Proven Strategies for Success!

Investing in the stock market can be one of the most rewarding ways to grow your wealth, but it requires a solid plan and proven strategies to achieve lasting success. We at Fairvalue-Calculator.com are committed to empowering investors like you with innovative tools and insights to make informed decisions. Whether you’re just starting out or looking to refine your approach, this guide will show you how to build the perfect stock portfolio for your financial goals.

Why a Well-Structured Portfolio Matters

Your portfolio is the foundation of your investment journey. A diversified and carefully planned portfolio minimizes risks, maximizes growth opportunities, and helps you stay on track during market fluctuations. With the right strategies, you can achieve financial independence and build wealth that stands the test of time.

Step 1: Set Clear Investment Goals

Before diving into stock selection, define your financial objectives. Ask yourself:

- What is my investment horizon? Are you investing for the short-term, medium-term, or long-term?

- What is my risk tolerance? Can you handle market volatility, or do you prefer safer, more stable investments?

- What are my income and growth expectations? Are you seeking dividend income, capital appreciation, or a balance of both?

Answering these questions will help you shape your investment strategy and guide your portfolio’s construction.

Step 2: Leverage Tools to Identify the Best Stocks

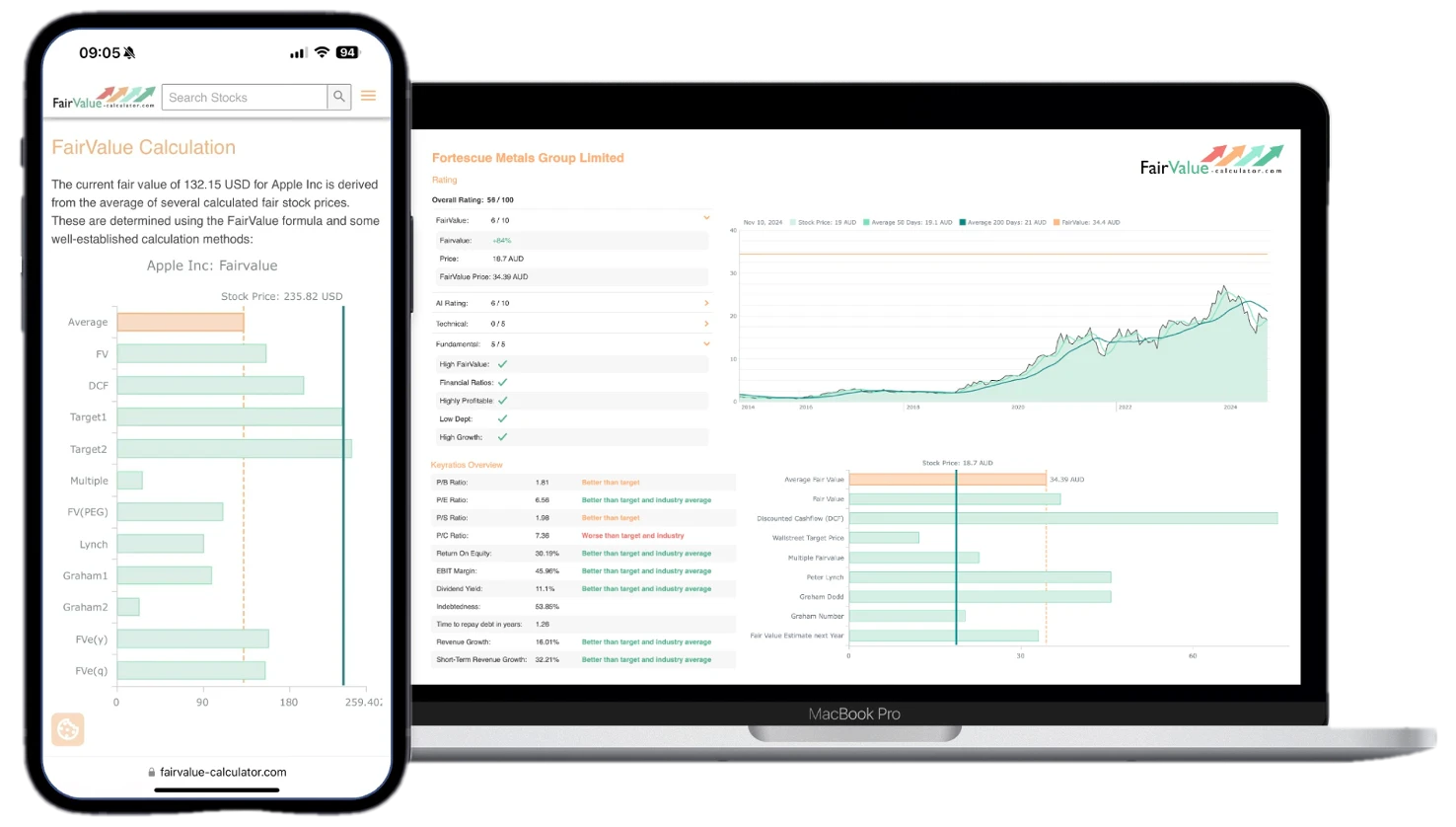

With the vast number of stocks available, finding the right ones can feel overwhelming. This is where Fairvalue-Calculator.com becomes your trusted ally. Our AI-powered tools analyze thousands of stocks to help you:

- Identify undervalued opportunities: Use the Fair Value Calculator to pinpoint stocks trading below their intrinsic value.

- Discover trending and high-growth companies: Explore curated lists of stocks with strong fundamentals and growth potential.

- Track your Watchlist and Portfolio Manager: Stay organized and informed about your current and potential investments.

Step 3: Diversify for Resilience

Diversification is one of the golden rules of investing. A well-diversified portfolio should include at least 10 stocks across various industries and regions. This approach reduces risk by ensuring that poor performance in one sector doesn’t derail your entire portfolio.

For example, you might include:

- Technology companies: For innovation and growth.

- Healthcare stocks: For stability and long-term potential.

- Consumer goods: For consistent returns during economic fluctuations.

- International stocks: To capitalize on opportunities outside your home market.

Step 4: Manage Risk Effectively

Even the best investors experience losses. The key is to limit them and let your profits run. Here are proven risk management strategies:

- Set stop-loss orders: Limit potential losses to a maximum of -25%.

- Reassess regularly: Continuously monitor your portfolio and adjust based on performance and market conditions.

- Avoid overexposure: Allocate no more than 10% of your portfolio to a single stock.

Step 5: Let Data Drive Your Decisions

Emotions can lead to poor investment choices. By relying on data-driven insights, you’ll make smarter decisions. Fairvalue-Calculator.com’s tools provide in-depth analytics and real-time updates to ensure you stay ahead of market trends.

Step 6: Monitor and Optimize Your Portfolio

Building the perfect stock portfolio is not a one-time task. Regular monitoring and optimization are essential for long-term success. Use our Portfolio Manager to:

- Track performance: Keep an eye on your portfolio’s growth and returns.

- Identify rebalancing opportunities: Adjust allocations to maintain your target diversification.

- Spot emerging trends: Stay informed about new investment opportunities.

Step 7: Save on Fees and Take Control

Why pay hefty fees to fund managers when you can achieve better results on your own? Fairvalue-Calculator.com helps you save money and become your own portfolio expert. With our premium tools, you’ll have all the resources you need to make confident, informed decisions.

Proven Success Strategies to Remember

- Think long-term: Successful investors focus on sustainable growth rather than short-term gains.

- Stay disciplined: Stick to your plan and avoid impulsive decisions.

- Keep learning: The market is dynamic, so continuously educate yourself and adapt to new developments.

Achieve Greatness with Fairvalue-Calculator.com

Investing doesn’t have to be daunting. With the right strategies and tools, you can transform your financial future. We’re here to guide you every step of the way.

Ready to Start Your Investing Journey?

Building your perfect stock portfolio is an achievable goal with the right mindset, tools, and strategies. Fairvalue-Calculator.com is designed to simplify this process, offering cutting-edge resources to help you succeed. From identifying undervalued stocks to managing your portfolio with precision, we empower you to take control of your investments.

Subscribe today and unlock the full potential of your portfolio. Let’s create a future of financial freedom, together. Start now by exploring our video tutorial here and take the first step toward investment success.

FAQs

1. How many stocks should I have in my portfolio?

It’s recommended to have at least 10 to 20 stocks across various industries and regions to ensure adequate diversification and minimize risk.

2. How often should I review my portfolio?

You should review your portfolio at least quarterly. However, significant market changes or life events might require more frequent reviews.

3. What is a stop-loss order, and why is it important?

A stop-loss order is an automatic sell order placed to limit potential losses by selling a stock when it falls below a predetermined price. This is crucial for managing risk and protecting your capital.

4. How do I determine the fair value of a stock?

Using tools like the Fair Value Calculator on Fairvalue-Calculator.com can help you analyze a stock’s intrinsic value based on financial data, trends, and AI-powered insights.

5. What should I prioritize: growth or dividends?

This depends on your financial goals. Growth stocks are ideal for long-term wealth accumulation while dividend-paying stocks provide regular income, suitable for retirees or income-focused investors.

6. Is investing in international stocks necessary?

Yes, including international stocks can diversify your portfolio and provide exposure to markets with high growth potential or lower correlation to your home market.

7. How do I handle market volatility?

Stay calm, avoid emotional decisions, and focus on your long-term strategy. Diversification and data-driven insights can help mitigate the impact of market fluctuations.

8. Should I invest in ETFs or individual stocks?

ETFs (Exchange-Traded Funds) offer instant diversification and lower risk, making them suitable for beginners. Individual stocks provide more control but require in-depth research.

9. How can I avoid common investing mistakes?

Common mistakes include overtrading, failing to diversify, and reacting emotionally to market news. Leverage tools like Fairvalue-Calculator.com to make informed, rational decisions.

10. What are the benefits of using Fairvalue-Calculator.com?

Our platform provides AI-powered insights, curated stock lists, a Portfolio Manager, and educational resources to help you build a smarter, more profitable portfolio while saving on fund manager fees.