EAF Fair Value

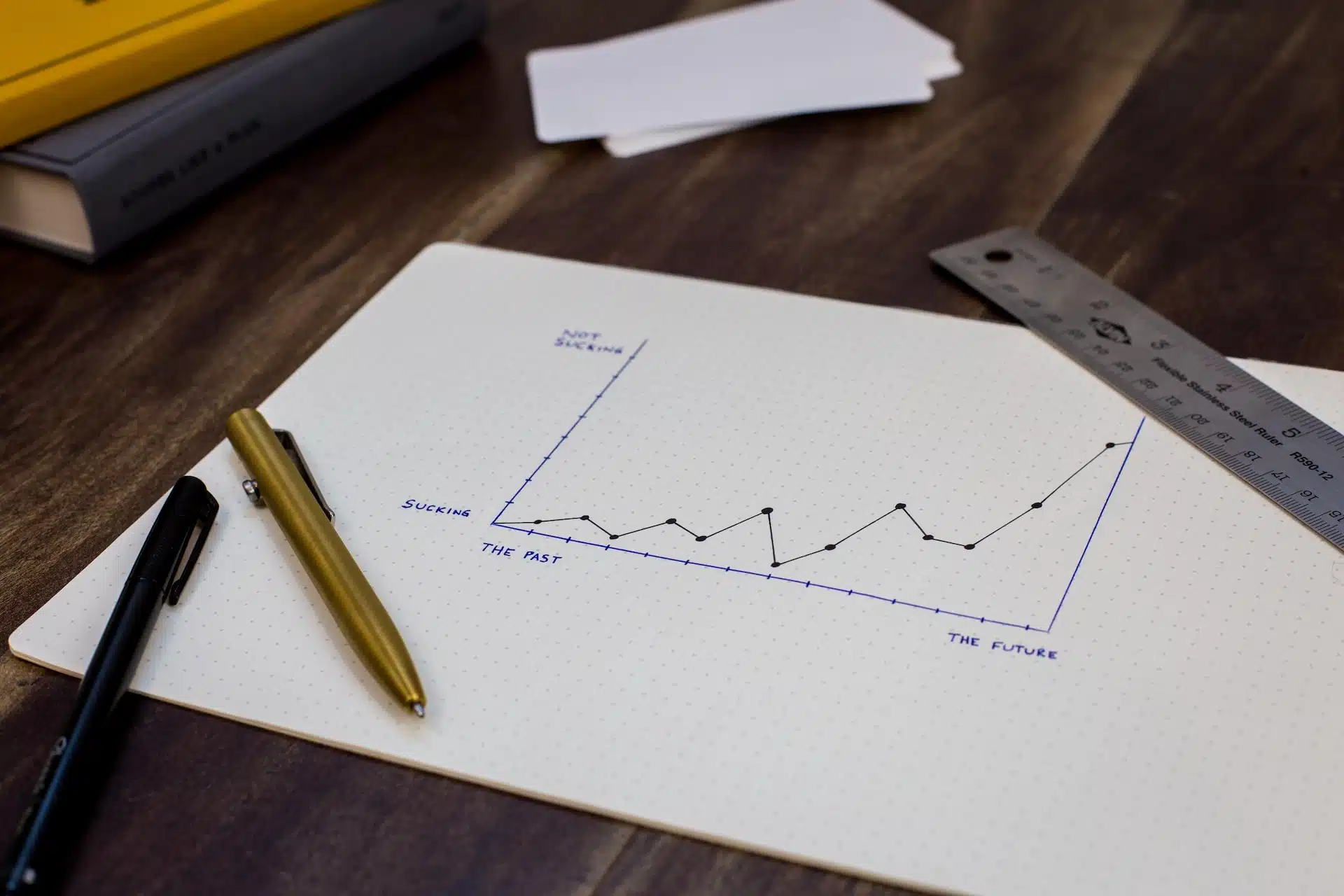

An In-Depth Analysis Enterprise Application Framing (EAF) fair value is an important concept for investors to understand when evaluating technology companies. EAF refers to proprietary software platforms and applications developed by a company for use in its operations. Determining the...

The Fama-French Three-Factor Model

The Fama-French three-factor model is an asset pricing model developed by Eugene Fama and Kenneth French in the early 1990s. It builds on the capital asset pricing model (CAPM) by adding two additional risk factors – size and value –...

Warren Buffett’s Intrinsic Value Calculator

A Guide to Estimating the True Value of a Stock Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, is renowned for his ability to identify undervalued stocks that have the potential for strong long-term growth. Central to Buffett’s...

Calculating the Fair Value of a Company

Determining the fair value of a company is an important part of fundamental analysis for investors. The fair value represents the true intrinsic worth of a business based on its financials, growth prospects, and risk factors. By comparing a stock’s...

Navigating the Financial Landscape with Equity Research Reports

In the dynamic and ever-evolving world of finance, investors seek to make informed decisions that can yield profitable returns. One powerful tool at the disposal of investors is Equity Research Reports. These comprehensive documents, crafted by financial analysts, serve as...

Magnificent 7 Stocks Valuation

The “Magnificent Seven” stocks also “Magnificent 7 Stocks” are a group of seven high-growth technology companies that are considered to be leaders in their respective industries. The term was originally coined by CNBC personality Jim Cramer in 2013 and included...

What is Lynch’s rule of 20?

A Guide to Valuing Stocks with Precision In the world of finance and investment, understanding the metrics and methodologies for valuing stocks is crucial. Investors often rely on various rules and strategies to make informed decisions about their investments. One...

Legends of Fair Value Investing – Part 4

“I am always prepared to do the right thing regardless of what other people think” – Bill Ackman Imagine undertaking a con scheme of such massive proportions that subsequent such attempts to swindle people in the future get associated with...

Legends of Value Investing

Prism of Fair Value Investing – The legends “All Intelligent Investing is value investing – acquiring more than you are paying for” – Charlie Munger 2+2 = 5!! Ok, it is not actually 5 and we are not here to...