The Role of Fair Value in Real Estate Investments

In the complex world of real estate investing, understanding fair value is crucial for making informed decisions. Fair value assessment provides a foundation for evaluating properties, identifying opportunities, and managing investment risks. This article explores how fair value calculations can...

How Economic Indicators Influence Fair Value

The relationship between economic indicators and fair value calculations is fundamental to financial analysis and investment decision-making. This article explores how key macroeconomic metrics impact the determination of an asset’s fair value, providing insights into the complex interplay between economic...

Fair Value and Cryptocurrency: Evaluating Digital Assets

In the rapidly evolving digital finance landscape, cryptocurrencies have emerged as a transformative force that challenges traditional notions of value and valuation. Bitcoin, Ethereum, and other digital assets have disrupted conventional financial paradigms, presenting unprecedented opportunities and complex challenges for...

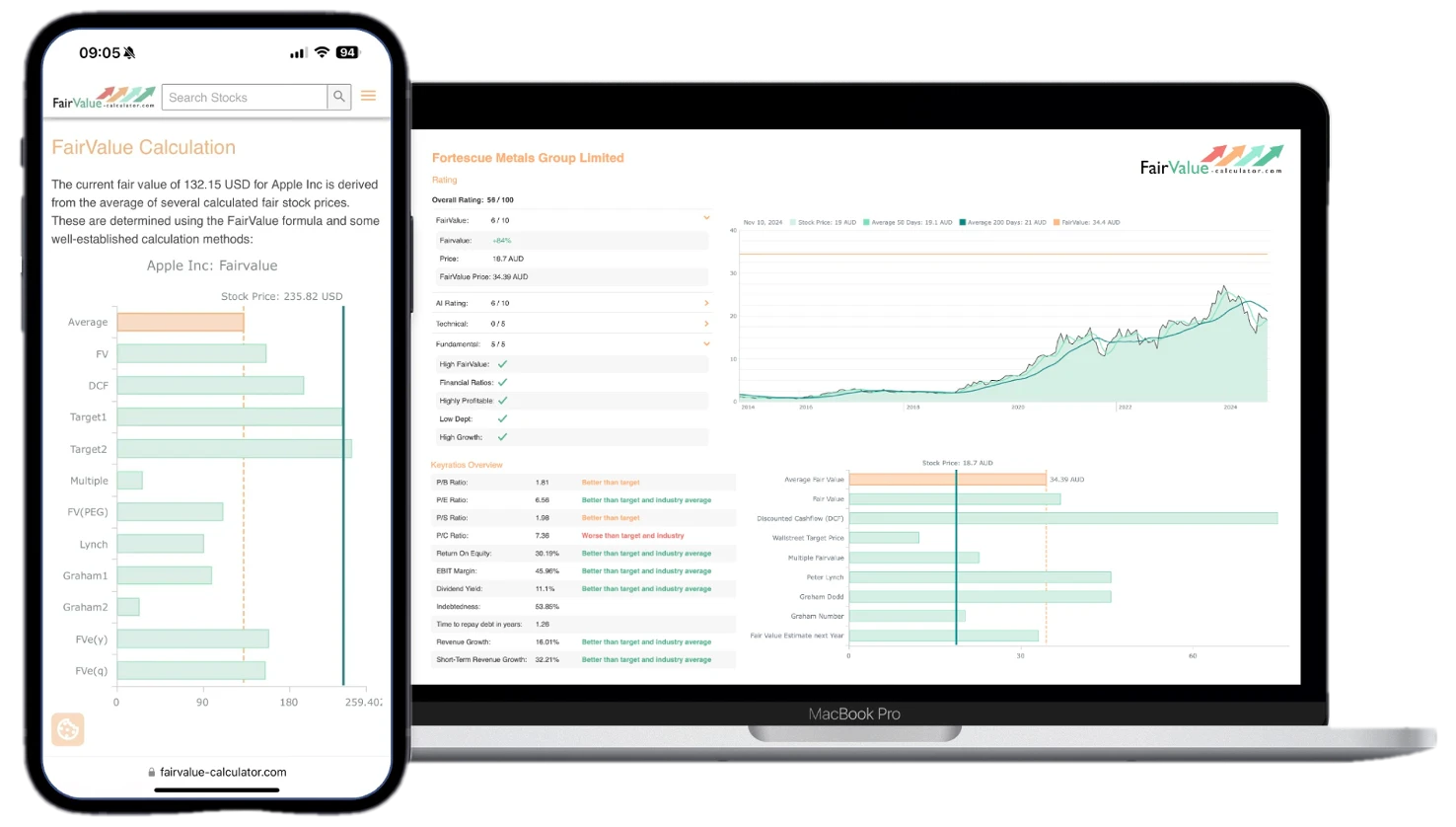

How to Build Your Perfect Stock Portfolio

Proven Strategies for Success! Investing in the stock market can be one of the most rewarding ways to grow your wealth, but it requires a solid plan and proven strategies to achieve lasting success. We at Fairvalue-Calculator.com are committed to...

What is the intrinsic value of an asset?

In the intricate realm of investing and financial analysis, the concept of intrinsic value emerges as a cornerstone of informed decision-making. It serves as a distinguishing factor between strategic, long-term investors and speculative traders who rely on short-term market fluctuations....

Fair Value vs. Market Value: What’s the Difference?

In finance and accounting, the concepts of fair value and market value play pivotal roles in asset valuation, financial reporting, and investment decisions. While these terms are sometimes used interchangeably in casual conversation, they represent distinct approaches to determining the...

Warren Buffett’s Investment Philosophy and Practice

Warren Buffett, often hailed as the “Oracle of Omaha,” is widely regarded as one of the most successful investors in history. His approach to investing has not only made him one of the wealthiest individuals in the world but has...

Fair Value and ESG

How to Integrate Sustainability into Your Investment Decisions In recent years, the investment landscape has undergone a significant transformation. No longer are financial metrics the sole determinants of a company’s worth or an investment’s potential. A new paradigm has emerged,...

The Importance of Fair Value in Portfolio Management

Fair value is a critical concept in modern portfolio management that plays a vital role in asset valuation, risk assessment, and investment decision-making. Understanding and accurately calculating fair values allows portfolio managers to make more informed choices about asset allocation,...

The Evolution of Global Equity Markets over the Past Century

Investing in the stock market has long been a popular strategy for individuals and institutions seeking to grow their wealth over time. While the inherent risks and volatility of equity markets can be daunting, the potential for substantial returns has...

Proudly powered by WordPress Theme: Essentials Child.