“I am always prepared to do the right thing regardless of what other people think” – Bill Ackman

Imagine undertaking a con scheme of such massive proportions that subsequent such attempts to swindle people in the future get associated with your name. Charles Ponzi, who is responsible for the coinage of the term “Ponzi Scheme”, was an Italian swindler and con artist who promised clients 50% profit within 45 days or 100% profit within 90 days by buying discounted postal reply coupons (international postage) in other countries and redeeming them at face value in the US.

On paper, it looks like a wonderful arbitrage, but in reality, this arbitrage did not exist. Charles Ponzi instead took money from new investors to pay the old investors which in such schemes then eventually collapsed as new investor flows reduced. The modern-day example of one such scheme and which was the largest Ponzi scheme in history ($64.8 billion) was the Bernie Madoff scheme.

Such investment schemes are nowadays disguised as multi-level marketing schemes or pyramid schemes. In addition to such schemes, swindlers and con artists also focused on launching fraudulent companies that sought to cheat their shareholders. The Enron scandal comes to mind whenever one thinks of fraudulent companies. Wouldn’t it be wonderful if someone could have stepped in and protected the investors? Someone who was knowledgeable, aware of industry practices, and had skin in the game?

The proliferation of new industries and increased public participation in equity markets led to a void in the markets where few con artists could separate people from their hard-earned money in the guise of investment. The void raised a separate class of investors who rose from their normal investing practices to become what is now known as activist investors.

Benjamin Graham was one of the earliest, well-known activist investors who would often take up a large stake in companies and then pressurize the management to distribute surplus cash left in the company to its investors. However as the level of conning and fraud increased, activist investors stepped up to the plate and began fighting harder and harder.

Our legend for this piece is one such activist investor who started his investing journey by naming his first investment firm after the city that has the most famous vigilante in comic book history, Gotham Partners. Worshipped and demonized by people, he has developed his investing strategy to not only recognize value but also those that pretend to have value and then go after the latter with guns blazing. Before we delve into this mastermind who shot into the limelight as one of the largest players in the financial crisis of 2007-2008, let us take a small detour to learn a concept called short selling.

Short Selling

This will be a brief explainer and you, my reader are encouraged to read about this practice in detail. Short selling is a technique where you sell a product that you don’t currently own and subsequently buy it back for delivery. Little confusing isn’t it? Let’s understand a bit of the history behind it.

A few centuries ago, when humans depended on hunting for food, skins, and other animal parts, hunters would often venture into forests during summer for months at a stretch. In order to gain funding for the same, they would sell their hunting products before the hunt began and then use that money to buy hunting supplies. Post their hunting trip, they would deliver the agreed-upon items to the buyers. However, hunting is an unpredictable profession and the hunters would often be “short” of the requisite items and would have “short-sold” those items. The solution for the same was to buy the requisite items from other hunters and fulfill their bargains.

As civilization evolved, this practice began to be followed by farmers as well. A potato farmer would sell his crop produce to a manufacturer like Lays and would have to deliver the same at a later date. Soon, traders and speculators began to see a profit-making opportunity. Anticipating supply and demand fluctuations, they would often short-sell the products (they do not own the product) at a certain price and would buy it back at a lower price to deliver the same.

As investors, most of us have bought and held stocks most of the time. However, during market corrections, we have no option but to continue to hold as the value of our stocks decreases or lock in a loss by selling them. However, if we could sell the stocks we don’t own, and buy them back later after the price has fallen, we would actually make a profit. This is the basic principle of short selling that activist investors often follow.

The Long Side of Activist Investing

There are two aspects to activist investing, one on the long side and one on the short side. On the long side of activist investing, investors acquire a significant portion of shares available on the market and secure a seat on the board of a company post which they then put up proposals for requisite change.

Bill Ackman, shortly after setting up his hedge fund Pershing in 2004, acquired a large stake in Wendy’s the fast food chain. Wendy’s at that time held Tim Horton’s coffee business as its subsidiary. Wendy’s acquired Tim Horton’s in 1995. Tim Horton’s grew rapidly to spread across Canada. They had excellent revenue growth and profitability.

Wendy’s on the other hand struggled with competition. McDonald’s and Burger King made the US burger chain market a three-way competition. It struggled to maintain market share and was losing money overshadowing Tim Horton’s profitability and suppressing the true value of both the companies.

Ackman acquired a 10% stake in Wendy’s and teamed up with other investors to pressurize the management to spin off Tim Horton into a separately listed company. They listed other proposals for Wendy along with this and in 2006, the spin-off materialized to raise about $670 million for Wendy’s shareholders. Ackman exited his position in 2009 for a substantial profit.

He repeated this with General Growth in 2009. General Growth was a Real Estate Investment Trust (REIT) which operated malls. He spent $60 million to acquire shares of General Growth in 2009 at $0.35 a share which he then sold for $1.6 billion after turning the company around, a phenomenal profit.

It was a pretty ingenious solution. He identified that General Growth had more assets than liabilities allowing it to file for bankruptcy but still retain value for equity shareholders which is what Ackman forced the company to do after acquiring a significant stake in it. While details are a bit complex to cover in this piece, the gist of the matter was that General Growth had not taken debt from its usual sources but had instead gone with the current hot trend and taken on a commercial mortgage-backed security route which as we all know blew up in 2009.

General Growth was a well-managed company and was in trouble only because of the financial crisis. Ackman was of the opinion that if given a debt extension, general growth could manage to repay the debt and emerge profitable for shareholders. The only way to get that restructuring and extension was via bankruptcy which he as an activist investor managed to do resulting in the windfall gain that he and his investors had.

The Short Side of Activist Investing

This brings us to the counterpart of the above. Good companies in distress were identified, joined the board as large investors, and unlocked value for all shareholders including oneself. Ackman also played vigilante throughout his investing career, and he still does. His most recent examples on short trades also highlight his flexibility and his adaptability to different market conditions. In fact, short selling is how Bill Ackman acquired his fame when he became famous for buying credit default swaps against Municipal Bond Insurance Association (MBIA) debt and profiting greatly from it in the financial crash of 2008-09.

(Credit Default Swap is a way to short sell bonds of a company where you enter into an agreement with a counterparty, mostly a bank, wherein you will pay a premium to the bank betting that a certain company will default on its debt within a certain period. The bank gets to keep the premium if the company does not default by then but if the company defaults, the bank has to pay out the agreed-upon sum to the buyer of the credit default swap).

Bill Ackman’s biggest short came at the onset of the pandemic in March 2020. His hedge fund acquired credit protection on investment grade and high-yield bond indexes, placing a bet on a full economic shutdown in the US due to the COVID pandemic, generating a cool $2.6 billion in profits and posting a gain of 7.9% in March 2020 when the S&P had dropped by 17%.

Just two years later, Ackman made a bet on markets moving up by a lot. His hedge fund bought interest rate-related hedges, trades that would benefit if the Federal Reserve was to increase rates sharply, which they did resulting in a profit of $2.7 billion for the fund. Both times, Ackman displayed a deep understanding of current market trends and a flexible attitude to make significant money off of it.

Core Philosophy

Bill Ackman’s value investing philosophy is quite simple. Find value, and force management to unlock value. Alternatively, find companies destroying value, short it, and call the management out for destroying value. In both cases, money is to be made by highlighting value or the lack of it.

The determination of value or the arrival at a decision of destroyed value remains a measure for Ackman, but the way he approaches a scenario allows us as investors, an idea of how we are supposed to approach our own investing. This philosophy is perfectly replicable as individual shareholders, holding even one share are allowed to be a part of shareholder meetings, where they can ask questions to the management directly and at the same time, meet like-minded investors who can then join up to enforce decisions on the management.

Ackman’s Failures

In markets, as in life, successes are never unilateral. They are always accompanied by failures and Bill Ackman has had his share of spectacular failures as well. Vigilantism is often a risky affair and in the case of activist investing, you are putting your money on the line. The losses can tend to be significant, especially on the short side, if the value destruction that you can envision becomes difficult to prove. Ackman has faced similar situations.

One of the biggest goofups of Ackman’s career was Valeant Pharmaceuticals. Pershing, his hedge fund acquired an 8.5% stake in 2014 at $180 per share. Over the next 3 years, Valeant was plagued by a string of accusations and lawsuits for fraud which saw its share price plummet by 90%. Ackman lost over $3 billion on the trade.

Another disaster and one which was quite popular was his short trade in Herbalife. Herbalife is a global multi-level marketing company, a fancy name for Ponzi schemes. Ackman put on a sizeable short trade in Herbalife and then fought an activist battle for five years. It was a hard battle, but with the market knowing the short position and size of the short, he had to eventually give in and take another significant loss.

The reason we have highlighted these failures is to caution our investors that activist investors have to take risks. The outsized returns are often a factor of hidden, outsized risks as well. Ackman has managed to bounce back from these disasters because his trade risk-to-reward ratio is skewed heavily towards the reward ensuring that he makes 10 to 100x on the trades that work.

Philosophy Caveat

Ackman’s strategy is often a function of scale as well as the influence he wields on social media and in traditional media. You might be able to find a good trade or a bad company, but there is no guarantee that it will work out for you unless the big players notice. This is especially brutal if you are short as a small investor. Hence for all practical purposes, we should simply be on the lookout for undervalued companies whose shares we can buy and then raise the issues in shareholder meetings in order to persuade the management to unlock value.

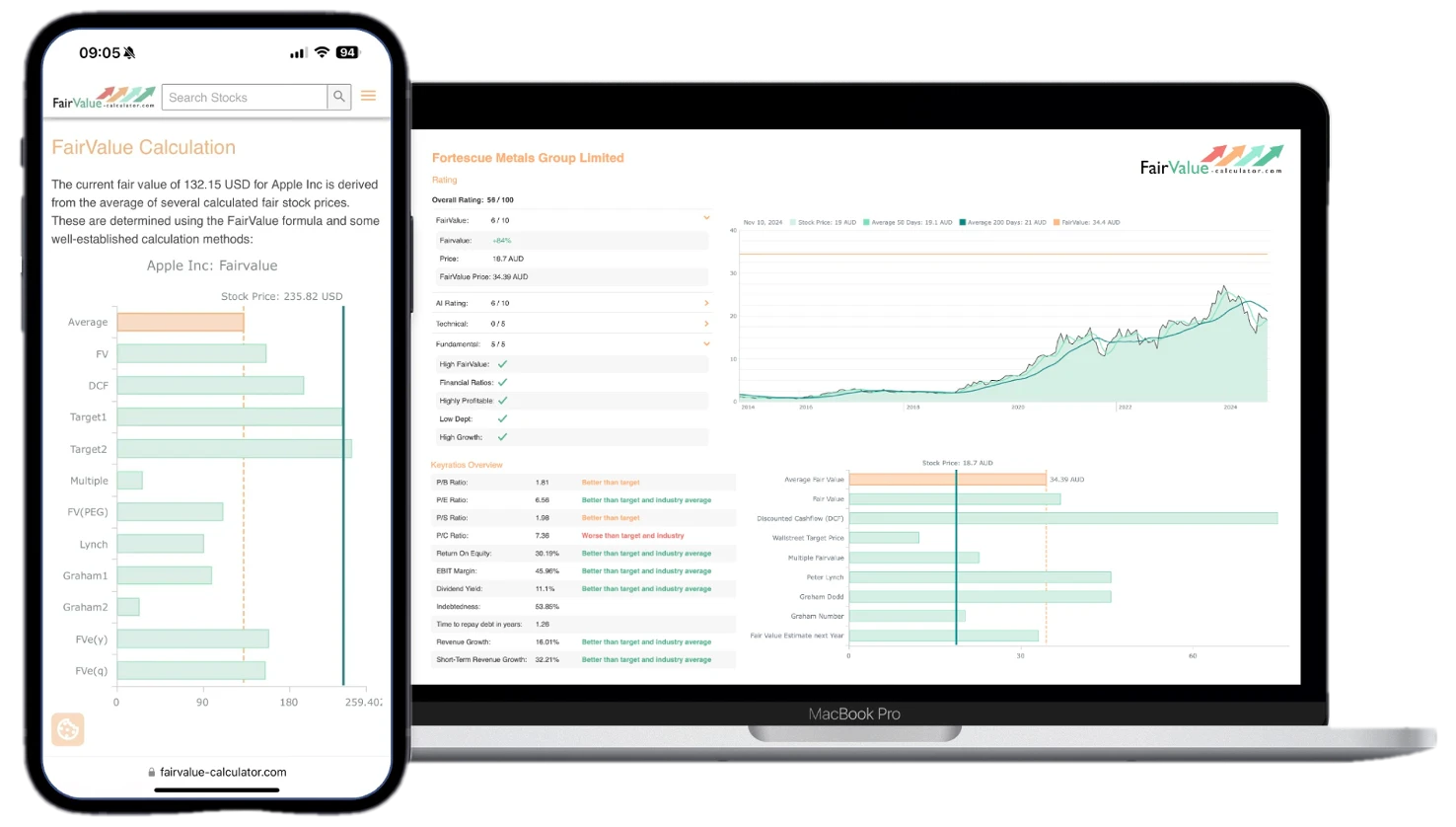

As small investors, we are best suited to ignore bad companies and let the big boys deal with the mess. Other than that, the philosophy is pretty straightforward and easily applied in the real world. How you unlock value is up to you and we at Fairvalue can help you out in that matter.

Application in the real world with fairvalue investing

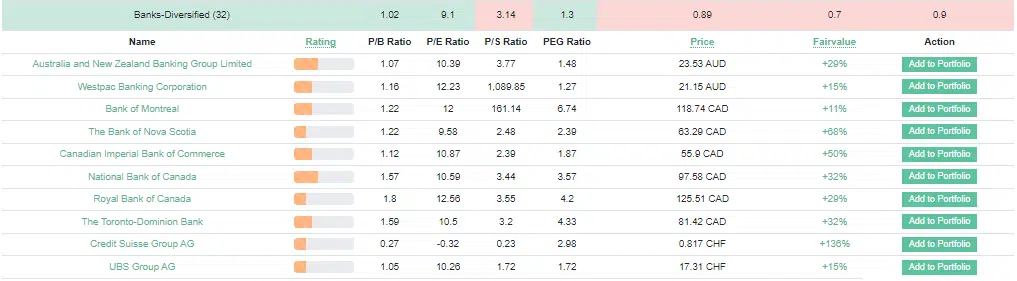

At fairvalue calculator, we have data on 30,000+ stocks listed across the world with automatic financial analysis. As our premium user, all you have to do is search for the listed company and you will find all the information you need. Alternatively, you can visit our sector analysis stock screener and check out the hot sector currently driving the economy. Here we take a look at banks.

Let us pick up the first name itself, Australia and New Zealand Banking Group Limited.

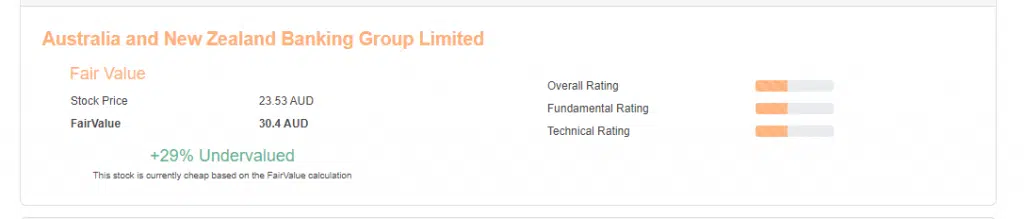

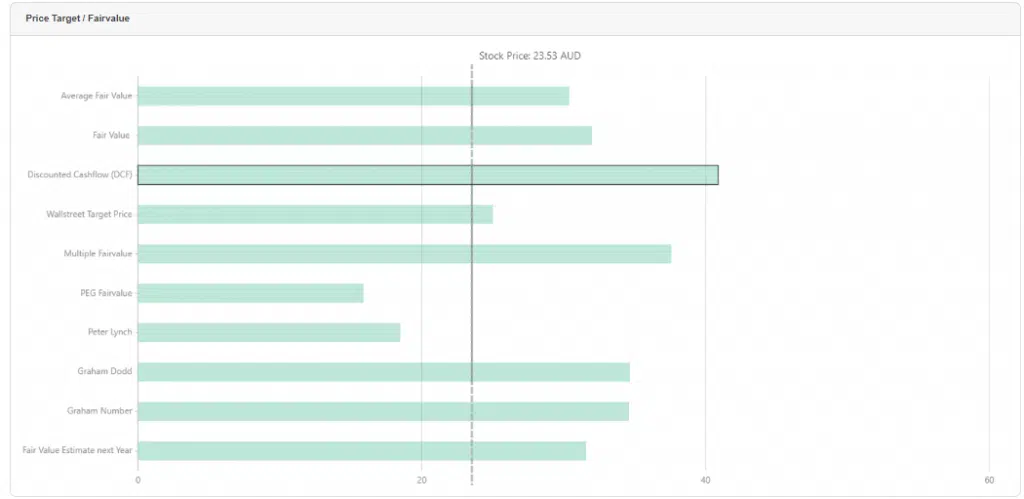

The initial snapshot tells us it is 29% undervalued.

Diving deeper, we discover that it is trading below fair value on a lot of parameters. This warrants further digging into company financials, management discussions, and analyst calls to figure out what is causing this undervaluation and then acquiring shares and raising this issue in the next shareholder meeting wherein the management is obligated to provide a response.

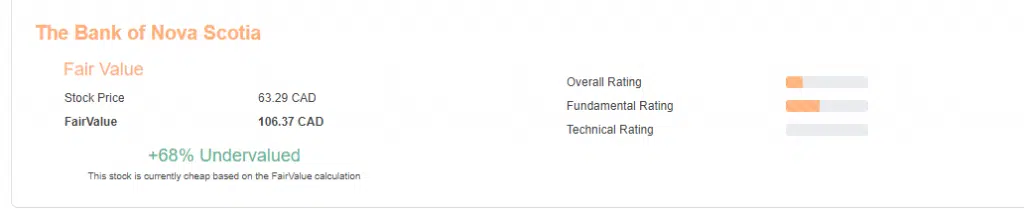

Another name on the banking list is The Bank of Nova Scotia.

The bank is 68% undervalued and we at fairvalue calculators have even written an article on this bank diving deeper into the company and its working.

We at fairvalue calculator have done most of the heavy lifting. All that remains is for you, dear investor to dig a bit deeper and then ask some strong questions to the management of the company in question.

Last words

Everybody loves a vigilante. It satisfies an innate instinct for vengeance and justice. While we may not go out to fight crime with our fists, we can certainly fight financial injustice with our strong questions and our hard-earned money which eventually will help us make more money while we correct the wrong of the financial world.

Bill Ackman channelized his inner vigilante with the power of scale. This has also led to him being demonized for his actions. A lot of his callouts on bad companies are blamed on him being biased because he has a short position. Others argue that it is a business and that if he profits from pointing out some wrongdoing, there is nothing wrong with it. There are no free lunches after all. The jury may be out on Ackman’s intention but in the world of finance, the numbers speak for themselves. His hedge fund has generated phenomenal returns and while he has had his occasional trysts with bad companies ending up in huge losses, on a broad, zoomed-out perspective, his head is in the right place and we as value investors can learn a lesson or two in lowering our waiting time for value unlocking by doing it ourselves.

In the next part of the series, we meet another contemporary of Bill Ackman, an activist investor like himself, but less flamboyant and less publicly known. He is most famous for a long drawn-out fight with Allied Capital (A private equity and lending firm) which he won leading to his publishing of the book “Fooling Some of the people all of the Time” and his famous short of Lehman Brothers during the financial crisis of 2008-09. He is also an excellent poker player, having finished in the top 10 of several major poker tournaments. Stay tuned for the next entry as we cover this mysterious investor and his unique style of activism. Until then, join our premium membership and unlock some value targets to sharpen your vigilante skills.

sports betting

Wonderful write-up. You’ve made some excellent observations.

Keep up the good work

aviator

Excellent content. You’ve made some excellent

observations. Looking forward to more