Making informed decisions is paramount to achieving long-term success. Whether you’re an individual investor or a seasoned professional, understanding the true value of an asset is crucial for maximizing returns and mitigating risks. This is where fair value calculators come into play, offering a powerful tool to elevate your financial decision-making process. By leveraging data-driven insights, these calculators provide a comprehensive approach to valuing assets, enabling you to make well-informed choices that align with your investment goals and risk tolerance.

The Significance of Fair Value in Financial Decision-Making

Fair value is a fundamental concept in finance that represents the estimated price at which an asset or liability would be exchanged between willing parties in an arm’s length transaction. It serves as a benchmark for assessing the true worth of an investment, taking into account various factors that influence its value. Accurately determining fair value is essential for making sound financial decisions, as it helps investors identify potential opportunities or risks associated with a particular asset.

In today’s complex financial landscape, where markets are influenced by a myriad of factors, relying solely on market prices can be misleading. Market prices may not always accurately reflect an asset’s true value due to factors such as market inefficiencies, investor sentiment, or incomplete information. Fair value calculators fill this gap by providing a more comprehensive and objective assessment, considering a wide range of quantitative and qualitative factors.

The Rise of Fair Value Calculators

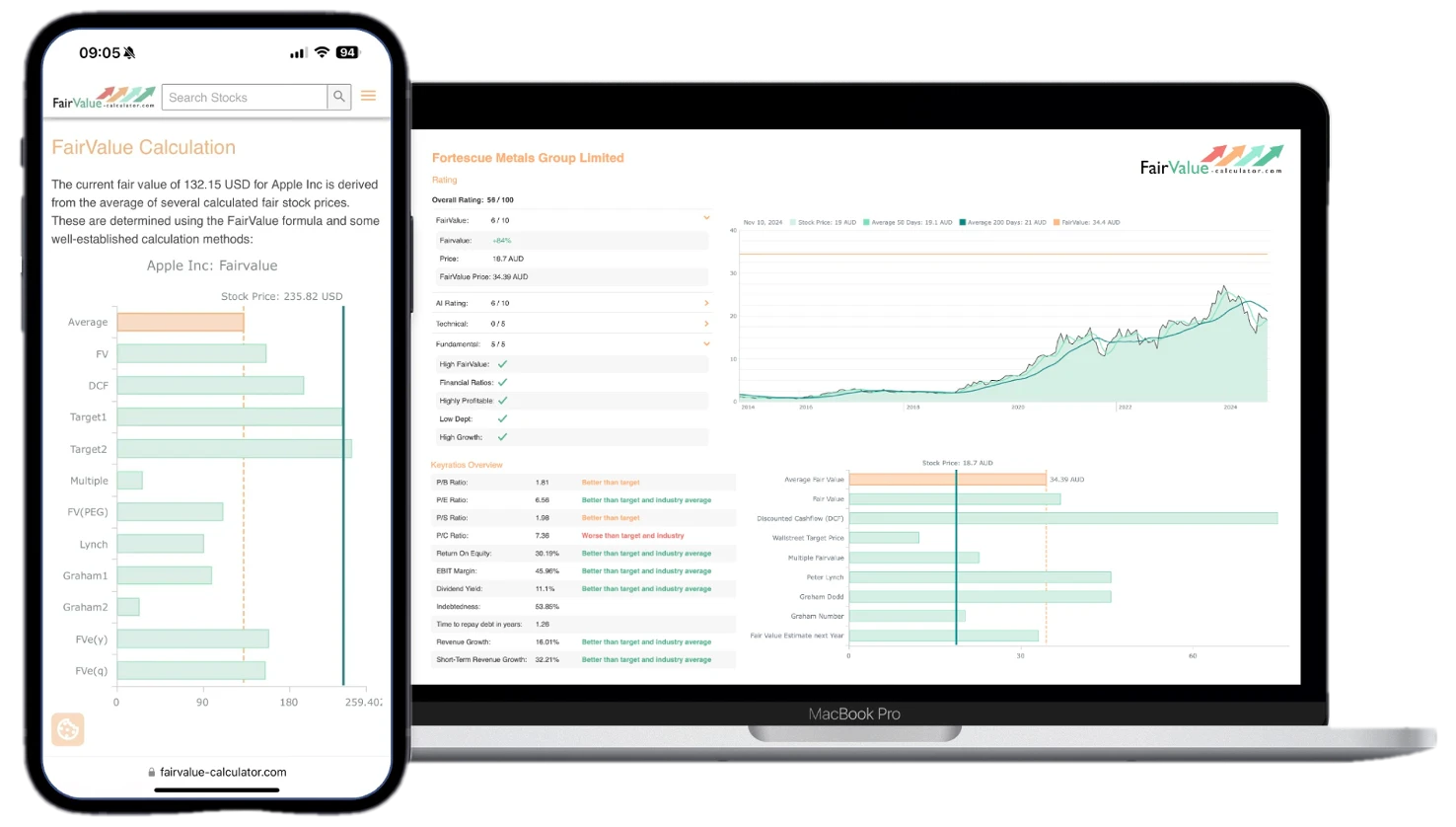

The advent of fair value calculators has revolutionized the way investors and financial professionals approach valuation. These sophisticated tools have gained significant traction in recent years, driven by the increasing availability of data, advancements in computational power, and the demand for more robust decision-making processes.

According to a report by Statista, the global investment management software market, which includes fair value calculators, is projected to reach $8.9 billion by 2027, growing at a compound annual growth rate (CAGR) of 9.4% from 2020 to 2027. This growth underscores the growing importance of advanced analytical tools in the financial industry and the recognition of their value in enhancing decision-making processes.

The Mechanics of Fair Value Calculators

Fair value calculators employ a range of methodologies and models to estimate the fair value of an asset. These methodologies can vary depending on the asset class, industry, and specific circumstances. Some of the most commonly used approaches include:

- Discounted Cash Flow (DCF) Analysis: This technique calculates the present value of an asset’s future cash flows, taking into account factors such as growth rates, discount rates, and terminal value. DCF analysis is widely used for valuing businesses, stocks, and income-generating assets.

- Comparable Company Analysis: This method involves comparing the asset being valued to similar assets or companies that have recently been sold or traded. It relies on identifying appropriate comparable companies and adjusting for differences in factors such as size, growth rates, and risk profiles.

- Precedent Transaction Analysis: Similar to comparable company analysis, this approach uses recent transactions involving similar assets or companies as a basis for valuation. It considers factors such as transaction multiples, deal structures, and market conditions at the time of the transaction.

- Option Pricing Models: These models, such as the Black-Scholes model or binomial options pricing model, are commonly used for valuing derivative instruments, including options and other complex financial products.

Fair value calculators often incorporate multiple valuation methodologies and cross-validate the results to enhance the accuracy and reliability of their estimates. Additionally, these calculators can incorporate various assumptions, scenarios, and sensitivity analyses to account for different market conditions and potential risks.

Enhancing Financial Decision-Making with Fair Value Calculators

Fair value calculators offer numerous benefits that can significantly enhance your financial decision-making process:

- Objective and Data-Driven Insights Fair value calculators rely on quantitative data and established valuation methodologies, providing an objective and unbiased assessment of an asset’s value. This objectivity helps mitigate the influence of personal biases, emotions, or market noise, allowing for more rational and well-informed decisions.

- Comprehensive Analysis These calculators consider a wide range of factors, including financial statements, industry trends, macroeconomic conditions, and market dynamics. By taking a holistic approach, they offer a more comprehensive understanding of an asset’s true value, enabling you to make informed decisions based on a complete picture.

- Scenario Analysis and Risk Management Fair value calculators often include scenario analysis and sensitivity testing capabilities, allowing you to evaluate the impact of various assumptions and potential risks on an asset’s value. This feature is particularly valuable for risk management and stress testing, enabling you to anticipate and prepare for different market conditions and potential downside scenarios.

- Identification of Mispriced Assets By comparing the calculated fair value with the current market price, fair value calculators can help identify potentially mispriced assets. This can reveal investment opportunities where assets are undervalued or highlight potential risks associated with overvalued assets, informing your buy, sell, or hold decisions.

- Portfolio Optimization Fair value calculators can be applied to individual assets or entire portfolios, enabling you to assess the overall value and risk profile of your investments. This information can guide portfolio rebalancing, asset allocation, and diversification strategies, ultimately optimizing your portfolio’s performance and aligning it with your investment objectives and risk tolerance.

Integrating Fair Value Calculators into Your Decision-Making Process

To effectively leverage the power of fair value calculators, it is essential to integrate them into your financial decision-making process. Here are some key steps to consider:

- Define Your Investment Objectives and Risk Tolerance Before using fair value calculators, clearly define your investment objectives, time horizon, and risk tolerance. This will help you select appropriate valuation methodologies and input assumptions that align with your goals and risk profile.

- Gather Relevant Data Fair value calculators require accurate and up-to-date data inputs, such as financial statements, market data, and industry-specific information. Ensure that you have access to reliable and comprehensive data sources to feed into the calculator.

- Understand the Valuation Methodologies While fair value calculators automate the valuation process, it is essential to have a fundamental understanding of the underlying methodologies and their assumptions. This knowledge will enable you to interpret the results accurately and make informed adjustments or sensitivity analyses when necessary.

- Validate and Cross-Check Results Fair value calculators should be used as a tool to support your decision-making process, not as a sole determinant. Cross-check the results with other valuation techniques, industry benchmarks, or expert opinions to validate the calculations and gain a more comprehensive perspective.

- Continuously Monitor and Update Markets are dynamic, and factors influencing an asset’s value can change rapidly. Regularly monitor relevant market developments, update your data inputs, and recalculate fair values to ensure that your decisions are based on the most current information.

- Integrate with Other Decision-Making Processes Fair value calculations should be integrated with your overall financial decision-making processes, including portfolio management, risk management, and investment strategy development. This holistic approach will ensure that your decisions are well-informed and aligned with your overarching financial goals.

Case Studies: Fair Value Calculators in Action

To illustrate the practical application and benefits of fair value calculators, let’s examine two real-world scenarios:

- Evaluating a Potential Acquisition Target A multinational corporation was considering acquiring a smaller company in a complementary industry. The target company’s stock price appeared attractive, but the corporation wanted to ensure that it was not overpaying. They employed a fair value calculator that utilized a combination of DCF analysis, comparable company analysis, and precedent transaction analysis.

The fair value calculator took into account the target company’s financial statements, industry growth projections, and recent merger and acquisition transactions in the sector. After running various scenarios and sensitivity analyses, the calculator revealed that the target company’s fair value was significantly higher than its current market price, indicating a potential undervaluation.

Armed with this insight, the corporation proceeded with the acquisition, confident that they were making a prudent investment decision based on a thorough understanding of the target’s true value.

- Optimizing an Investment Portfolio An institutional investor with a diversified portfolio of stocks, bonds, and alternative investments recognized the need to rebalance their holdings to align with their long-term investment strategy. They utilized a fair value calculator to assess the fair value of each asset in their portfolio, taking into account factors such as earnings growth, risk profiles, and market conditions.

The calculator revealed that certain assets were overvalued relative to their fair value, while others were undervalued, presenting potential investment opportunities. Based on these insights, the investor made strategic adjustments to their portfolio, selling overvalued assets and reallocating funds into undervalued assets with better long-term prospects.

By leveraging the fair value calculator, the investor was able to optimize their portfolio’s risk-return profile, ensuring alignment with their investment objectives and risk tolerance.

Navigating the Future with Fair Value Calculators

As the financial landscape continues to evolve, the importance of fair value calculators is poised to grow. Technological advancements, such as artificial intelligence (AI) and machine learning (ML), are expected to further enhance the capabilities of these calculators, providing more accurate and sophisticated valuation models.

According to a report by Statista, the global AI software market is projected to reach $126 billion by 2025, growing at a CAGR of 33.2% from 2018 to 2025. This rapid growth underscores the increasing adoption of AI and ML technologies across various industries, including finance.

The integration of AI and ML into fair value calculators can lead to several improvements:

- Enhanced Data Processing and Pattern Recognition AI and ML algorithms can process vast amounts of structured and unstructured data, identifying patterns and relationships that may be imperceptible to human analysts. This can lead to more accurate valuation models and the ability to incorporate a wider range of factors into the fair value calculations.

- Continuous Learning and Adaptation Machine learning algorithms have the ability to learn from new data and adapt their models accordingly. As market conditions and industry dynamics evolve, fair value calculators powered by ML can continuously update and refine their valuation methodologies, ensuring that calculations remain relevant and accurate.

- Predictive Analytics and Scenario Modeling AI and ML techniques can be used to develop predictive models and simulate various scenarios, providing valuable insights into potential future outcomes. This can enhance the scenario analysis capabilities of fair value calculators, enabling better risk management and strategic planning.

- Automation and Efficiency By automating data collection, processing, and analysis, AI-powered fair value calculators can significantly improve efficiency and reduce the risk of human error. This can lead to faster and more consistent valuations, enabling timely decision-making.

As these technologies continue to advance, fair value calculators are likely to become even more sophisticated and user-friendly, further democratizing access to advanced valuation tools for investors of all levels.

Embracing Fair Value Calculators: A Strategic Imperative

In today’s rapidly changing financial landscape, embracing fair value calculators is not just a choice but a strategic imperative. These powerful tools offer a competitive edge by providing data-driven insights, enabling more informed decision-making, and ultimately enhancing the potential for better returns and risk management.

However, it is important to recognize that fair value calculators are not a panacea; they should be used in conjunction with other valuation techniques, expert opinions, and a deep understanding of the underlying assets and markets. Additionally, the quality of the inputs and assumptions used in these calculators is crucial, as garbage in will inevitably lead to garbage out.

As investors and financial professionals navigate the complexities of the modern financial world, fair value calculators can serve as valuable allies, empowering them to make well-informed decisions based on objective and comprehensive assessments of an asset’s true value.

By embracing these tools and integrating them into their decision-making processes, investors can stay ahead of the curve, capitalize on opportunities, and mitigate risks more effectively, ultimately positioning themselves for long-term success in an ever-evolving financial landscape.