Peter Lynch is a name that is synonymous with the world of investing. The former manager of the Fidelity Magellan Fund, Lynch is known for his successful stock-picking strategies and his ability to spot promising investments before others did. One of the key factors that contributed to Lynch’s success was his use of calculators to analyze financial data. In this article, we will delve deeper into Lynch’s ideas about the stock market and calculators, and how you can use these tools to make informed investment decisions.

💡 Discover Powerful Investing Tools

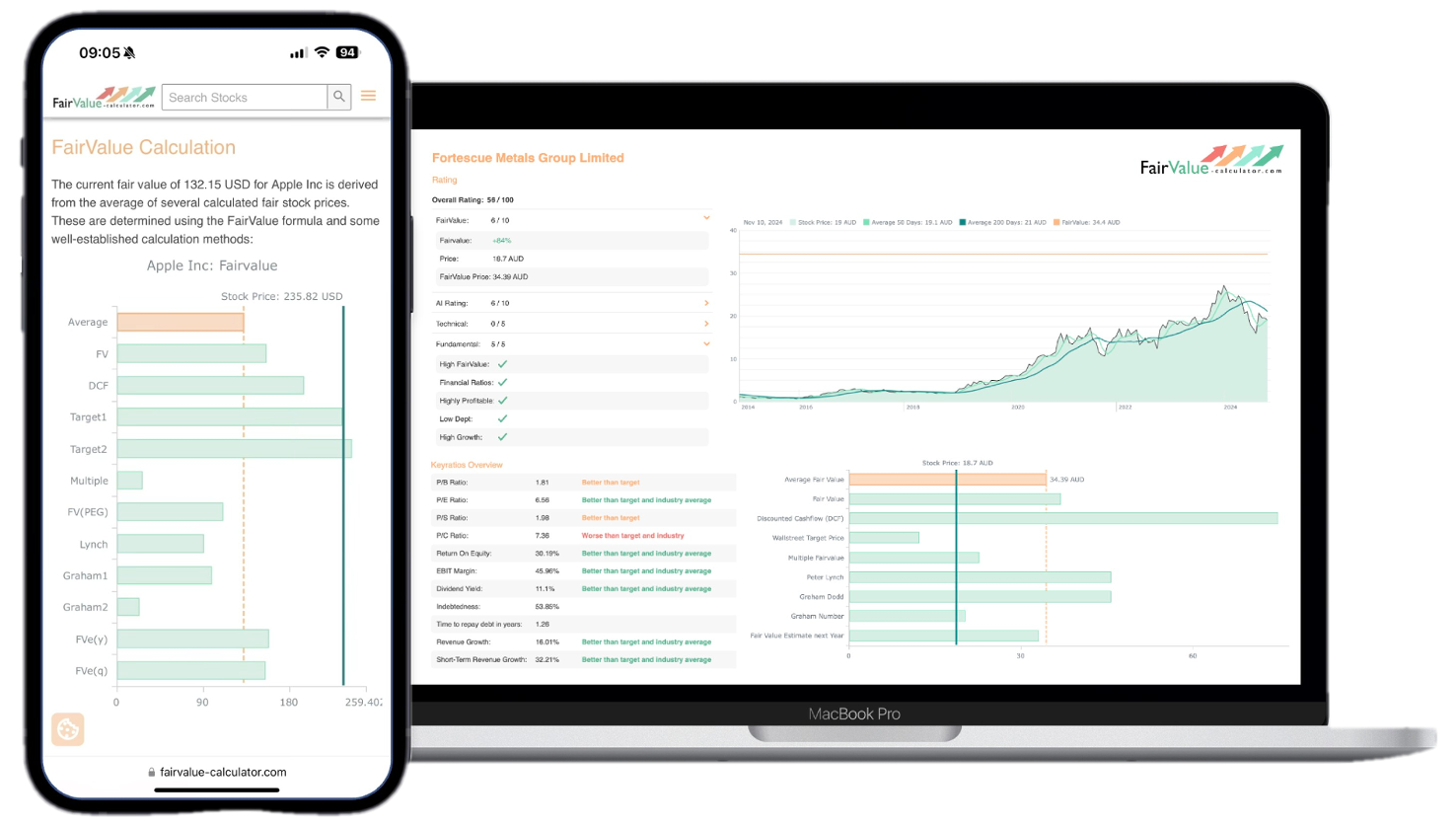

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Use financial data to your benefit with Peter Lynch

Lynch’s stock analysis tools were based on the idea that investors could use financial ratios and other data to identify companies that were undervalued by the market. He believed that investors should focus on companies with strong fundamentals, such as high earnings growth, low debt-to-equity ratios, and attractive price-to-earnings ratios. By analyzing financial data and comparing it to industry averages, Lynch was able to identify stocks that were trading at a discount to their intrinsic value.

🚀 Test the Fair Value Calculator Now!

Find out in seconds whether your stock is truly undervalued or overpriced – based on fundamentals and future growth.

Try it for Free →To help him with this analysis, Peter Lynch developed a number of calculators that he used to crunch the numbers and identify promising investments. These calculators included tools for calculating earnings growth rates, price-to-earnings ratios, and dividend yields, among others. By using these tools, Lynch was able to quickly analyze large amounts of financial data and identify investment opportunities that others had overlooked.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

Find your investment now

So, how can you use these tools developed by Peter Lynch to benefit your own investment portfolio? The first step is to understand the basic principles behind Peter Lynch’s approach to investing. This means analyzing financial data to identify companies that have strong fundamentals and are trading at a discount to their intrinsic value. Once you have identified these companies, you can use Lynch’s calculators to dive deeper into the financial data and determine whether the company is truly undervalued.

For example, let’s say you are interested in investing in a company in the technology sector. Using Peter Lynch’s approach, you would start by analyzing the company’s earnings growth rate over the past few years. You would then compare this growth rate to industry averages to determine whether the company is growing faster or slower than its peers. Next, you would use a calculator to determine the company’s price-to-earnings ratio, which would give you an idea of how the stock is valued compared to its earnings. If the company has a low price-to-earnings ratio and a high earnings growth rate, it may be a good investment opportunity.

Financial data – let us do the work for you

Of course, analyzing financial data like Peter Lynch can be a time-consuming process, and not everyone has the expertise or the resources to do it effectively. This is where the Premium Tools offered by Fair Value Calculator can be incredibly helpful. Our tools allow investors to quickly and easily analyze financial data and identify promising investment opportunities. Whether you are looking for stocks with high earnings growth rates, low price-to-earnings ratios, or attractive dividend yields, our calculators can help you find the right investments for your portfolio.

To summarize, Peter Lynch’s approach to investing is based on the idea that investors can use financial data to identify undervalued companies and generate significant returns over the long term. By using Lynch’s calculators and analyzing financial data, investors can gain a deeper understanding of the companies they are investing in and make informed investment decisions. At Fair Value Calculator, we offer a range of Premium Tools that can help you apply Lynch’s approach to your own investment portfolio. So why not give our tools a try and see how they can help you achieve your investment goals?