The Role of Fair Value in Real Estate Investments

In the complex world of real estate investing, understanding fair value is crucial for making informed decisions. Fair value assessment provides a foundation for evaluating properties, identifying opportunities, and managing investment risks. This article explores how fair value calculations can...

How Economic Indicators Influence Fair Value

The relationship between economic indicators and fair value calculations is fundamental to financial analysis and investment decision-making. This article explores how key macroeconomic metrics impact the determination of an asset’s fair value, providing insights into the complex interplay between economic...

Fair Value and Cryptocurrency: Evaluating Digital Assets

In the rapidly evolving digital finance landscape, cryptocurrencies have emerged as a transformative force that challenges traditional notions of value and valuation. Bitcoin, Ethereum, and other digital assets have disrupted conventional financial paradigms, presenting unprecedented opportunities and complex challenges for...

Fair Value and ESG

How to Integrate Sustainability into Your Investment Decisions In recent years, the investment landscape has undergone a significant transformation. No longer are financial metrics the sole determinants of a company’s worth or an investment’s potential. A new paradigm has emerged,...

Understanding Fair Value – What It Means for Investors

In the complex world of finance and investment, understanding the concept of fair value is crucial for making informed decisions. Fair value is a fundamental principle that helps investors, analysts, and financial professionals assess the true worth of assets, securities,...

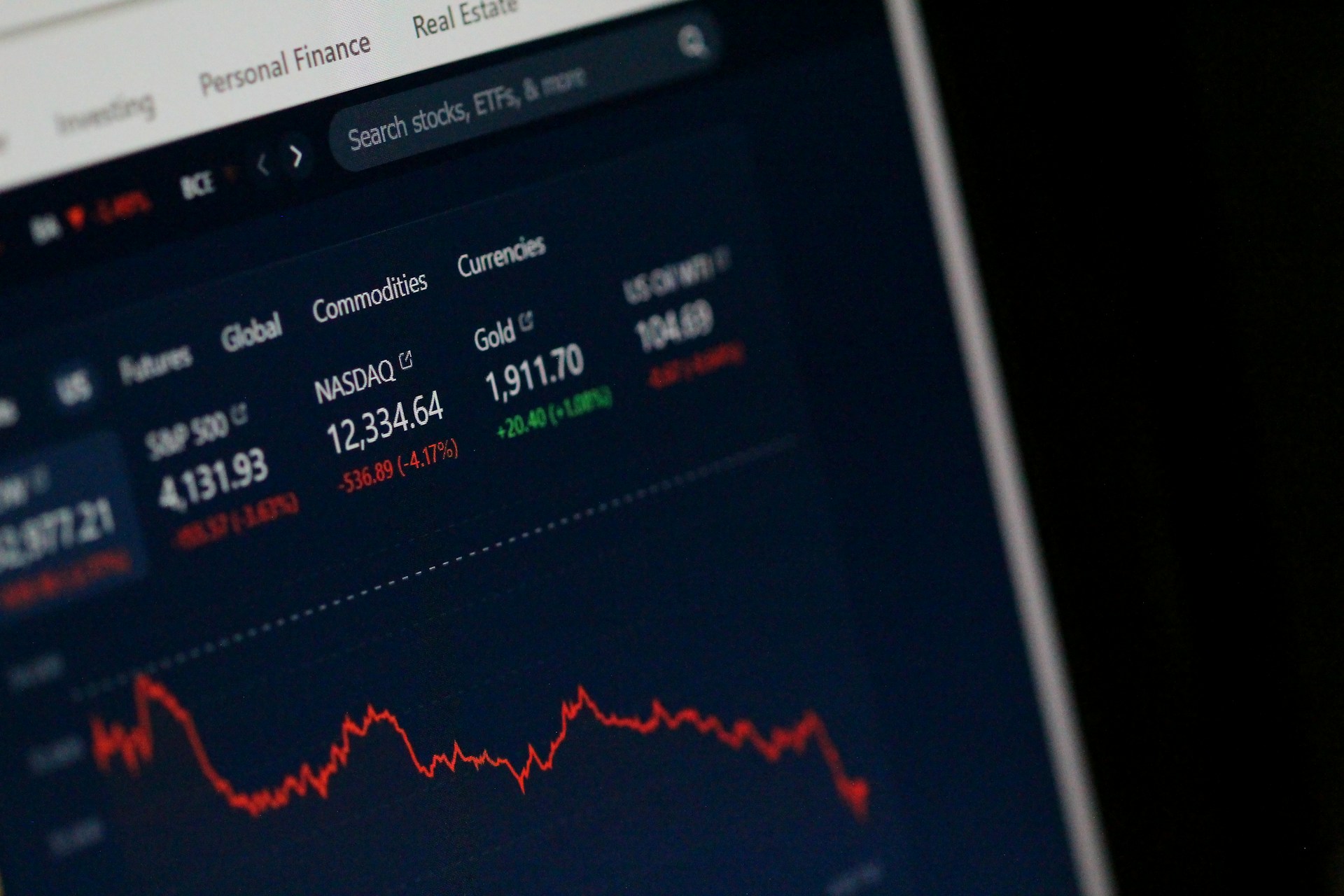

Value of Stock

A Key Metric for Smart Investing In the dynamic world of finance and investing, one concept stands out as a fundamental principle for valuing stocks: intrinsic value. This metric goes beyond the surface-level fluctuations of stock prices and dives deep...

The Evolution of Global Equity Markets over the Past Century

Investing in the stock market has long been a popular strategy for individuals and institutions seeking to grow their wealth over time. While the inherent risks and volatility of equity markets can be daunting, the potential for substantial returns has...

How Fair Value Calculators can Enhance your Financial Decision-Making Process

Making informed decisions is paramount to achieving long-term success. Whether you’re an individual investor or a seasoned professional, understanding the true value of an asset is crucial for maximizing returns and mitigating risks. This is where fair value calculators come...

Warren Buffett’s Intrinsic Value Calculator

A Guide to Estimating the True Value of a Stock Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, is renowned for his ability to identify undervalued stocks that have the potential for strong long-term growth. Central to Buffett’s...

Navigating the Financial Landscape with Equity Research Reports

In the dynamic and ever-evolving world of finance, investors seek to make informed decisions that can yield profitable returns. One powerful tool at the disposal of investors is Equity Research Reports. These comprehensive documents, crafted by financial analysts, serve as...

Proudly powered by WordPress Theme: Essentials Child.