How to Calculate the Piotroski F-Score

Introduction to the Piotroski F-Score The Piotroski F-Score is a relatively simple quantitative scoring system used to evaluate the financial strength of a company. Developed by accounting professor Joseph Piotroski in 2000, the F-Score aims to identify firms with strong...

The Evolution of Global Equity Markets over the Past Century

Investing in the stock market has long been a popular strategy for individuals and institutions seeking to grow their wealth over time. While the inherent risks and volatility of equity markets can be daunting, the potential for substantial returns has...

How Fair Value Calculators can Enhance your Financial Decision-Making Process

Making informed decisions is paramount to achieving long-term success. Whether you’re an individual investor or a seasoned professional, understanding the true value of an asset is crucial for maximizing returns and mitigating risks. This is where fair value calculators come...

What is the Difference Between Intrinsic and Extrinsic Value?

Value is a complex and multifaceted concept that has been the subject of intense philosophical and economic debate for centuries. At the heart of this debate is the fundamental distinction between intrinsic value and extrinsic value. Understanding this distinction is...

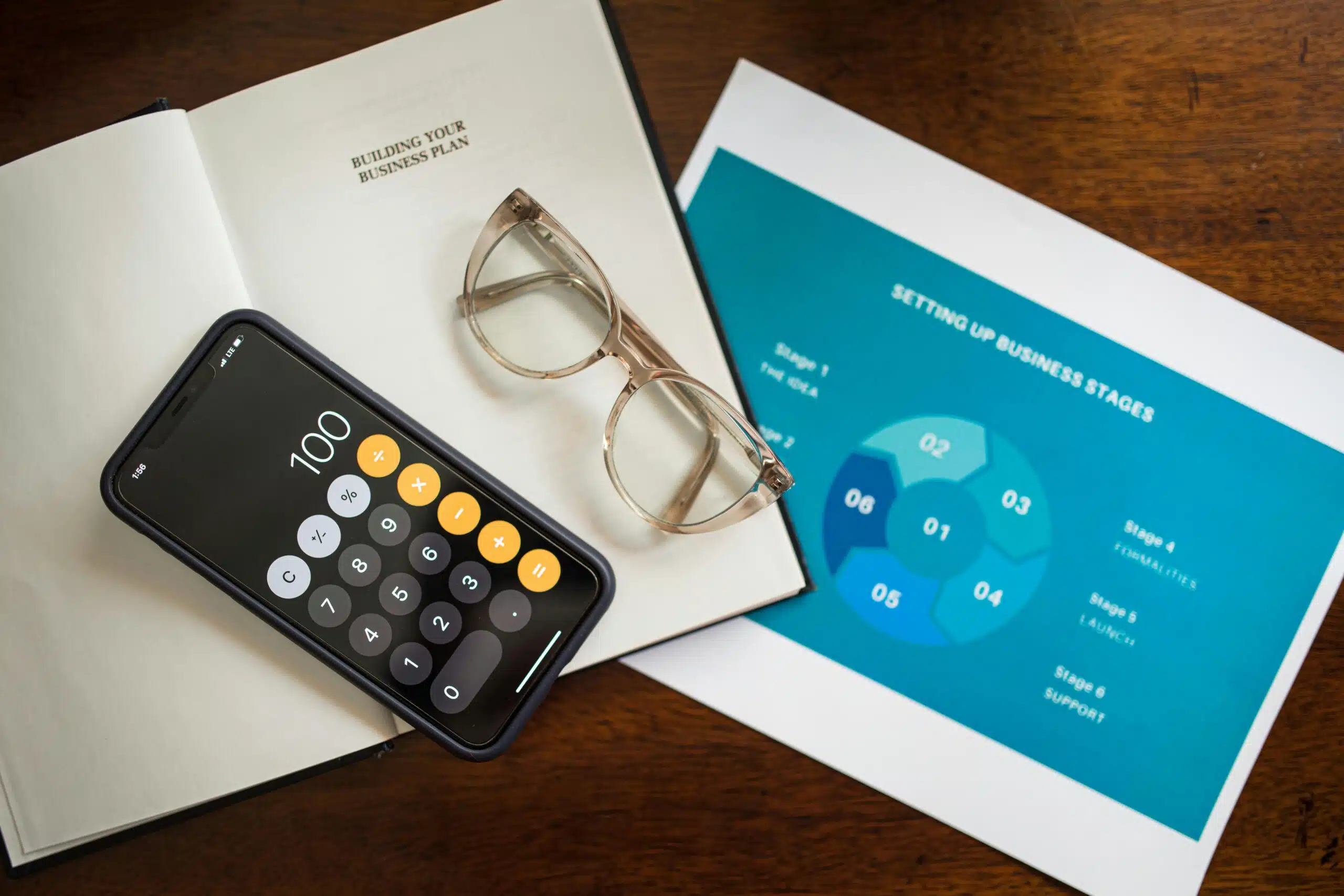

The Monaco Method Fair Value Calculator

A Revolutionary Approach to Business Valuation In the dynamic world of business, accurate valuation is paramount for strategic decision-making, mergers and acquisitions, and investment planning. Traditional valuation methods often rely on complex financial models and subjective assumptions, leading to potential...

How to Calculate the Fair Value of a Stock in 2024

In today’s fast-paced and volatile global markets, determining the fair value of a stock has become more crucial than ever for investors. As we navigate through 2024, the process of stock valuation remains a critical aspect of fundamental analysis, enabling...

EAF Fair Value

An In-Depth Analysis Enterprise Application Framing (EAF) fair value is an important concept for investors to understand when evaluating technology companies. EAF refers to proprietary software platforms and applications developed by a company for use in its operations. Determining the...

The Fama-French Three-Factor Model

The Fama-French three-factor model is an asset pricing model developed by Eugene Fama and Kenneth French in the early 1990s. It builds on the capital asset pricing model (CAPM) by adding two additional risk factors – size and value –...

Warren Buffett’s Intrinsic Value Calculator

A Guide to Estimating the True Value of a Stock Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, is renowned for his ability to identify undervalued stocks that have the potential for strong long-term growth. Central to Buffett’s...

Calculating the Fair Value of a Company

Determining the fair value of a company is an important part of fundamental analysis for investors. The fair value represents the true intrinsic worth of a business based on its financials, growth prospects, and risk factors. By comparing a stock’s...

Proudly powered by WordPress Theme: Essentials Child.