Investing in the stock market has long been a popular strategy for individuals and institutions seeking to grow their wealth over time. While the inherent risks and volatility of equity markets can be daunting, the potential for substantial returns has consistently drawn investors from around the world. As we reflect on the past 100 years of global stock market performance, a remarkable tale emerges – one of resilience, innovation, and the enduring power of patient capital.

This article delves into the historical returns of major stock markets across the globe, highlighting the long-term trends and patterns that have shaped the investment landscape. From the United States to Europe, Japan to China, and emerging markets to Australia, we’ll explore the diverse experiences and trajectories of these financial powerhouses, ultimately illuminating the global average stock return over the past century.

The United States: A Beacon of Equity Market Strength

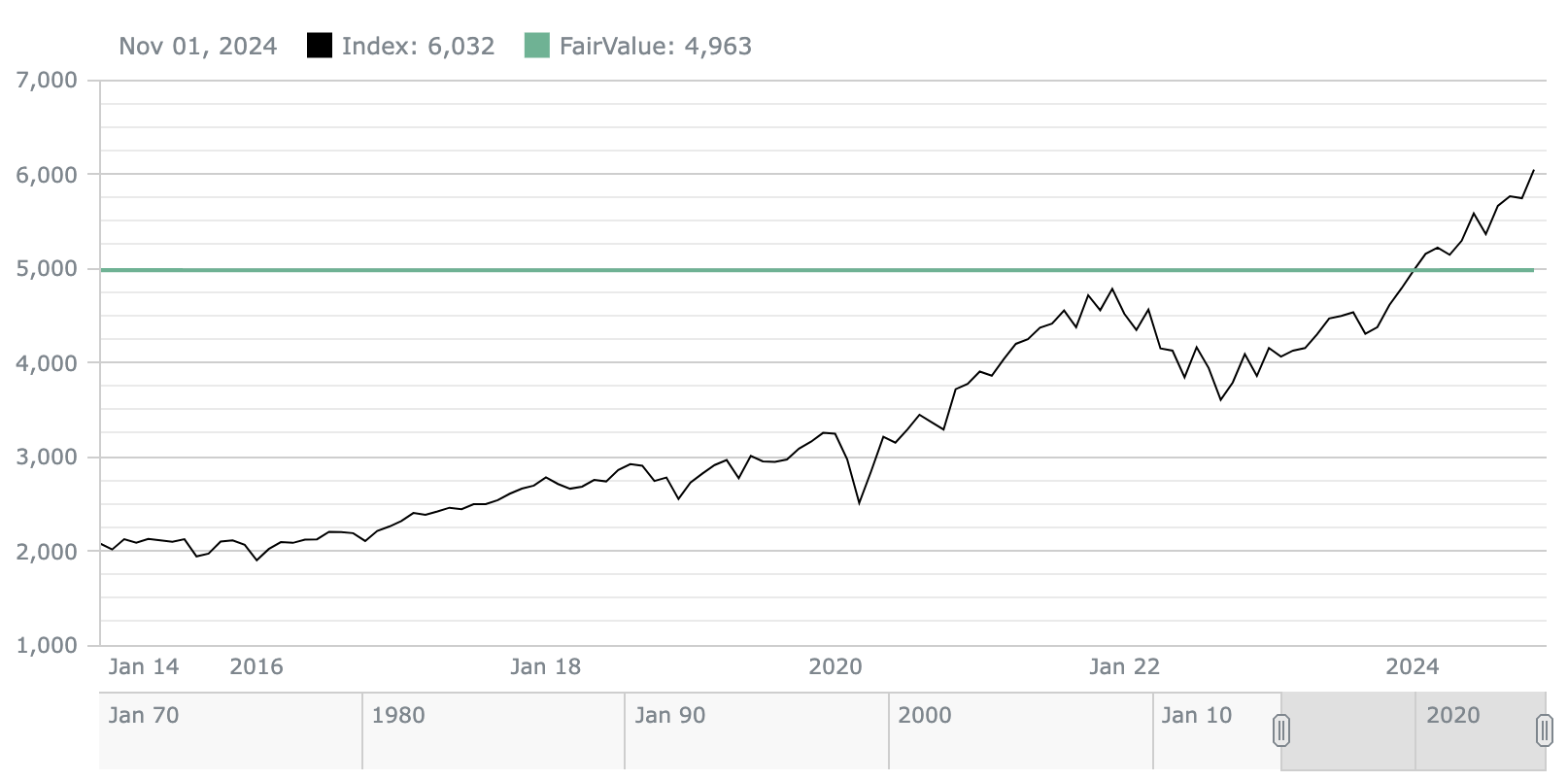

At the forefront of global equity markets stands the United States, represented by the iconic S&P 500 index. Over the past 100 years, this bellwether of American corporate performance has delivered an average annual return of 8.5%. This remarkable figure underscores the resilience and growth potential of the U.S. economy, which has navigated through numerous challenges, including wars, recessions, and paradigm-shifting technological advancements.

The S&P 500’s impressive performance can be attributed to several factors, including the dynamism of American businesses, the strength of the country’s regulatory and legal frameworks, and the depth and liquidity of its financial markets. Furthermore, the U.S. has consistently fostered an environment conducive to innovation, entrepreneurship, and capital formation – elements that have fueled the growth and success of countless companies over the decades.

While the path has not been without its obstacles, the long-term upward trajectory of the S&P 500 serves as a powerful testament to the potential rewards of patient, disciplined investing in the U.S. equity market.

Europe’s Storied Markets: Navigating Challenges and Opportunities

Across the Atlantic, Europe’s equity markets have followed a distinct path, characterized by both triumphs and tribulations. The Euro Stoxx 50, a widely followed index comprising some of the region’s largest and most influential companies, has delivered an average annual return of 5% over the past 100 years.

Europe’s financial landscape has been shaped by a rich tapestry of cultural, economic, and political forces. From the devastating impact of the two world wars to the ongoing process of economic integration and the formation of the European Union, the region has faced numerous challenges that have influenced its equity market performance.

Despite these obstacles, Europe’s resilience and innovative spirit have shone through. Industries such as automotive, pharmaceuticals, and luxury goods have consistently contributed to the region’s economic prowess, with companies in these sectors often leading the charge in their respective markets.

As Europe continues to navigate the complexities of an ever-changing global economy, its equity markets remain a compelling investment destination for those seeking exposure to a diverse array of industries and companies with a global footprint.

The Land of the Rising Stocks: Japan’s Equity Market Journey

Turning our gaze towards the East, Japan’s Nikkei 225 index has been a barometer of the country’s economic fortunes over the past century. With an average annual return of 4%, the Nikkei’s performance reflects both the remarkable rise of Japan’s post-war economy and the challenges posed by demographic shifts, economic stagnation, and global competition.

In the decades following World War II, Japan’s equity market experienced a meteoric ascent, fueled by the nation’s rapid industrialization and the emergence of globally renowned companies across industries such as automotive, electronics, and manufacturing. This period of economic resurgence, often referred to as the “Japanese Miracle,” propelled the Nikkei 225 to unprecedented heights, capturing the attention of investors worldwide.

However, the latter part of the 20th century brought new challenges, as Japan grappled with deflation, an aging population, and the rise of emerging economies. Despite these headwinds, the resilience of Japanese corporations and their commitment to innovation have ensured that the Nikkei 225 remains a significant player in the global equity market landscape.

The Asian Powerhouse: China’s Equity Market Ascendancy

No discussion of global stock market performance would be complete without acknowledging the meteoric rise of China’s equity markets. The Shanghai Composite, a barometer of the world’s second-largest economy, has delivered an average annual return of 7% over the past 100 years.

China’s remarkable economic transformation, which began in earnest with the implementation of market-oriented reforms in the late 1970s, has been a defining narrative of the modern era. As the country’s economy rapidly industrialized and embraced global trade, its equity markets have emerged as a formidable force, reflecting the ambitions and aspirations of a nation determined to secure its place on the world stage.

While China’s equity market has experienced periods of volatility and uncertainty, the sheer scale and growth potential of its economy have continued to captivate investors seeking exposure to one of the world’s most dynamic and rapidly evolving markets.

As China navigates the challenges of transitioning towards a more sustainable and consumption-driven economic model, its equity markets are poised to play a pivotal role in shaping the global investment landscape for decades to come.

The Promise of Emerging Markets: High Rewards and Elevated Risks

Beyond the established financial centers of the world, emerging markets have emerged as a compelling investment destination, offering both substantial growth potential and heightened risks. With an average annual return of 11% over the past 100 years, these markets have demonstrated the capacity to deliver outsized returns to those willing to embrace their inherent volatility.

Encompassing a diverse array of economies across regions such as Latin America, Asia, Africa, and Eastern Europe, emerging markets have benefited from rapid industrialization, burgeoning consumer markets, and an influx of foreign investment. However, these markets have also grappled with political instability, economic imbalances, and regulatory uncertainties – factors that have contributed to periods of significant turbulence and market corrections.

Investing in emerging markets requires a keen understanding of the unique risks and opportunities presented by each individual market. While the potential rewards can be substantial, navigating these complex and rapidly evolving environments demands a disciplined and well-informed approach.

As the world’s economic center of gravity continues to shift towards emerging economies, their equity markets are poised to play an increasingly pivotal role in shaping the global investment landscape.

The Australian Outback: A Resilient Equity Market Down Under

Nestled in the southern hemisphere, Australia’s equity market, represented by the ASX 200 index, has carved out a unique niche in the global investment landscape. With an average annual return of 6% over the past 100 years, the Australian market has demonstrated remarkable resilience and stability, underpinned by the country’s rich natural resources and robust financial sector.

Australia’s economy has benefited from its position as a major exporter of commodities, particularly to the rapidly growing economies of Asia. This strategic advantage has fueled the growth of companies across sectors such as mining, energy, and agriculture, contributing substantially to the performance of the ASX 200.

However, Australia’s equity market success extends beyond its resource wealth. The country’s well-regulated financial system, strong governance frameworks, and commitment to innovation have fostered an environment conducive to the growth of diverse industries, ranging from healthcare to technology.

As the global economy continues to evolve, Australia’s equity market stands poised to capitalize on its strengths, offering investors a unique combination of stability and growth potential in a dynamic and increasingly interconnected world.

The Global Mosaic: The MSCI World Index and the Breadth of Opportunity

While exploring individual markets provides valuable insights, it is also essential to consider the broader global perspective. The MSCI World Index, a widely followed benchmark that captures the performance of large and mid-cap stocks across 23 developed markets, has delivered an average annual return of 7% over the past 100 years.

This index highlights the remarkable breadth of opportunity available to investors willing to embrace a truly global approach. By diversifying across markets and regions, investors can potentially mitigate the risks associated with any single market while capitalizing on the collective strength and resilience of the world’s leading economies.

The MSCI World Index’s performance underscores the enduring power of patient capital and the ability of equity markets to generate long-term wealth creation. From the established financial centers of the West to the rapidly emerging powerhouses of the East, this index captures the rich tapestry of global economic activity, offering investors a front-row seat to the ever-evolving narrative of human ingenuity and progress.

The Global Average: A Testament to the Power of Equities

Amidst the diverse experiences and trajectories of individual markets, a common thread emerges – the remarkable long-term performance of global equity markets as a whole. Over the past 100 years, the global average stock return stands at an impressive 6.93% per year.

This figure serves as a powerful reminder of the enduring capacity of equity investments to generate substantial wealth over extended periods. While individual markets and asset classes may experience periods of volatility and underperformance, the global equity market’s ability to deliver attractive long-term returns has been a consistent historical trend.

The 6.93% global average stock return represents the collective resilience, innovation, and entrepreneurial spirit that has driven economic progress across the globe over the past century. It is a testament to the power of patient capital, disciplined investing, and the unwavering belief in the capacity of human ingenuity to create value and drive sustained growth.

Investing for the Long Haul: Lessons from a Century of Stock Market Performance

As we reflect on the past 100 years of global stock market performance, several key lessons emerge that can guide investors as they navigate the ever-changing investment landscape:

- The Power of Compounding and Time One of the most remarkable aspects of the global equity market’s long-term performance is the transformative power of compounding returns over extended periods. Even seemingly modest annual returns can compound into substantial wealth creation when held for decades or generations. This underscores the importance of adopting a patient, long-term investment mindset and resisting the temptation of short-term speculation or market timing.

- Diversification: A Bulwark Against Volatility The diverse experiences of individual markets highlight the crucial role of diversification in mitigating risk and capturing opportunities across regions and sectors. By constructing well-diversified portfolios that span multiple asset classes, industries, and geographies, investors can potentially smooth out the inherent volatility of equity markets and position themselves to benefit from a broader range of growth drivers.

- Resilience and Adaptation The global equity market’s ability to weather economic storms, political upheavals, and paradigm-shifting technological disruptions is a testament to the resilience and adaptability of human enterprise. While individual companies and industries may rise and fall, the broader market has consistently demonstrated a capacity to evolve, innovate, and capitalize on emerging opportunities, rewarding those investors who remain steadfast in their commitment to long-term investing.

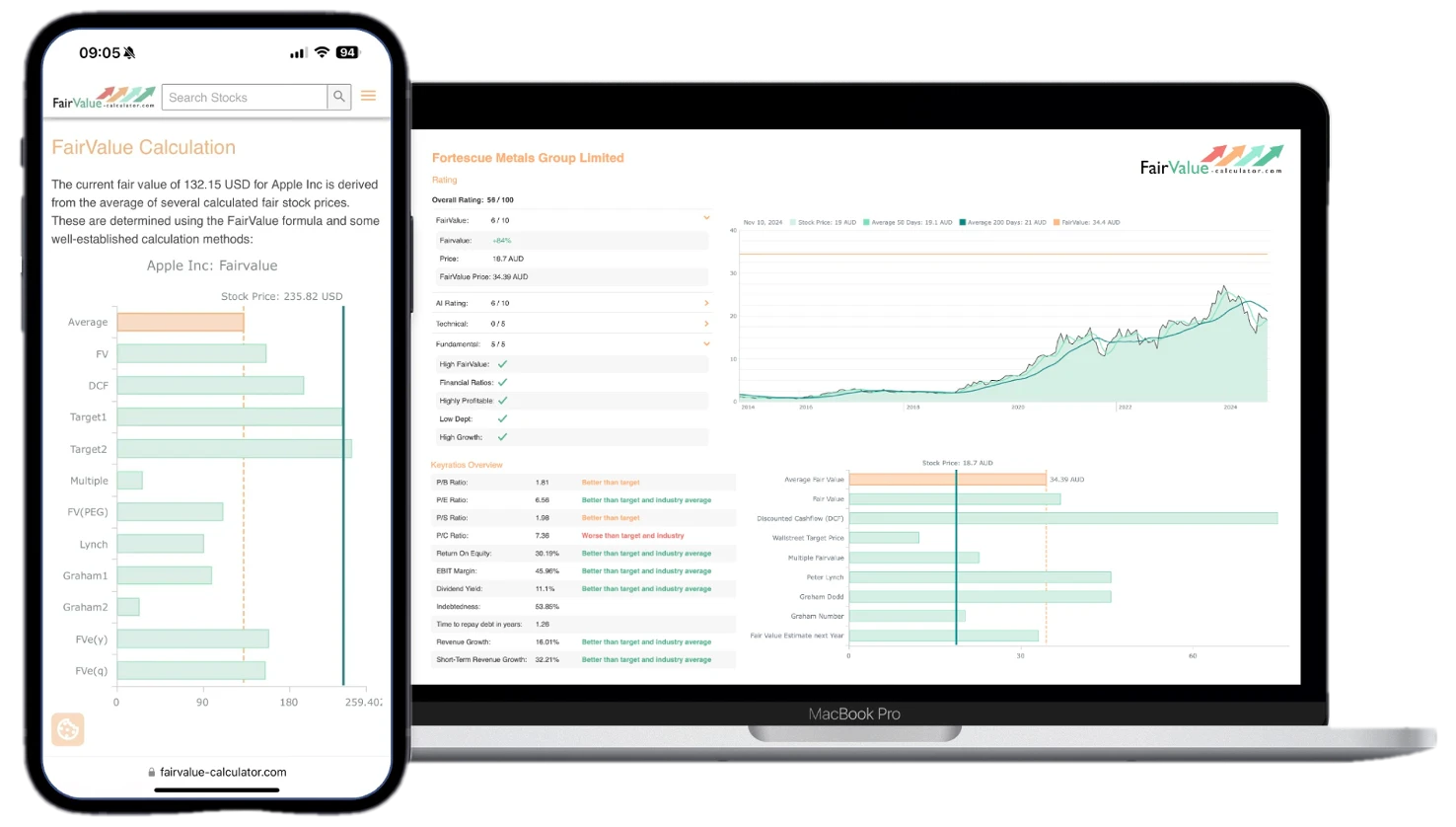

- The Importance of Fundamentals Amidst the noise and excitement of short-term market fluctuations, it is essential for investors to maintain a disciplined focus on fundamental analysis and valuation. Companies with strong competitive advantages, sound financial practices, and the ability to adapt to changing market conditions have historically been well-positioned to generate sustainable long-term returns, even in the face of temporary setbacks or market downturns.

- Embracing a Global Perspective The diverse experiences of markets around the world underscore the importance of adopting a truly global investment mindset. By embracing the breadth of opportunities presented by the global equity market, investors can potentially access a wider range of growth drivers, mitigate country-specific risks, and benefit from the collective strength and resilience of the world’s leading economies.

As we stand at the dawn of a new century, the past 100 years of global stock market performance serve as a powerful reminder of the enduring capacity of equity investments to generate substantial wealth over the long term. From the towering skyscrapers of New York to the bustling streets of Shanghai, the global equity market has been a crucible of innovation, resilience, and human ingenuity, rewarding those investors who have embraced its opportunities with patience and disciplined investing.

The journey ahead will undoubtedly present new challenges and uncertainties, but the lessons of the past century offer a guiding light for those committed to the principles of long-term investing. By embracing diversification, adhering to fundamental analysis, and maintaining a global perspective, investors can position themselves to navigate the ever-shifting tides of the global economy, capitalizing on the collective strength and potential of the world’s equity markets.

Ultimately, the past 100 years have demonstrated that patient capital, coupled with a steadfast belief in the power of human enterprise, can yield remarkable rewards. As we embark on the next chapter of this remarkable journey, the global equity market stands poised to continue shaping the narratives of wealth creation, economic progress, and the enduring quest for financial prosperity.