Portfolio Manager

The Portfolio Manager helps you build a balanced Fair Value portfolio.

Portfolio Manager

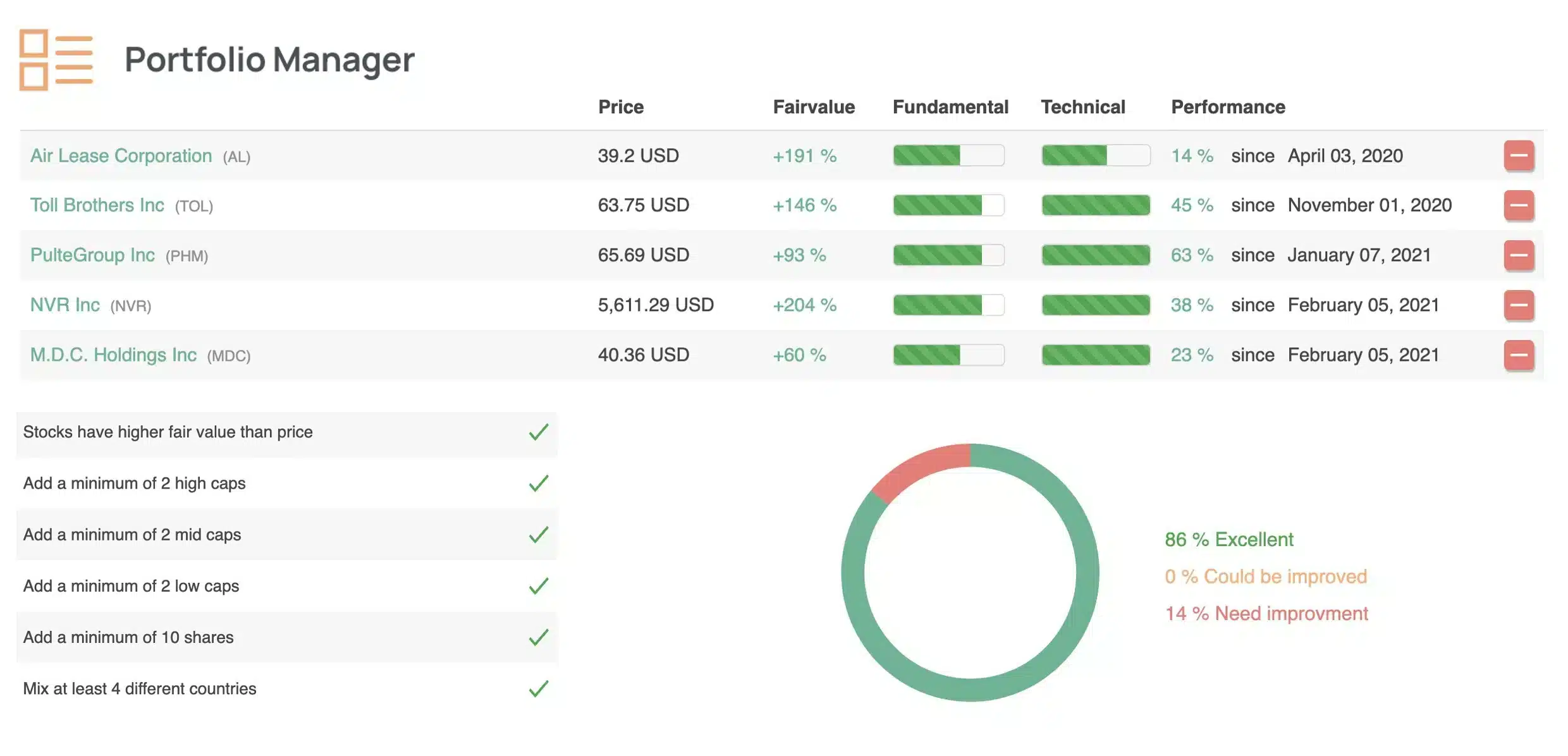

The Portfolio Manager is a powerful tool that helps you effectively manage your stock portfolio. With this tool, you get a detailed overview of your entire portfolio (watchlist), including all stock positions, current values, and gains/losses. You can add stocks to this overview from various tools, no matter where you are. The Portfolio Manager then helps you create a well-balanced, low-risk portfolio.

The Portfolio Manager provides comprehensive performance analysis, allowing you to track the development of your portfolio over time. You receive information on total gains/losses and returns to better understand the performance of your portfolio. Keep an eye on the Fair Value and various fundamental and technical ratings. If a stock no longer has a higher Fair Value or if one of the ratings declines, consider selling the stock and adding a new Fair Value stock to your portfolio.

Furthermore, risk analysis is conducted to assist you in evaluating the risk in your portfolio. Another important aspect of the Portfolio Manager is diversification. You can review the weighting of your stock positions and ensure that you distribute your portfolio across different industries and markets to minimize risk and seize potential opportunities.

With the Portfolio Manager, you can also generate custom email reports to receive notifications when actions are needed in your portfolio. Go to your profile settings to configure your notifications. Overall, the Portfolio Manager offers a comprehensive range of tools and features to manage, analyze, and optimize your stock portfolio. It enables better control and effective decision-making for your portfolio.

Portfolio Manager — Diversification with a System

The Portfolio Manager helps you run your portfolio in a balanced, disciplined, and transparent way. It checks every position for Fair Value vs. Price, evaluates quality (fundamentals & technicals), and ensures the right mix across sectors, countries, and size buckets (large/mid/small caps). On top of that, it suggests a cash allocation — derived from the Market Valuation — and gives you clear, actionable improvement tips.

How it works

You add stocks to your watchlist. The manager detects concentration risk, checks minimums and diversification rules (e.g., “at least 10 positions”, “mix large/mid/small caps”, “at least 4 countries”), and shows you a checklist with ticks for what’s already solid and what’s missing. The donut chart summarizes everything as “Excellent / Could be improved / Need improvement” — including prioritized next steps.

- Fair Value check per position: If Fair Value > Price, the stock stays on your radar.

- Quality at a glance: Fundamental and technical ratings support disciplined decisions.

- Diversification built in: Sector, country, and size-bucket balance — not random picks.

- Cash allocation guidance: Dynamic based on market signals — expensive ⇒ build some cash, cheap ⇒ invest gradually.

For deep dives into single stocks, use our tools like the DCF Calculator and the Sector Heatmap. This way you combine top-down discipline with bottom-up analysis.

FAQ: Stock Portfolio Manager

Balance diversification, fair value and risk: monitor positions, set targets for sectors/countries/sizes, define a cash buffer and act with discipline.

What does the Portfolio Manager do? ▾

How does it help with diversification? ▾

Cash buffer: how much cash should I hold? ▾

Where do “improvement suggestions” come from? ▾

Position sizing & limits—any best practices? ▾

- Set max weight per single stock and per sector/region.

- Use larger sizes only with higher conviction and lower correlation.

- Reduce when a position exceeds band limits after rallies.

Calendar vs. band rebalancing—what should I use? ▾

How do I source new ideas to fill gaps? ▾

How do dividends fit into portfolio planning? ▾

Which data should I maintain for clean tracking? ▾

- Trades (date, quantity, price, fees) and cost basis.

- Notes on thesis, target ranges, review date.

- Optional: dividend settings and planned cash quota.

Common pitfalls in portfolio construction ▾

- Overconcentration in one sector, region or theme.

- Ignoring correlation—winners often move together.

- Acting without fair-value cross-checks (DCF, EV/EBIT).

- Forgetting cash and execution costs.