The Role of Fair Value in Real Estate Investments

In the complex world of real estate investing, understanding fair value is crucial for making informed decisions. Fair value assessment provides a foundation for evaluating properties, identifying opportunities, and managing investment risks. This article explores how fair value calculations can...

How Economic Indicators Influence Fair Value

The relationship between economic indicators and fair value calculations is fundamental to financial analysis and investment decision-making. This article explores how key macroeconomic metrics impact the determination of an asset’s fair value, providing insights into the complex interplay between economic...

Fair Value and Cryptocurrency: Evaluating Digital Assets

In the rapidly evolving digital finance landscape, cryptocurrencies have emerged as a transformative force that challenges traditional notions of value and valuation. Bitcoin, Ethereum, and other digital assets have disrupted conventional financial paradigms, presenting unprecedented opportunities and complex challenges for...

Intrinsic Value vs. Discounted Cash Flow Analysis

Valuation is a cornerstone of investment decision-making, helping investors assess whether an asset is overvalued, undervalued, or fairly priced. Among the various valuation methodologies, intrinsic value and discounted cash flow (DCF) analysis stand out for their focus on the underlying...

Value of Stock

A Key Metric for Smart Investing In the dynamic world of finance and investing, one concept stands out as a fundamental principle for valuing stocks: intrinsic value. This metric goes beyond the surface-level fluctuations of stock prices and dives deep...

EAF Fair Value

An In-Depth Analysis Enterprise Application Framing (EAF) fair value is an important concept for investors to understand when evaluating technology companies. EAF refers to proprietary software platforms and applications developed by a company for use in its operations. Determining the...

Warren Buffett’s Intrinsic Value Calculator

A Guide to Estimating the True Value of a Stock Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, is renowned for his ability to identify undervalued stocks that have the potential for strong long-term growth. Central to Buffett’s...

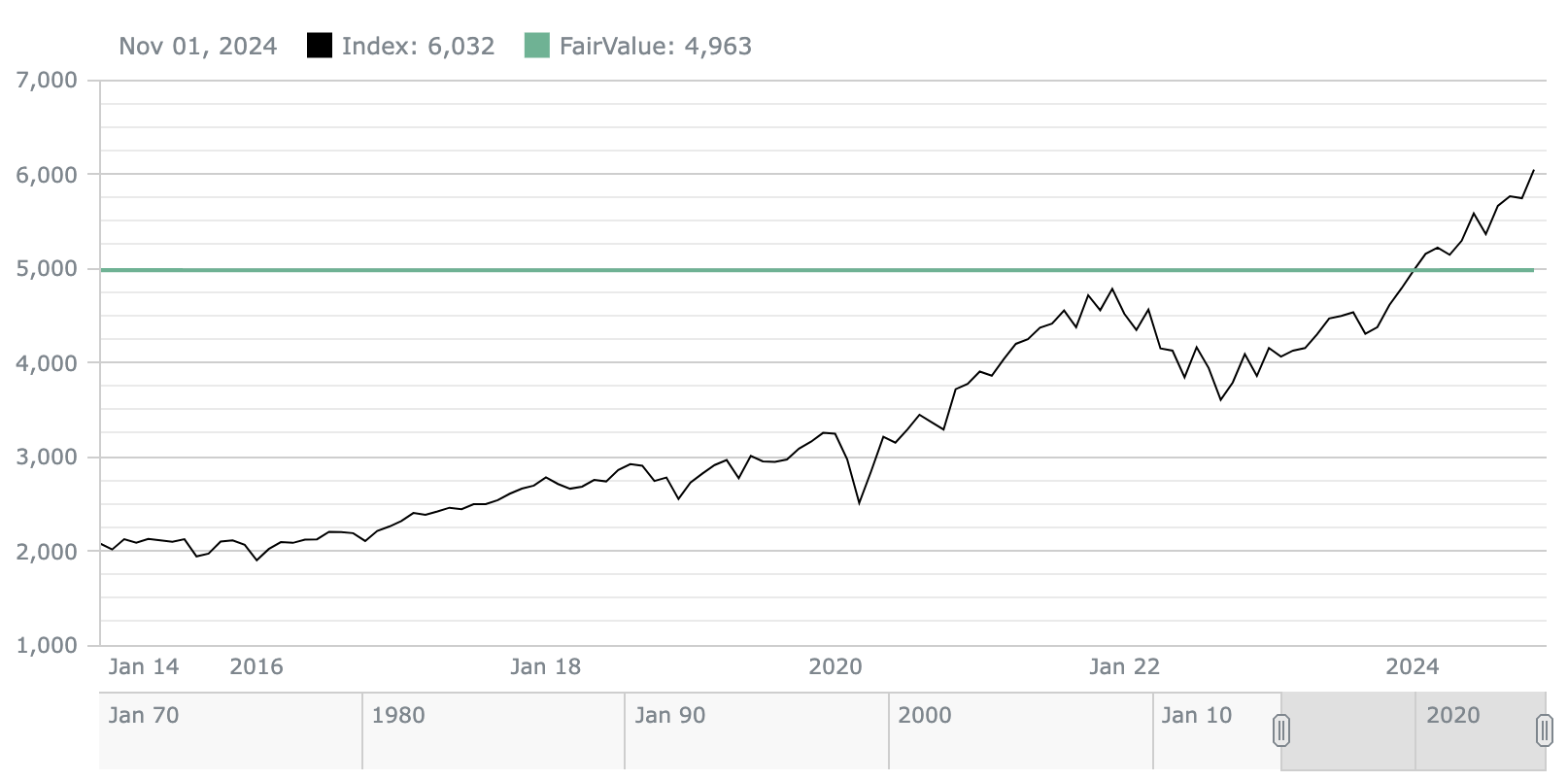

Calculating the Fair Value of a Company

Determining the fair value of a company is an important part of fundamental analysis for investors. The fair value represents the true intrinsic worth of a business based on its financials, growth prospects, and risk factors. By comparing a stock’s...

Navigating the Financial Landscape with Equity Research Reports

In the dynamic and ever-evolving world of finance, investors seek to make informed decisions that can yield profitable returns. One powerful tool at the disposal of investors is Equity Research Reports. These comprehensive documents, crafted by financial analysts, serve as...

What is Lynch’s rule of 20?

A Guide to Valuing Stocks with Precision In the world of finance and investment, understanding the metrics and methodologies for valuing stocks is crucial. Investors often rely on various rules and strategies to make informed decisions about their investments. One...

Proudly powered by WordPress Theme: Essentials Child.