Total Stock Return Calculator

Total Performance Stock Return Calculator and Where to Invest Money.

Where to Invest Money?

Often in life, we find the difference between success and failure to be a small incremental amount of effort. Let us use math to make this point. Say you make a daily effort of 1. An incremental increase or decrease in effort of 1% over a period of one year can make a tremendous difference in your end result as can be seen below:

1% more effort (1.01)365 = 37.78

1% less effort (0.99)365 = 0.03

This is a clichéd example but there is a grain of truth to it. It is not possible to practically apply this in all scenarios but there are scenarios where this actually works to a great effect. The above example is useful to highlight the power of compounding and if there is one thing we want compounded in life, it is our wealth and the happiness it brings for us. Two critical elements to ensure you can compound your wealth are time and incremental investments and in this article, we will run you through them so that you can not only invest your money but also optimize your savings and investments while figuring out how to double your money.

Why invest?

Curiosity is an inherent trait in our species. It is a genetic instinct that manifests as soon as we can begin crawling. As kids, we are at our most curious wanting to find answers to everything that the universe has to offer. The curiosity dissipates to some extent in most of us as we age but the instinct remains sharp as ever.

We are inclined to do something, no matter how tough or challenging it is as long as we know why we are doing it. It becomes paramount before we undertake any task that requires effort to know the purpose behind that task.

The purpose is what drives us, gives us motivation, and ensures we stick around till the end to experience the outcome as well.

Investing, at least successful investing requires a similar purpose as well. That purpose has to meet dual objectives, it has to be high enough so that we feel good doing it and at the same time grounded enough that it is achievable. Like a perfect mixture of sugar and salt in lemonade, if the balance of your purpose is out of whack, it will either taste too sweet (low-risk low return investments) or too salty (high-risk high return investments).

Investing needs a purpose:

While each individual will have his/her purpose tailored to their specifications, the broad strokes as outlined in the next paragraph form a general purpose for all investors across the globe. Once that purpose is established, the probability of one sticking to their investment journey and seeing it to a successful end increases significantly.

Investment purpose:

The journey to identifying the best way of investing money begins with the question: why create wealth? The most common answers to this question range from having a luxurious life to giving back to society via charity with early retirement and financial freedom thrown in the mixture. It all boils down to maintaining or improving one’s current lifestyle even after retirement.

Nobody wishes to work forever. We all wish to retire, sooner the better, and devote our time to worldly pursuits unrelated to our professions or careers. However, while our paychecks stop, our expenses do not. Not only do our expenses remain, but they also grow every year aided in their rise by the forces of inflation.

Inflation constantly erodes the value of money and over a sufficiently large period of time, it can compound as well and make your savings quite worthless.

This is the primary reason we find a lot of seniors in the workplace who are working way past their retirement. They have simply not saved enough and with rising prices, are forced to work to make ends meet. This is one of the reasons; why one must start investing in your 20s and we will tell you how to invest in your 20s so that you can retire well before your time.

To highlight the effect of inflation, here are the prices of common things in 1968 vs. 2018 (Source: www.thebrainpenny.com)

Total Stock Return Investment Calculator

Prices have gone up a crazy amount for someone who retired in 2018 and who was working in 1968. This makes it essential to invest your money and to do it well so that you have enough to be able to meet rising expenses past your retirement.

Healthcare forms another significant expense that has seen an uptick. The average life expectancy in Europe for someone born in 2019 is 78.6 years vs. 62 years for someone born in the mid-1960s. Not only do you live longer post your retirement but also face increasing healthcare expenses that come with an advanced age. Increasing expenses with age fueled by inflation makes a powerful case to begin investing in your 20s in order to create wealth that will sustain you in the twilight of your life.

Lifestyle creep rounds out the trinity of reasons that answer why one must create wealth. Lifestyle creep also known as lifestyle inflation is the increase in discretionary expenses that accompanies an increase in income. The price of essentials does not grow at pace with income growth for most of us. Food and groceries cost almost the same irrespective of whether we are making €100,000 a year or €1 million.

However other aspects of our life get upgraded. The small car is replaced by a big, luxury one. Big houses, expensive restaurants, and high-end electronics all add to your expenses as your income increases. This leads to a point where maintaining your current lifestyle requires a lot more money than what you had envisaged when you began your investing journey which again makes a point of identifying how to invest your money, where to invest your money, and more importantly how to double your money and do it successfully and repeatedly.

Now that we know why we need to invest, let us look at how to invest your money and where to invest your money.

Investing in your 20s:

The 20s are an amazing time. You are young, energetic, have decades of income potential in front of you and quick to learn and overcome any challenges that come your way. Your first focus in your 20s is to spend your paycheck in as fruitful a way as possible. Forget about investing for the moment. Spend your money on experiences and lessons. Go try that restaurant you wanted, take a trip to that exotic country you heard about, and try out some acting classes at your local theatre. Be free and let your imagination guide you. The only thing to take care of is to not go into debt doing this.

As long as you are debt-free, use your 20s to gain as much experience and lessons as possible. You can focus on investing when you have higher responsibilities in your job and life, settle down, marry and start a family, and in general, have a higher income than before.

However, this does not mean that if you have some money left over at the end of the month, you use it all on intoxicating substances or frivolous expenses. That money can and must be invested in the asset classes that we shall talk about and once you have settled down, begin allocating incrementally more money to these investments than you would in your 20s.

Compounding:

Before we talk about where to invest, a quick primer on compounding would be useful to understand the dual elements of time and incremental investment. Time is an exponential factor in compound and the longer you stay invested, the larger the returns. This directly translates to the earlier you invest, the better your chances of becoming rich by the time you retire.

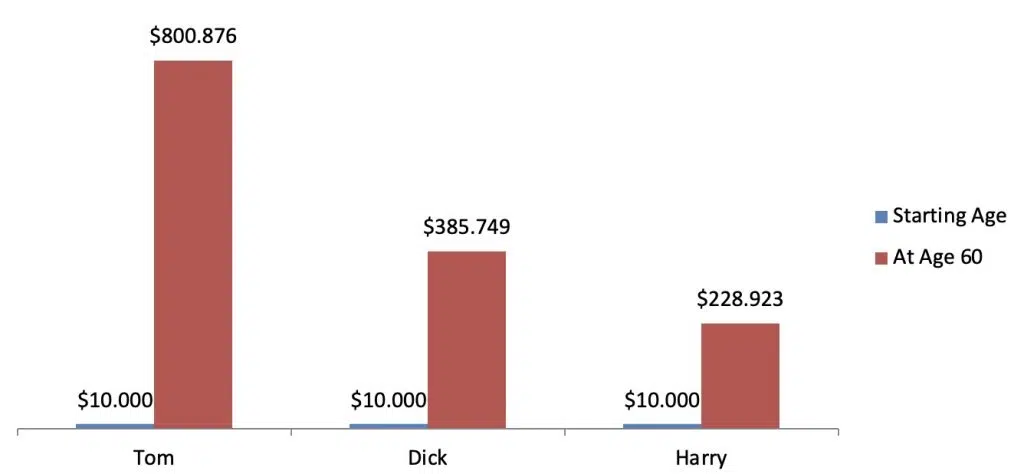

Let us do a quick study. Let us consider three people Tom, Dick, and Harry who each begin their investment journey at different ages. We assume they all retire at 60 years of age and they all earn the same rate of return (11%). Tom begins at 18 years of age, Dick at 25 years and Harry at 30 years of age.

As you can see, just a 5-year gap can mean a huge difference in the income of Dick and Harry. The gap between the final income of Tom and Harry is unassailable just by virtue of starting early. It is of utmost importance that one starts investing as soon as possible, no matter how small it is, and stays invested throughout for the role of compounding to play itself out. Time is precious and until one can reverse it, any opportunity to put it in our favour must not be lost. Here is a cleaner summary of the money made by each of the three

As you can see, just a 5-year gap can mean a huge difference in the income of Dick and Harry. The gap between the final income of Tom and Harry is unassailable just by virtue of starting early. It is of utmost importance that one starts investing as soon as possible, no matter how small it is, and stays invested throughout for the role of compounding to play itself out. Time is precious and until one can reverse it, any opportunity to put it in our favour must not be lost. Here is a cleaner summary of the money made by each of the three

Asset Classes

You want to begin your savings & investments as early as possible and always into assets. Simply put, assets are instruments or resources of value that appreciate in value over time and at the same time generate a periodic, predictable income. For e.g. a land or a property that provides rental income as well as appreciates in value is an asset.

Conversely, we have liabilities that do not generate income and or depreciate in value. They also often require additional capital for upkeep and maintenance. A personal car and a mobile phone, from an investment point of view are liabilities. Almost all legitimate investment opportunities can be classified into the following 5 asset classes: Equity, Fixed Income, Gold, Real Estate, and Cash. All that you see are variations of these 5 asset classes and before you ask, cryptocurrencies are not asset classes. They are yet to prove their value or achieve wide-scale acceptability of their presence as an asset class.

Here are a few of the asset classes you can invest in

Equity:

One of the most popular and commonly known asset classes, equity has been one of the best wealth generators over the last 200 years, generating a return of 9.56% per annum from 1825 to 2019. That is doubling your money approximately every seven years. Equity as an asset class represents shares of various public companies that retail investors like you and me as well as institutional investors like companies and funds can invest in. Equities are probably the only way to beat inflation and have displayed tremendous potential for wealth generation and appreciation.

Debt/Fixed Income securities:

Debt as we know is the borrowing and lending of money. We all have lent to and borrowed money from our friends and family and we all have that one friend who has borrowed money from us and then ran away faster than me after teasing my neighbor’s dog (who was not on a leash and which I regret not checking before), (also let that be a lesson never to lend money to friends unless you want to lose your money or friend or both).

However, lending in a professional manner is governed by laws and rules and one can earn some income in the form of interest on it. The Federal Government, State Government, Local Municipal bodies, various corporations, and financial institutions like banks are often in need of money and are willing to borrow it from you. Of course, nothing is free and they will be paying you some interest for borrowing that money. This act of lending and borrowing needs to be documented and like shares that represent ownership of a company, this document represents ownership of the debt. The document is most commonly known as a bond.

Gold & Precious Metals:

Human beings have an attraction for gold akin to one that Gollum has for its precious and this has continued since time immemorial. With its origins as currency and its transition to asset due to its rarity, gold has been a reliable store of value and safe haven asset during crises since ancient history. While the world markets crashed during the pandemic, gold shone bright, crossing $2000 per troy oz. for the first time in its entire history.

One can store gold in physical form like bars and coins; however, that requires additional expense in safekeeping. Alternatively one can invest in gold ETFs which are funds that are set up to purchase and hold gold. While a single ounce of gold may cost $2000 dollar to buy, in the case of ETFs one can buy a fraction of that allowing you to hold gold in the portfolio.

Real Estate:

Real Estate refers to land, the mineral and agricultural resources available on that land as well as any buildings that are built on that land. An important distinction when investing in real estate as an asset is that the house one lives in cannot be considered an asset. Sure in an emergency, one can sell it but in normal life, one does not a) earn any income from the house and b) does not buy it with the intention of selling it making it a conditional asset at best.

However, for those who invest in real estate, either residential or commercial with the aim of earning a rental income, real estate is a good asset to hold in your portfolio. It has had its ups and downs like any other asset class and it particularly suffered a hard time after the 2008 Global Financial Crisis, however, it has picked up steam and is once again one of the favorite asset classes of several investors. There is also a psychological aspect of owning a hard, physical asset and that is what attracts investors to real estate.

Cash & Cash Equivalents:

Cash is also an asset; albeit one that does not generate any returns. Cash is usually kept for emergencies and one must have at least a year’s worth of expenses in cash. It can be parked in a checking account or short-term government securities for a nominal interest rate. These short-term securities that can be easily exchanged for cash are called liquid securities or cash equivalents.

Other Asset Classes:

The asset classes mentioned above are the most common and widely accepted asset classes. There are several other asset classes available that are non-traditional and their acceptability depends on the environment in which they operate. Baseball cards, once considered a treasure have begun losing their relevance and thus their value as the popularity of the sport wanes. Art is another asset class and is often subjective in its valuations. What is worth millions to someone might be worth junk to another. There was a time when Tulips were the most expensive assets in the entire world. The most recent asset class to join the fad is cryptocurrencies. They have displayed all the signs of past manias and hold value as long as people are willing to ascribe value to them. The day people decide cryptocurrencies are just code and not worth putting a cent in, all of them will lose value. For investment purposes, it is always recommended to stick to the traditional asset classes for the majority of your portfolio and invest a very small amount of money one is willing to lose in these non-traditional asset classes.

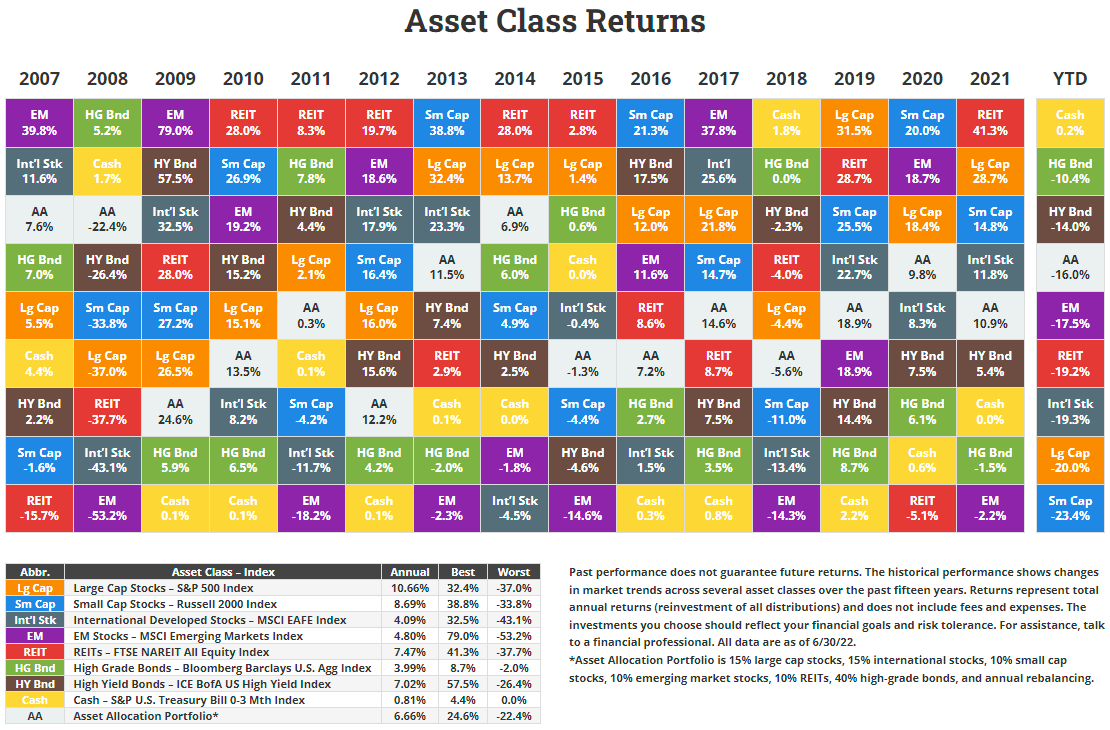

Source: NovelInvestor.com

Source: NovelInvestor.com As you can see, no single asset class has performed consistently. Investing all your money in one asset class be it equities debt or real estate means you are subjected to periods of outperformance and underperformance and the returns generated might not be worth the roller coaster ride that you have to experience for it. As a matter of fact, 2018 saw cash outperforming everything else. Hence, investments must be structured in a way to participate in maximum asset classes as per the risk profile and goals of the investors. These structured investments in a portfolio are referred to as Asset Allocation and shall be explored in another article. We at fairvalue-calculator.com will construct these portfolios for you as well utilizing a mix of equities and ETFs from across the globe to give you access to the benefits of asset allocation.

This can be extremely confusing when you decide to invest your money, especially if it is your first time doing it. Investing in your 20s can be scary but also rewarding. You have a lot more room for making mistakes as the size of your mistakes will be small and with a long earning potential ahead of you, next to negligible in the long term.

We at fairvalue-calcuator.com can make things simple for you. Our detailed database of thousands of stocks across the world serves as a rich repository of information on any company you wish to explore. We not only give you all the financial information on these stocks that you need but also provide the optimum price at which they must be bought to minimize risk and maximize return.

Our Premium Tools come with a portfolio constructor using my very own proprietary methods that will build a fair value portfolio for you intending to maximize your returns while keeping your risks in control. I, Peter Klein will be invested in the same portfolio as you and will be a friend and companion on this investing journey that you undertake with us.

Starting something new can be scary. It can be scarier once you realize that this something new is a life-changing journey. What you need during this period is a friend and a mentor. I have been where you have, made a lot of mistakes, and learned from it to perfect my investment technique which is a fair value calculator. I invite you to join me and learn from my mistakes. Let them be a source of guidance as you embark on your own journey. I shall be the Samwise Gamgee to your Frodo as you begin to shape your investments in your portfolio and I shall carry you when your mind falters (as it will during market crashes). All I ask is for you to have faith and begin your investing journey with us. Let the markets and fate take care of the rest.