Investing in stocks can be a rewarding endeavor, but it also carries inherent risks. One of the biggest challenges for investors is determining the true worth or fair value of a stock before making an investment decision. Overpaying for a stock can lead to disappointing returns while identifying undervalued stocks presents an opportunity for potential gains. This is where a fair value calculator comes into play, offering a powerful tool to help investors make informed decisions.

We will explore the concept of fair value, the importance of fair value calculations, and how to effectively utilize a fair value calculator to evaluate stocks. We’ll also discuss the various methodologies and factors that influence fair value calculations and best practices for incorporating this analysis into your overall investment strategy.

Understanding Fair Value

Fair value, also known as intrinsic value, is a fundamental concept in finance and investing. It refers to an asset’s estimated true worth or value, such as a stock, based on its underlying characteristics and future cash flow potential. The fair value of a stock represents the price at which an informed and rational investor would be willing to buy or sell the stock, considering all available information and assumptions.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

Determining the fair value of a stock is crucial for investors because it helps them identify whether a stock is currently overvalued (trading above its fair value) or undervalued (trading below its fair value). Overvalued stocks may present a higher risk of potential losses or lower returns, while undervalued stocks could offer attractive investment opportunities with the potential for capital appreciation.

The Importance of Fair Value Calculations

💡 Discover Powerful Investing Tools

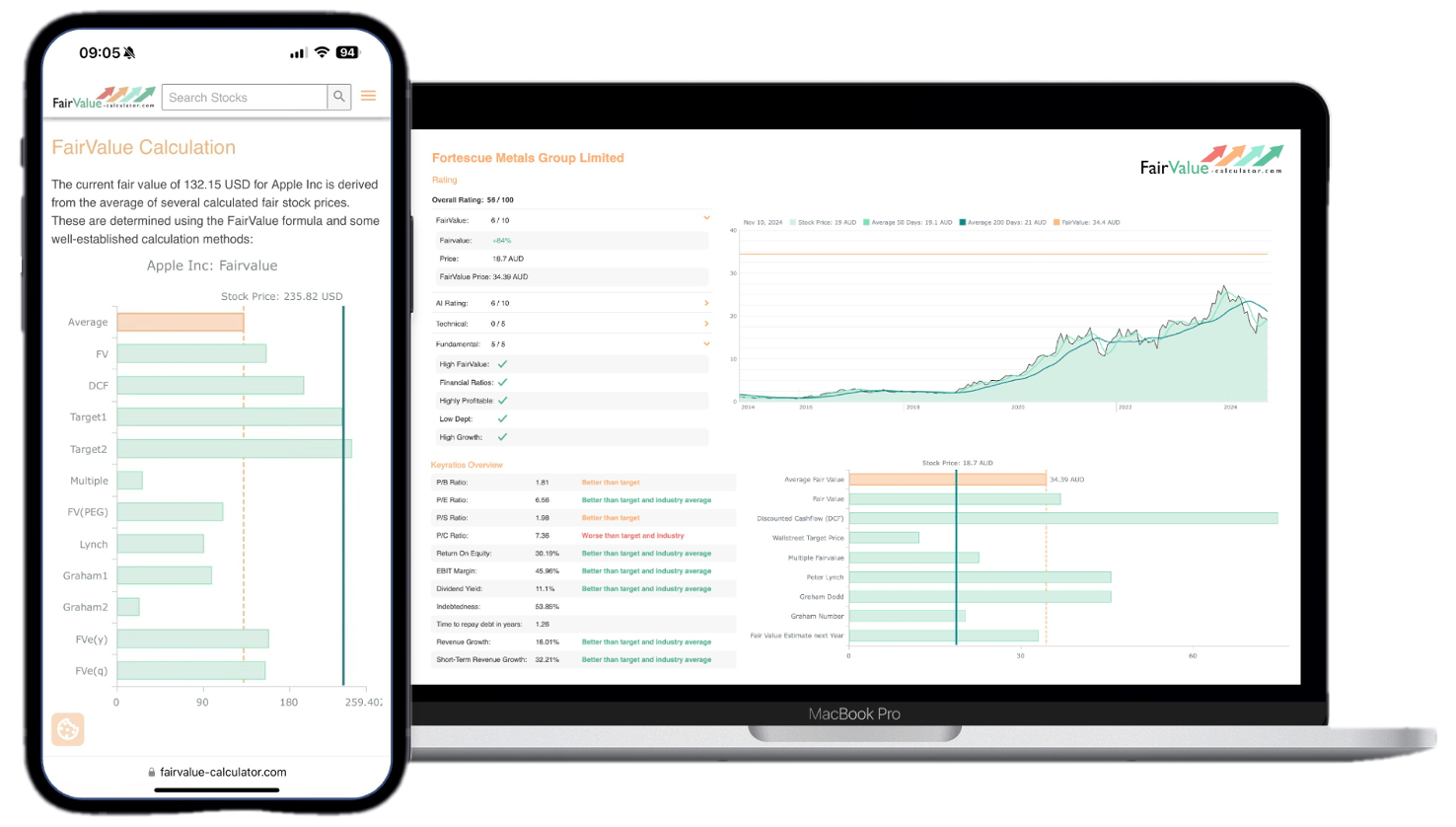

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Fair value calculations play a vital role in investment decision-making for several reasons:

- Identifying Mispriced Stocks: By comparing a stock’s current market price to its calculated fair value, investors can identify potential mispricings in the market. Stocks trading significantly below their fair value may be considered undervalued and represent potential buying opportunities, while stocks trading substantially above their fair value may be considered overvalued and present potential selling opportunities or risks.

- Informed Investment Decisions: Fair value calculations provide a quantitative basis for evaluating the potential risks and rewards associated with a stock investment. By considering the fair value alongside other factors like market trends, company fundamentals, and investment goals, investors can make more informed and rational investment decisions.

- Portfolio Management: Fair value calculations can be applied to individual stocks or entire portfolios, allowing investors to assess the overall valuation of their holdings. This information can guide portfolio rebalancing decisions, such as trimming overvalued positions or adding undervalued stocks to maintain an optimal portfolio allocation.

- Risk Management: Incorporating fair value analysis into investment strategies can help investors manage risk more effectively. By avoiding overvalued stocks and focusing on undervalued opportunities, investors can potentially mitigate the risk of overpaying for assets and potentially enhance their overall risk-adjusted returns.

Utilizing a Fair Value Calculator

While fair value calculations can be performed manually using various valuation models and techniques, utilizing a fair value calculator can streamline the process and provide a more user-friendly experience. Fair value calculators are software tools or online platforms that automate the fair value calculation process based on user inputs and pre-defined methodologies.

When using a fair value calculator, investors typically need to provide certain inputs related to the stock they wish to evaluate. These inputs may include financial metrics such as earnings, dividends, growth rates, and risk factors. The calculator then applies a chosen valuation model or methodology to these inputs and generates an estimated fair value for the stock.

It’s important to note that different fair value calculators may employ different valuation models or methodologies, which can lead to variations in the calculated fair values. Therefore, it’s essential to understand the underlying assumptions and methodologies used by a particular fair value calculator to ensure alignment with your investment philosophy and risk tolerance.

Valuation Methodologies and Factors

Fair value calculators can employ various valuation methodologies to estimate a stock’s fair value.

Some of the most common methodologies include:

- Discounted Cash Flow (DCF) Analysis: This methodology involves projecting a company’s future cash flows and discounting them back to their present value using an appropriate discount rate. The sum of these discounted cash flows represents the estimated fair value of the stock.

- Dividend Discount Model (DDM): This model is particularly useful for valuing stocks that pay consistent dividends. It calculates the fair value based on the present value of expected future dividend payments, assuming a certain growth rate and discount rate.

- Relative Valuation: This approach involves comparing a company’s financial metrics, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, or enterprise value-to-EBITDA (EV/EBITDA) ratio, to those of similar companies or industry averages. The fair value is then estimated based on these relative valuations.

- Asset-Based Valuation: This methodology focuses on the value of a company’s underlying assets, such as tangible assets (e.g., real estate, equipment) and intangible assets (e.g., patents, trademarks). The fair value is calculated by estimating the net asset value or the sum of the company’s assets minus its liabilities.

In addition to the chosen valuation methodology, fair value calculations may incorporate various factors and assumptions, including:

- Growth rates: Assumptions about a company’s future revenue, earnings, or cash flow growth rates can significantly impact fair value calculations.

- Discount rates: The discount rate used to calculate the present value of future cash flows or dividends can have a substantial effect on the fair value estimate. Discount rates typically reflect the risk associated with the investment and the investor’s required rate of return.

- Risk factors: Fair value calculations may consider various risk factors, such as company-specific risks, industry risks, market risks, and macroeconomic risks, which can influence the assumptions and discount rates used.

- Competitive landscape: The competitive dynamics within a company’s industry, including the presence of competitors, barriers to entry, and industry growth prospects, can impact fair value calculations.

- Management quality: The quality and track record of a company’s management team can influence assumptions about future performance and, consequently, the fair value estimate.

Best Practices for Using Fair Value Calculators

While fair value calculators can be powerful tools, it’s important to use them judiciously and in conjunction with other investment research and analysis.

Here are some best practices to consider when utilizing fair value calculators:

- Understand the Methodology: Before using a fair value calculator, take the time to understand the underlying valuation methodology and assumptions it employs. Ensure that the methodology aligns with your investment philosophy and risk tolerance.

- Sensitivity Analysis: Conduct sensitivity analyses to understand how changes in key assumptions, such as growth rates or discount rates, can impact the calculated fair value. This can help you assess the robustness of the fair value estimate and identify potential risks or opportunities.

- Incorporate Qualitative Factors: While fair value calculators provide a quantitative estimate, it’s essential to consider qualitative factors as well. These may include the company’s competitive advantages, management quality, industry trends, and other non-financial factors that can influence long-term performance and fair value.

- Compare Multiple Methodologies: Consider using multiple fair value calculators or valuation methodologies to cross-check and validate your fair value estimates. Significant discrepancies between different methodologies may warrant further investigation and analysis.

- Use Fair Value as a Guide: Fair value calculations should be viewed as a guide rather than an absolute determinant of a stock’s worth. Investors should incorporate fair value analysis into their overall investment decision-making process, which should also consider factors such as investment goals, risk tolerance, and portfolio diversification.

- Regularly Review and Update: Fair value calculations should be regularly reviewed and updated as new information becomes available, such as changes in a company’s financial performance, industry dynamics, or macroeconomic conditions. This ensures that your fair value estimates remain relevant and accurate.

Determining the true worth of stocks is a critical aspect of successful investing. Fair value calculators provide a powerful tool to help investors estimate the intrinsic value of stocks based on various valuation methodologies and assumptions. By understanding the underlying methodologies, incorporating relevant factors, and following best practices, investors can leverage fair value calculations to identify potential mispricings in the market, make informed investment decisions, and manage risk more effectively.

However, it’s important to remember that fair value calculations are not infallible and should be used in conjunction with other investment research and analysis. Investors should also consider their investment goals, risk tolerance, and overall portfolio diversification when making investment decisions.

Ultimately, utilizing a fair value calculator is just one part of a comprehensive investment strategy. By combining fair value analysis with sound investment principles, discipline, and ongoing monitoring, investors can increase their chances of achieving long-term investment success.