Fair value is a critical concept in modern portfolio management that plays a vital role in asset valuation, risk assessment, and investment decision-making. Understanding and accurately calculating fair values allows portfolio managers to make more informed choices about asset allocation, risk management, and overall portfolio construction. This article will explore the importance of fair value in portfolio management, examining how it impacts various aspects of the investment process and discussing strategies for leveraging fair value calculations to optimize portfolio performance.

Understanding Fair Value

Definition of Fair Value

Fair value refers to the estimated price at which an asset would change hands in an orderly transaction between market participants under current market conditions. It represents the true economic value of an asset, taking into account all relevant factors and available information.

Fair Value vs. Market Price

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

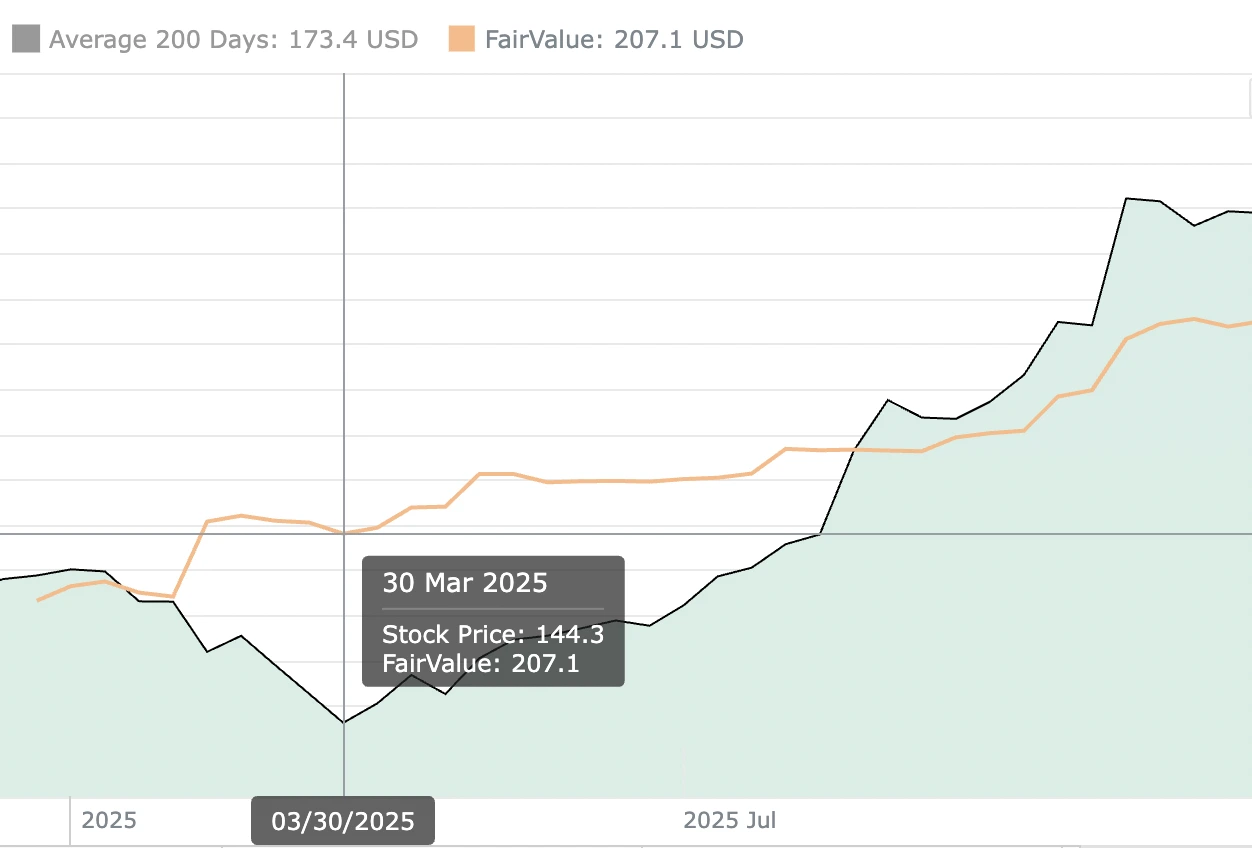

While fair value and market price are related concepts, they are not always identical. Market prices can deviate from fair values due to various factors such as market inefficiencies, lack of liquidity, or temporary supply and demand imbalances. Understanding the relationship between fair value and the market price is crucial for portfolio managers seeking to identify mispriced assets and potential investment opportunities.

Fair Value Accounting Standards

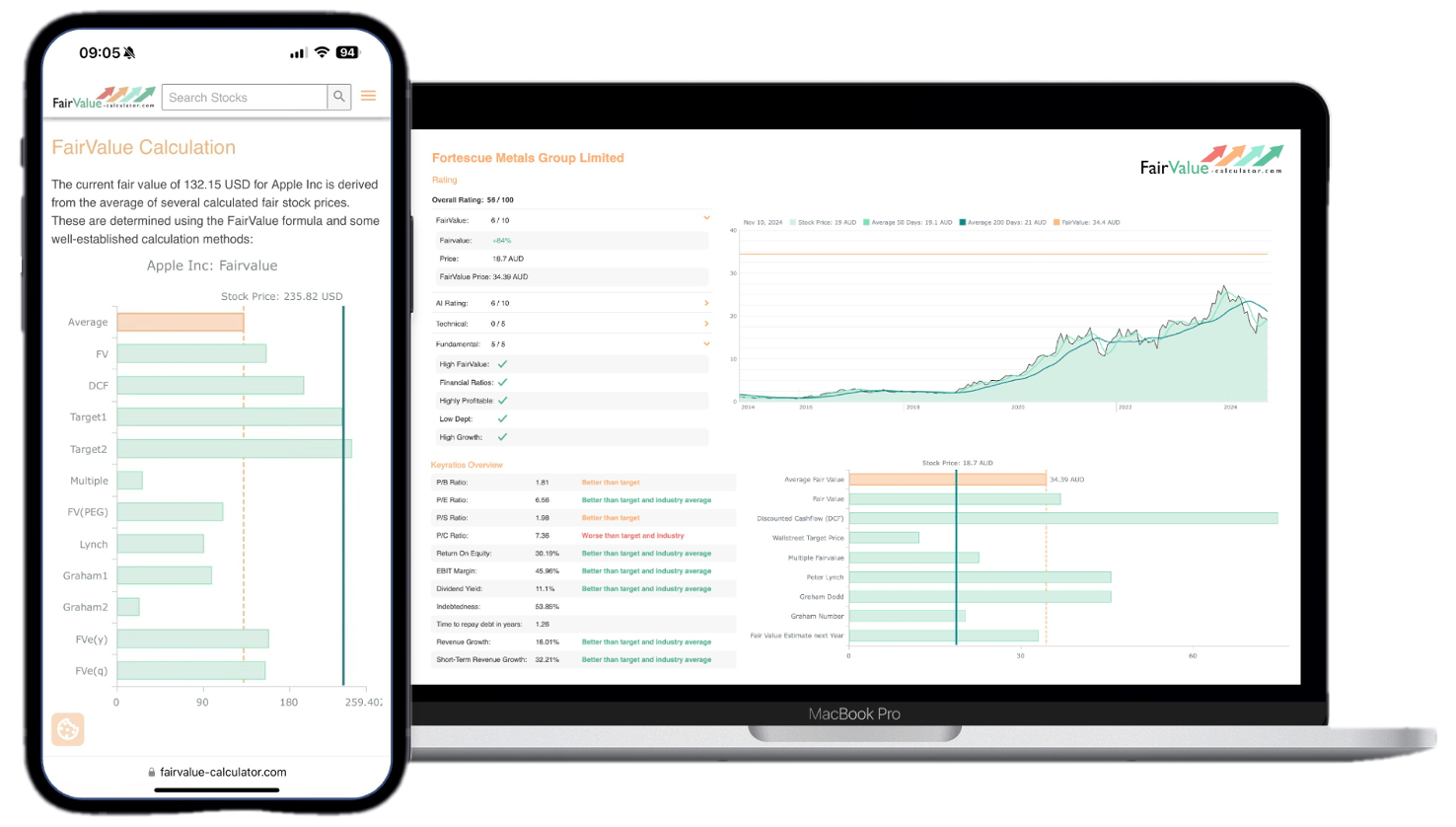

💡 Discover Powerful Investing Tools

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Financial accounting standards, such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP), provide guidelines for fair value measurement and reporting. These standards aim to enhance transparency and comparability in financial reporting, which in turn helps investors and portfolio managers make more informed decisions.

The Role of Fair Value in Portfolio Management

Asset Valuation

Accurate asset valuation is fundamental to effective portfolio management. Fair value calculations provide a more reliable estimate of an asset’s true worth, enabling portfolio managers to:

a) Identify undervalued or overvalued assets

b) Make informed buy, hold, or sell decisions

c) Assess the overall value of the portfolio

d) Compare the relative attractiveness of different investment opportunities

Risk Assessment

Fair value plays a crucial role in assessing and managing portfolio risk:

a) Volatility Measurement: By comparing fair values to market prices over time, managers can gauge the volatility of individual assets and the portfolio as a whole.

b) Downside Risk: Fair value calculations help estimate potential losses in adverse market conditions, allowing managers to implement appropriate risk mitigation strategies.

c) Correlation Analysis: Understanding the fair values of different assets enables more accurate correlation analysis, which is essential for diversification and risk management.

Performance Measurement

Fair value is integral to accurately measuring portfolio performance:

a) Return Calculation: Using fair values ensures that performance metrics reflect the true economic returns of the portfolio, rather than being distorted by market price anomalies.

b) Benchmark Comparison: Fair value-based performance measurement allows for more meaningful comparisons with benchmarks and peer portfolios.

c) Attribution Analysis: Accurate fair values enable more precise attribution of returns to various factors, helping managers understand the sources of portfolio performance.

Fair Value Calculation Methods

Market Approach

The market approach estimates fair value by comparing the asset to similar assets that have been sold in the market. This method is particularly useful for liquid assets with readily available market data.

Income Approach

The income approach calculates fair value by discounting expected future cash flows to their present value. This method is commonly used for income-generating assets such as bonds, real estate, and certain types of equities.

Cost Approach

The cost approach estimates fair value based on the cost to replace or reproduce the asset. This method is often used for tangible assets and is particularly relevant in industries with significant physical capital.

Option Pricing Models

For complex financial instruments such as derivatives, option pricing models like the Black-Scholes model or Monte Carlo simulations are used to estimate fair value.

Challenges in Fair Value Calculation

Illiquid Assets

Determining fair value for illiquid assets can be challenging due to the lack of readily available market data. Portfolio managers must often rely on more subjective valuation methods or third-party appraisals.

Complex Financial Instruments

Derivatives and structured products can be difficult to value due to their complexity and sensitivity to various market factors. Advanced modeling techniques and expert judgment are often required to estimate fair values accurately.

Market Volatility

During periods of high market volatility, fair values can fluctuate rapidly, making it challenging to maintain up-to-date valuations and adjust portfolio allocations accordingly.

Data Quality and Availability

The accuracy of fair value calculations depends heavily on the quality and availability of input data. Incomplete or unreliable data can lead to significant valuation errors.

Implementing Fair Value in Portfolio Management Strategies

Asset Allocation

Fair value calculations play a crucial role in optimizing asset allocation:

a) Strategic Asset Allocation: Long-term fair value estimates help determine the optimal mix of asset classes to achieve the portfolio’s investment objectives.

b) Tactical Asset Allocation: Short-term deviations between market prices and fair values can inform tactical allocation decisions to capture alpha opportunities.

c) Rebalancing: Regular fair value assessments guide rebalancing decisions, ensuring the portfolio maintains its target allocation over time.

Security Selection

Fair value analysis is essential for effective security selection:

a) Bottom-up Analysis: Comparing a security’s market price to its estimated fair value helps identify potentially undervalued investments.

b) Relative Value Analysis: Fair value calculations enable meaningful comparisons between securities within the same asset class or sector.

c) Scenario Analysis: By adjusting fair value estimates under different economic scenarios, managers can assess the potential performance of securities in various market conditions.

Risk Management

Fair value-based risk management strategies include:

a) Value-at-Risk (VaR): Using fair value estimates to calculate potential portfolio losses under different scenarios.

b) Stress Testing: Assessing how changes in fair values under extreme market conditions would impact portfolio performance.

c) Hedging: Identifying and implementing appropriate hedging strategies based on fair value relationships between assets.

Performance Attribution

Fair value-based performance attribution helps managers understand the sources of portfolio returns:

a) Factor Attribution: Analyzing how different factors contribute to changes in fair values and overall portfolio performance.

b) Style Analysis: Assessing how various investment styles (e.g., value, growth, momentum) contribute to portfolio returns based on fair value metrics.

c) Risk-Adjusted Performance: Calculating risk-adjusted performance measures using fair value-based risk assessments.

Fair Value and Market Efficiency

The Efficient Market Hypothesis

The Efficient Market Hypothesis (EMH) posits that market prices fully reflect all available information. However, the existence of deviations between market prices and fair values challenges the strong form of the EMH.

Market Anomalies and Fair Value

Identifying situations where market prices deviate significantly from fair values can reveal potential market anomalies or inefficiencies that portfolio managers can exploit to generate alpha.

Behavioral Finance and Fair Value

Behavioral finance theories help explain why market prices may deviate from fair values due to investor psychology and cognitive biases. Understanding these factors can improve fair value estimates and inform investment decisions.

Technology and Fair Value Calculation

Automated Valuation Models

Advancements in technology have led to the development of sophisticated automated valuation models that can quickly estimate fair values for a wide range of assets.

Big Data and Machine Learning

The integration of big data and machine learning techniques is enhancing the accuracy and timeliness of fair value calculations by incorporating a broader range of relevant information.

Blockchain and Fair Value

Blockchain technology has the potential to improve the transparency and reliability of fair value calculations by providing a secure and immutable record of transactions and valuations.

Regulatory Considerations

Fair Value Measurement Standards

Portfolio managers must stay informed about evolving fair value measurement standards and ensure compliance with relevant regulations.

Disclosure Requirements

Many jurisdictions require detailed disclosures regarding fair value measurements, including the methodologies used and the level of uncertainty in the estimates.

Auditor Scrutiny

Fair value calculations are subject to scrutiny by auditors, who may challenge the assumptions and methodologies used in the valuation process.

Ethical Considerations in Fair Value Estimation

Conflicts of Interest

Portfolio managers must be aware of potential conflicts of interest that may arise in the fair value estimation process and take steps to mitigate them.

Transparency and Disclosure

Maintaining transparency in fair value calculations and providing clear disclosures to stakeholders is essential for maintaining trust and credibility.

Professional Judgment

While fair value calculations often involve quantitative models, professional judgment plays a crucial role in interpreting results and making final valuation decisions. Managers must exercise this judgment ethically and responsibly.

Future Trends in Fair Value and Portfolio Management

Increased Standardization

Efforts to standardize fair value calculation methodologies across different asset classes and jurisdictions are likely to continue, improving comparability and consistency.

Enhanced Real-time Valuation

Advancements in technology and data availability are enabling more frequent and timely fair value updates, moving towards real-time portfolio valuation and risk management.

Integration of Environmental, Social, and Governance (ESG) Factors

The growing importance of ESG considerations in investment decision-making is likely to lead to their increased integration into fair value calculations and portfolio management strategies.

Fair value is a fundamental concept that underpins many aspects of modern portfolio management. By providing a more accurate representation of an asset’s true economic value, fair value calculations enable portfolio managers to make better-informed decisions about asset allocation, risk management, and security selection. While challenges remain in accurately estimating fair values, particularly for complex or illiquid assets, ongoing advancements in technology and valuation methodologies are continually improving the process.

As the investment landscape evolves, the importance of fair value in portfolio management is likely to grow. Portfolio managers who can effectively leverage fair value calculations to optimize their investment strategies will be better positioned to generate superior risk-adjusted returns and meet their client’s investment objectives. By staying informed about the latest developments in fair value measurement and integrating these insights into their portfolio management processes, investment professionals can enhance their ability to navigate complex and dynamic financial markets.