Sector Valuation

Tools for Valuation of Entire Stock Industries & Sectors.

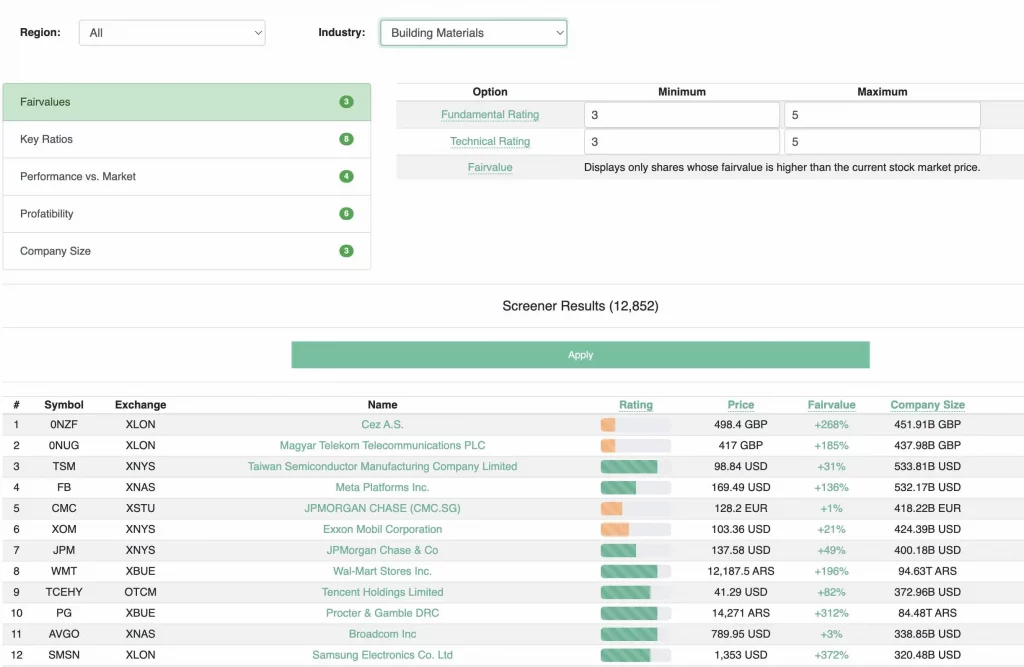

In the Fair Value Calculator, the Sector Valuation tool is used to analyze and assess the valuation of different sectors or industries in the stock market.

The aim is to identify sectors that are particularly undervalued. The tool displays key financial metrics and the relative performance of each sector compared to the overall market.

The greener a sector is, the more attractive it is for investment. When the market valuation indicates a favorable stock market, undervalued stocks in those green sectors should be considered.

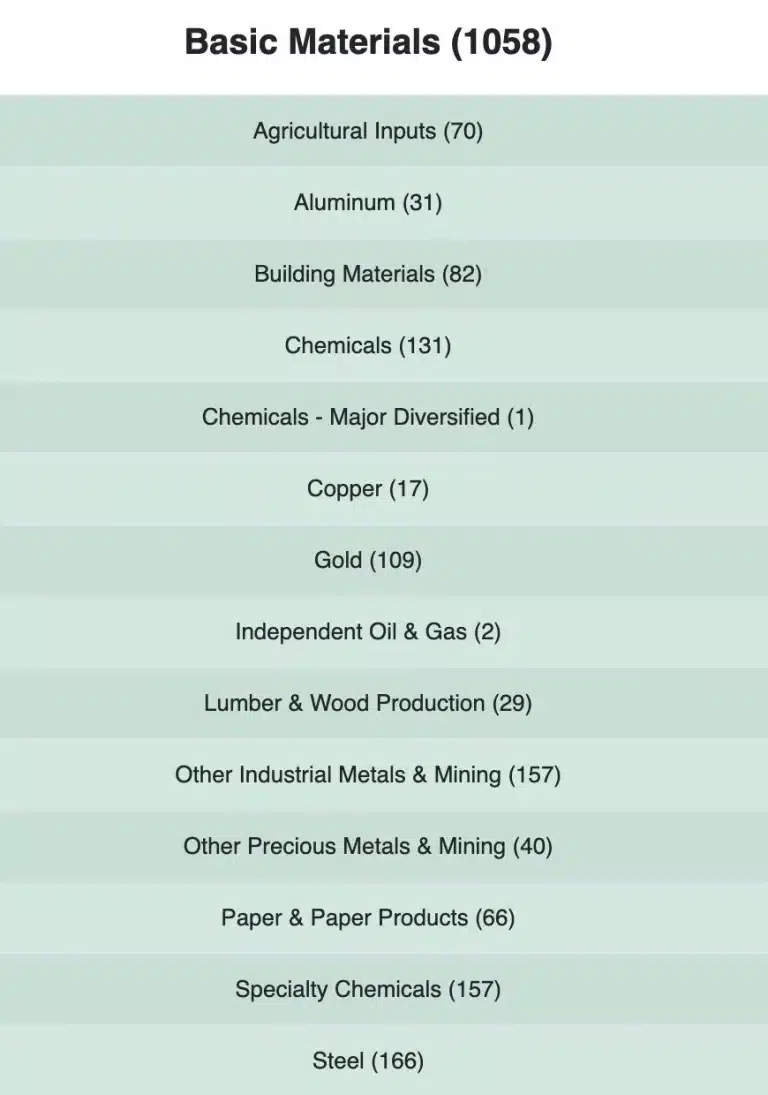

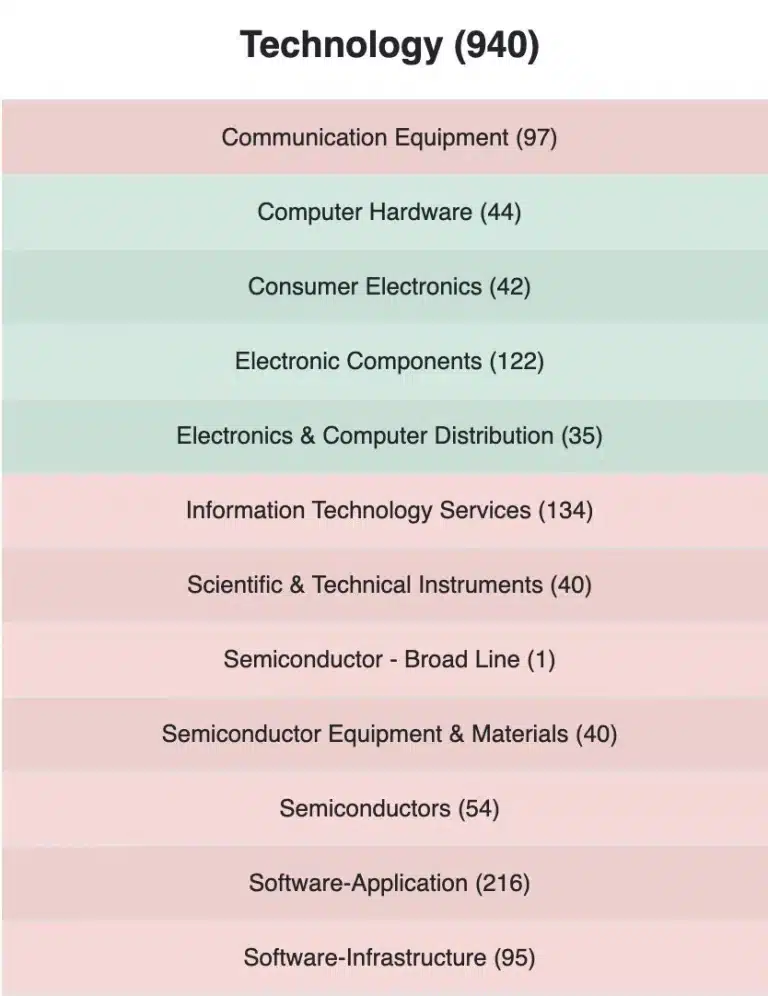

Each sector can be expanded, allowing you to search for undervalued stocks with high fair value directly within that sector.

The Sector Valuation in the Tool

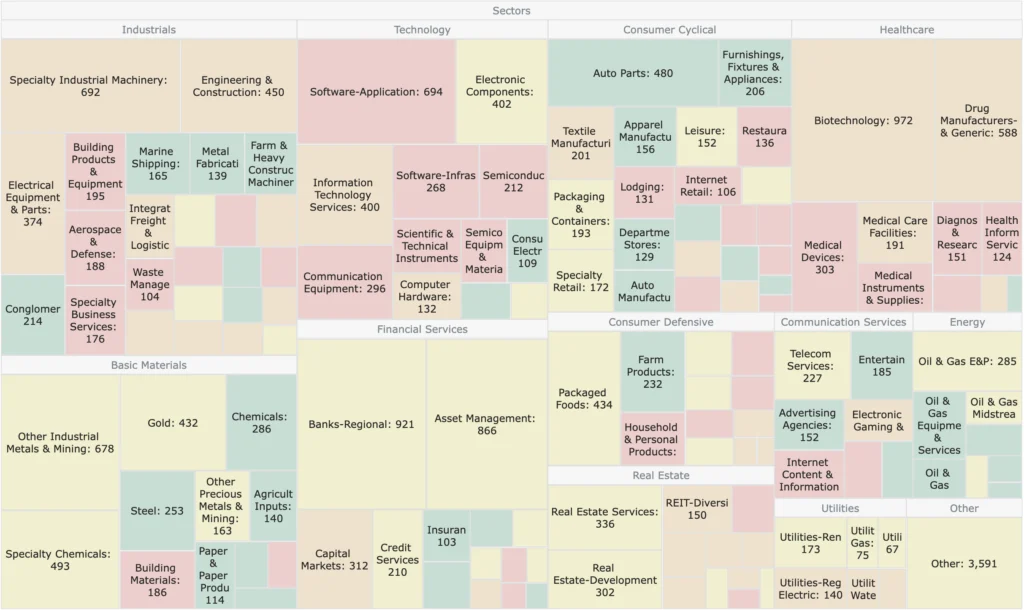

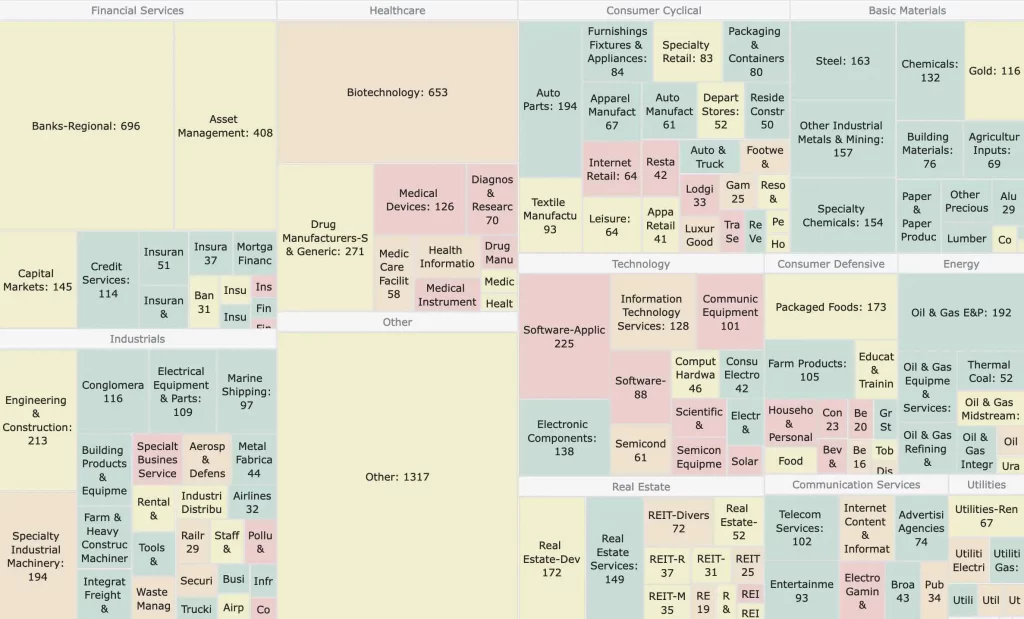

The more green fields in a sector, the more advantageous the sector is evaluated. In the first image, you can see an advantageously valued industry. Here, it indicates that there are likely undervalued stocks to be found in the sector related to basic materials. In the second image, the technology sector is displayed, which appears to be expensive.

Sector List, Screener and Heatmap

Once you have identified an undervalued sector, you can analyze individual industries within that sector to find undervalued stocks. Click on each sector or use the sector screener and the user-friendly heatmap to quickly identify which sector is the best-rated.

The Different Sectors and Their Characteristics

Here are examples of different sectors and industries in stock analysis, along with a brief explanation of each industry. Additionally, insights into how each industry behaves in different market phases and conditions will be provided, highlighting what to consider when investing in each sector:

Basic Materials: This sector includes companies involved in the extraction, production, and distribution of raw materials such as metals, chemicals, paper, and wood. The performance of these stocks can be influenced by fluctuating commodity prices. In periods of positive economic growth and increasing demand for raw materials, stocks in this sector can perform well.

Communication: This sector includes telecommunications companies, cable providers, and media companies. During periods of economic stability, companies in the communication industry can benefit from rising revenues and customer growth. However, technological advancements and shifts in consumer behavior can impact the performance of this sector.

Cyclical Consumer: This sector consists of companies that offer products and services whose demand is highly influenced by economic cycles. This includes automobile manufacturers, retailers, and travel companies. During periods of economic expansion, stocks in this sector tend to perform well, while they may underperform during recessions.

Defensive Consumer: This sector includes companies that provide products and services that are considered essential or necessary regardless of the economic conditions. Examples include food manufacturers, pharmaceutical companies, and utility providers. Stocks in this sector can exhibit stability during uncertain economic times as the demand for their products tends to remain consistent.

Energy: This sector encompasses companies in the oil and gas industry, renewable energy, and utility companies. The performance of energy stocks is often affected by changes in oil prices, energy demand, and supply dynamics. The energy sector’s performance can vary based on geopolitical events, supply and demand factors, and regulatory changes.

Financials: This sector includes banks, insurance companies, investment firms, and other financial service providers. The performance of this sector is closely tied to interest rates, credit lending, market conditions, and overall economic stability. Changes in interest rate policies and regulations can impact stock prices in this sector.

Healthcare: This sector includes pharmaceutical companies, medical device manufacturers, hospital chains, and other healthcare service providers. Demographic shifts, medical innovations, and government regulations can influence the performance of healthcare stocks. The healthcare sector tends to demonstrate relative stability and resilience during economic fluctuations.

Industrials: This sector comprises companies involved in manufacturing, aerospace, transportation, and construction. The performance of this sector is closely tied to global economic conditions, order volumes, and industrial production. Industrial stocks can be influenced by economic fluctuations and geopolitical events.

Real Estate: This sector includes real estate developers, REITs (Real Estate Investment Trusts), and companies in the real estate industry. The performance of this sector depends on factors such as interest rates, demand for residential and commercial properties, construction activity, and real estate prices. The real estate sector can benefit from economic upswings but may also be vulnerable to changes in interest rates and the real estate market.

Technology: This sector includes companies in software, hardware, internet, semiconductor, and telecommunications industries. Technology companies are often dependent on innovation, demand for technology products, and overall economic growth. The performance of this sector can be highly volatile due to technological advancements and competitive factors.

Utilities: This sector comprises companies that provide utility services such as electricity, gas, and water. Utility companies are often considered defensive investments as the demand for their services tends to remain stable. The performance of this sector can be influenced by regulations, energy prices, and consumer behavior.

When investing in different sectors, it is important to understand the specific risks and opportunities associated with each industry. Consideration should be given to the market environment, economic conditions, demand trends, and other relevant factors.

Discover the Sector Tool now!

100% Satisfaction. 0% Risk. Always cancellable.