The Role of Fair Value in Real Estate Investments

In the complex world of real estate investing, understanding fair value is crucial for making informed decisions. Fair value assessment provides a foundation for evaluating properties, identifying opportunities, and managing investment risks. This article explores how fair value calculations can...

How Economic Indicators Influence Fair Value

The relationship between economic indicators and fair value calculations is fundamental to financial analysis and investment decision-making. This article explores how key macroeconomic metrics impact the determination of an asset’s fair value, providing insights into the complex interplay between economic...

Fair Value and Cryptocurrency: Evaluating Digital Assets

In the rapidly evolving digital finance landscape, cryptocurrencies have emerged as a transformative force that challenges traditional notions of value and valuation. Bitcoin, Ethereum, and other digital assets have disrupted conventional financial paradigms, presenting unprecedented opportunities and complex challenges for...

Intrinsic Value vs. Discounted Cash Flow Analysis

Valuation is a cornerstone of investment decision-making, helping investors assess whether an asset is overvalued, undervalued, or fairly priced. Among the various valuation methodologies, intrinsic value and discounted cash flow (DCF) analysis stand out for their focus on the underlying...

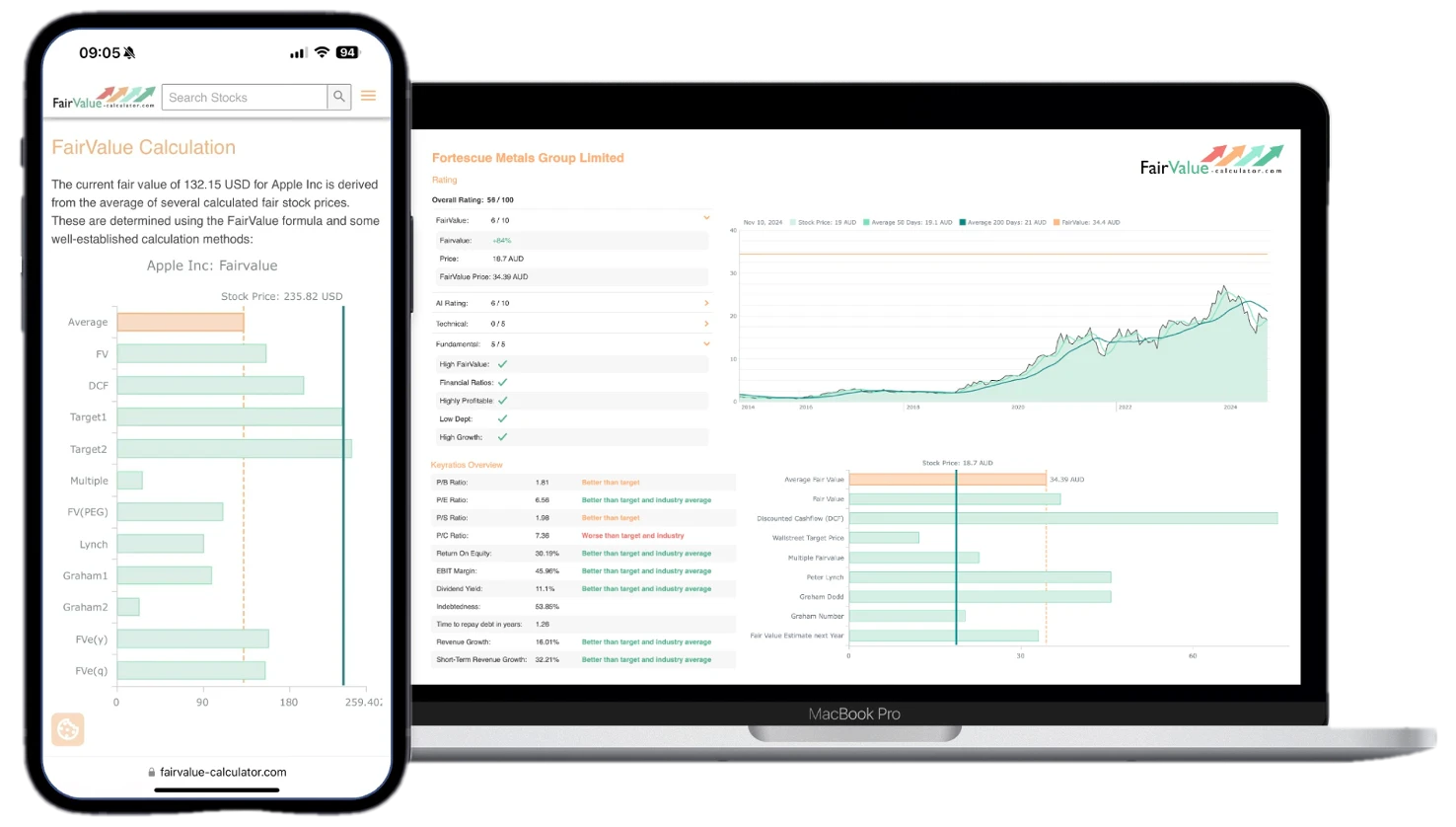

How to Build Your Perfect Stock Portfolio

Proven Strategies for Success! Investing in the stock market can be one of the most rewarding ways to grow your wealth, but it requires a solid plan and proven strategies to achieve lasting success. We at Fairvalue-Calculator.com are committed to...

What is the intrinsic value of an asset?

In the intricate realm of investing and financial analysis, the concept of intrinsic value emerges as a cornerstone of informed decision-making. It serves as a distinguishing factor between strategic, long-term investors and speculative traders who rely on short-term market fluctuations....

Fair Value vs. Market Value: What’s the Difference?

In finance and accounting, the concepts of fair value and market value play pivotal roles in asset valuation, financial reporting, and investment decisions. While these terms are sometimes used interchangeably in casual conversation, they represent distinct approaches to determining the...

Understanding Fair Value – What It Means for Investors

In the complex world of finance and investment, understanding the concept of fair value is crucial for making informed decisions. Fair value is a fundamental principle that helps investors, analysts, and financial professionals assess the true worth of assets, securities,...

The Importance of Fair Value in Portfolio Management

Fair value is a critical concept in modern portfolio management that plays a vital role in asset valuation, risk assessment, and investment decision-making. Understanding and accurately calculating fair values allows portfolio managers to make more informed choices about asset allocation,...

Value of Stock

A Key Metric for Smart Investing In the dynamic world of finance and investing, one concept stands out as a fundamental principle for valuing stocks: intrinsic value. This metric goes beyond the surface-level fluctuations of stock prices and dives deep...

Proudly powered by WordPress Theme: Essentials Child.