, well-established companies, he also believes in the importance of diversification. He spreads his investments across a variety of industries and companies, reducing his overall risk while still maintaining exposure to the market.

In conclusion, Warren Buffett’s approach to stock valuation is centered around the fundamental strength of the underlying business, intrinsic value, a long-term investment horizon, avoiding overpaying for stocks, and diversification. These principles have proven successful for him over his long career, and continue to be a valuable framework for investors today.

Margin of Safety

For Warren Buffett, the margin of safety is a concept that plays an important role in his investment decisions. The margin of safety refers to the difference between a stock’s fair value and the current market price. Buffett looks for stocks where this gap is large enough to provide some hedging against unexpected negative developments. This margin of safety gives him a buffer to minimize potential losses if the company doesn’t perform as expected. In short, the margin of safety is an important part of Buffett’s value investing approach, as it allows him to buy cheaply priced stocks to maximize potential returns.

Companies with Economic Moat

Warren Buffett looks for companies with competitive advantages known as “moats.” A moat describes a company’s ability to protect its profits and market position over an extended period of time. Buffett looks for companies with strong brands, patents, network effects, and other factors that make it difficult for them to be driven out by competitors. A strong moat can also protect a company from price wars and increase its ability to generate profits over the long term.

Buffett also places a high priority on conducting a thorough review of the company’s finances and business practices to ensure it is financially healthy and competitive. If he identifies a company with a strong moat and a solid financial position, he is ready to make long-term investments.

💬 Comment by Dr. Peter Klein, Founder of Fairvalue Calculator:

Warren Buffett is a true legend in the world of investing. What I admire most is his calm, unshaken demeanor — always focused on the raw numbers, with a brilliant business sense, yet grounded and modest in his lifestyle. He radiates confidence and peace, and that’s powerful.

It’s important to recognize, however, that his impressive performance was also supported by structural advantages. Through Berkshire Hathaway, Buffett was able to use the insurance float as a form of internal leverage — roughly a factor of 1.5 — which amplified returns and made beating the market more feasible.

He also benefited from a long-term bull market and the consistent reinvestment of dividends, which significantly boosted compounding. These were key ingredients of his long-term success.

Still, Buffett’s ability to identify companies with a durable competitive advantage, his patience, and his discipline to hold cash when valuations were high are what truly make his approach exceptional.

That very philosophy inspired the Premium Tool on this platform. With the built-in Market Watch, we estimate current overall market valuations and recommend a corresponding cash position. It’s Buffett-style caution — powered by data and automation.

Warren Buffett's Teacher

Warren Buffett learned a lot from Benjamin Graham, the father of value investing. Graham was Buffett’s professor at Columbia University and was a major influence on his investment philosophy. Buffett learned from Graham that it’s important to conduct a thorough analysis of companies and their financials in order to determine a stock’s fair value. Graham has also stressed the importance of the concept of margin of safety, which is maintaining a margin of safety by buying stocks that are priced below their fair value.

Additionally, Graham introduced the idea that investing should be a consideration of company fundamentals, such as sales, earnings, and cash flows, rather than simply responding to short-term market fluctuations. Buffett has taken these concepts further and incorporated them into his strategy, which is based on buying high-quality companies at cheap prices to generate long-term returns.

Fair Value Calculator of Warren Buffett's Teacher

Benjamin Graham was the teacher of Warren Buffett. Benjamin Graham invented value investing and also published a stock valuation formula that this calculator makes use of. The Graham number is a concept introduced by Benjamin Graham, the father of value investing. The Graham number is a measure of a stock’s fair value, calculated as the ratio of the company’s book value to earnings per share.

Enter earnings per share (EPS) and book value per share into this calculator and get the Graham number. Earnings per share and the book value per share can be found via a Google search, in the annual report on the company’s website under “Investor Relations” or on relevant stock portals.

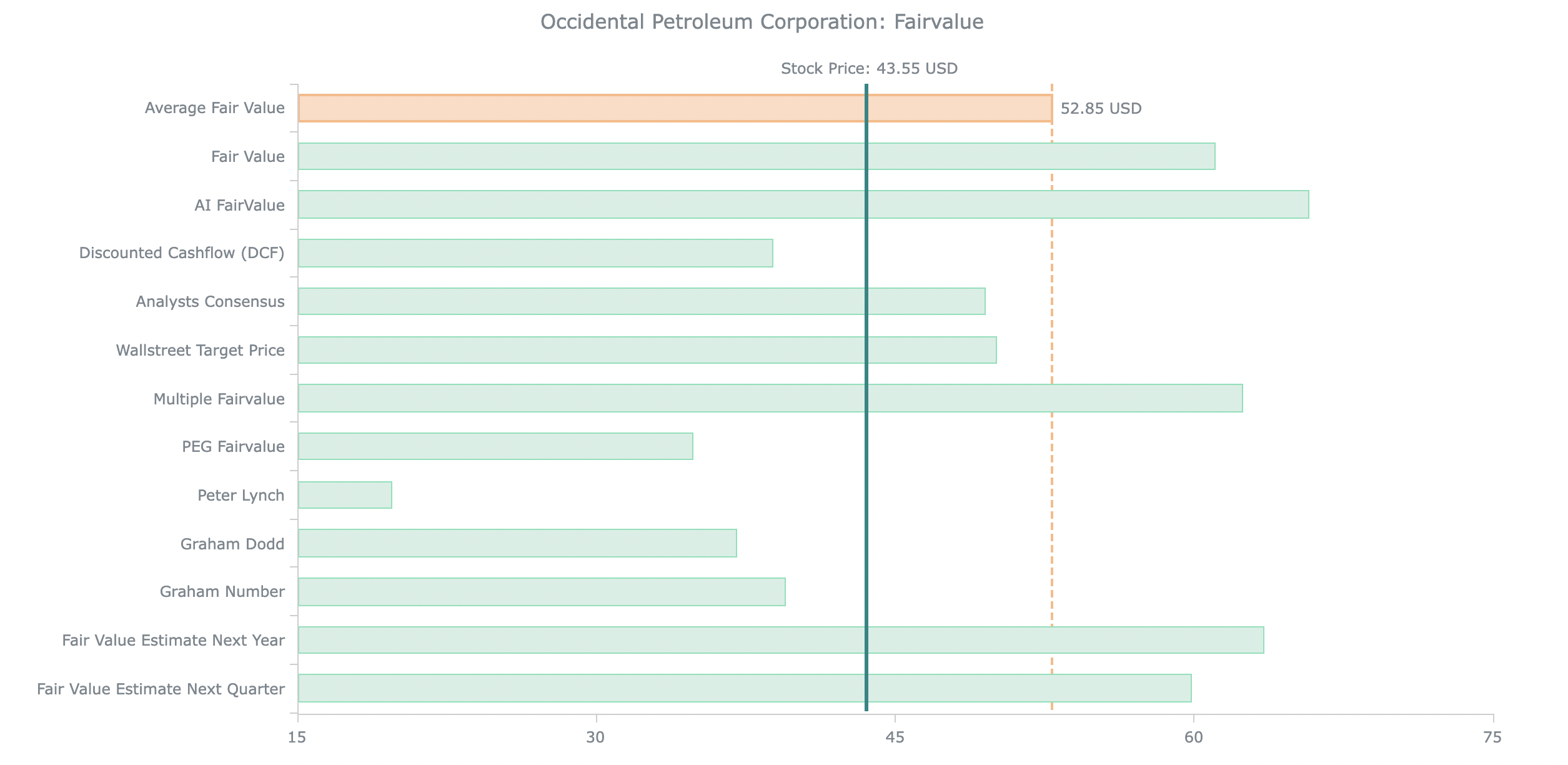

In our Premium Tool, a large number of different evaluation models are used and the required data is loaded automatically.

Conclusion

Warren Buffett is a famous value investor who looks for companies with a strong competitive advantage, a good management team, and a favorable long-term outlook. Here’s a summary of his approach to picking stocks:

Look for companies with a durable competitive advantage. This could be in the form of a strong brand, a large market share, or a patented technology.

Focus on the management team: Buffett values strong leadership and looks for CEOs who are honest, competent, and aligned with shareholder interests.

Consider the financial health of the company: Buffett looks for companies with a strong balance sheet, steady earnings growth, and low levels of debt.

Look for companies that are undervalued: Buffett looks for companies that are trading at a discount to their intrinsic value, and he uses financial metrics such as price-to-earnings (P/E) ratios to determine this. (This is where the Premium Tools of fairvalue-calculator.com may be helpful.)

Invest in businesses you understand: Buffett believes in investing in businesses that are easy to understand, and he avoids investing in industries he doesn’t know well. This is a simplified version of Buffett’s approach, but it provides a good starting point for anyone who wants to pick stocks like him.

FAQ: Warren Buffett Fair Value

Estimate intrinsic value from “owner earnings” discounted at a sensible required return—then cross-check with modern valuation tools.

What is “Buffett Fair Value” on this page? ▾

How do you estimate owner earnings in practice? ▾

Which inputs do I set on this calculator? ▾

- Base-year owner earnings per share.

- Growth path and forecast length (e.g., 5–10 years).

- Discount rate (required return) and terminal value method.

- Share count and expected dilution/buybacks.

What discount rate should I use for a Buffett-style model? ▾

Terminal value: perpetual growth or exit multiple? ▾

When does this method work best—and when not? ▾

- Best: predictable businesses with stable reinvestment and cash conversion.

- Use caution: highly cyclical, hyper-growth or accounting-noisy firms—run a full DCF as a cross-check.

How do dividends and buybacks affect owner earnings? ▾

How do I cross-check results before acting? ▾

How should I set a Margin of Safety (MoS) here? ▾

Common pitfalls with Buffett-style fair value ▾

- Using total CapEx instead of maintenance CapEx.

- Mixing TTM and forward inputs inconsistently.

- Overly optimistic growth or too high terminal assumptions.

- Ignoring dilution and capital structure when moving to per-share value.

What’s a practical workflow around this page? ▾

- Context: Review Market Valuation and Sector Valuation.

- Screen: Shortlist candidates in the Stock Screener.

- Value: Run the Buffett Fair Value model here and a full DCF if needed.

- Cross-check: Compute EV and review on Stock Valuation.

- Allocate: Size and rebalance in the Portfolio Manager.

Is this investment advice? ▾

Find Thousands of Undervalued Stocks!

100% Satisfaction. 0% Risk. Cancel Anytime.