The relationship between economic indicators and fair value calculations is fundamental to financial analysis and investment decision-making. This article explores how key macroeconomic metrics impact the determination of an asset’s fair value, providing insights into the complex interplay between economic conditions and valuation methodologies.

💡 Discover Powerful Investing Tools

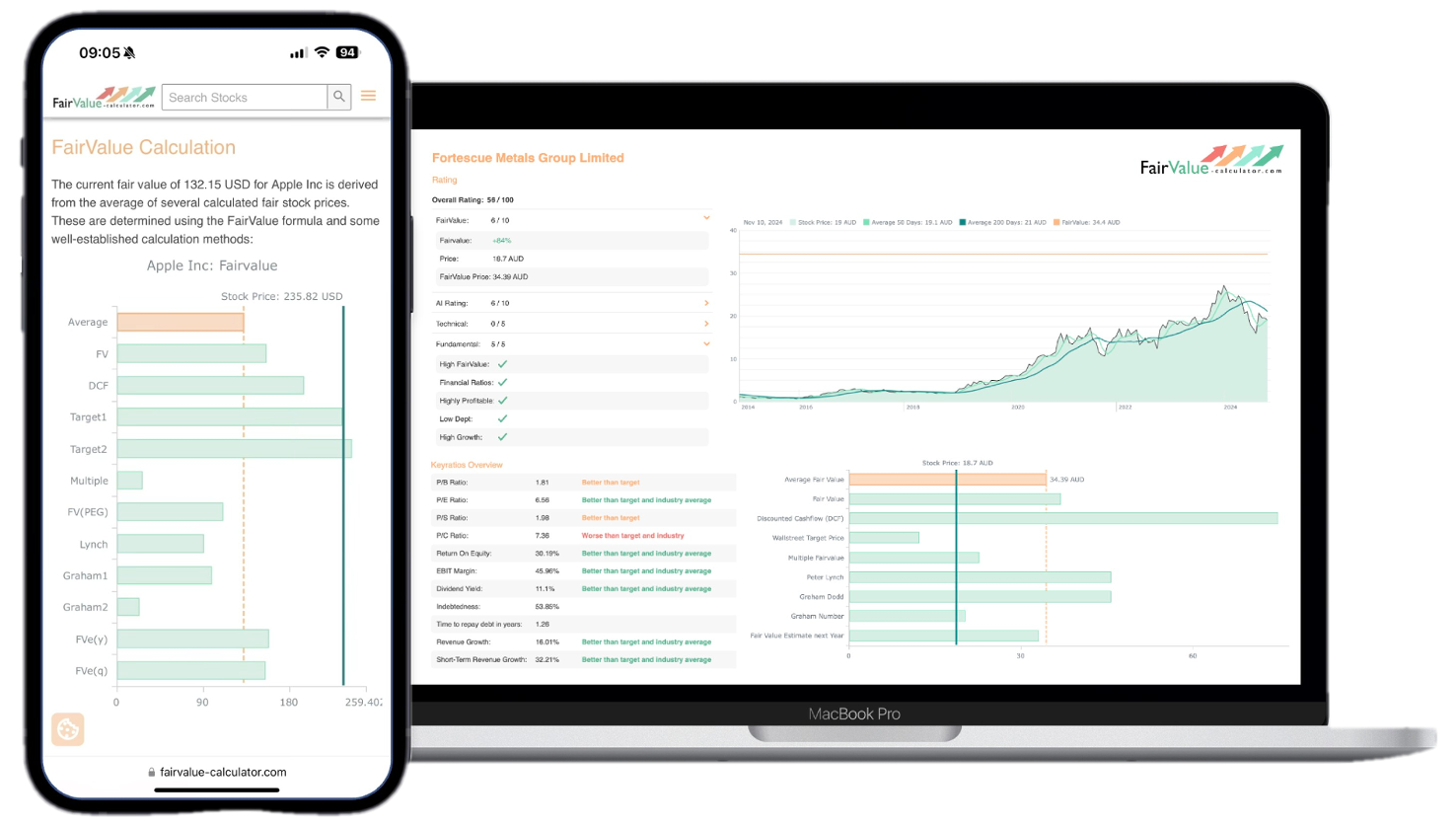

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Fair value, the theoretical price at which an asset should trade under normal market conditions, is not determined in isolation. It is heavily influenced by the broader economic environment in which assets operate. Understanding how economic indicators affect fair value calculations is crucial for investors, analysts, and financial professionals seeking to make informed decisions in dynamic market conditions.

🚀 Test the Fair Value Calculator Now!

Find out in seconds whether your stock is truly undervalued or overpriced – based on fundamentals and future growth.

Try it for Free →Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

The Role of Inflation

Direct Impact on Fair Value Calculations

Inflation serves as one of the most significant economic indicators affecting fair value assessments. It influences both the numerator and denominator in traditional valuation models, creating a complex web of effects that must be carefully considered.

When calculating fair value using discounted cash flow (DCF) analysis, inflation affects:

- Future Cash Flows: Expected cash flows must be adjusted to reflect anticipated inflation rates. Higher inflation typically leads to increased nominal cash flows, though real purchasing power may remain constant or decline.

- Discount Rates: The discount rate used in DCF calculations must incorporate inflation expectations through the risk-free rate component, affecting the present value of future cash flows.

Secondary Effects

Beyond direct mathematical impacts, inflation influences fair value through various secondary channels:

- Asset Replacement Costs: Rising prices affect the cost of replacing assets, which can impact fair value calculations, particularly for capital-intensive businesses.

- Consumer Behavior: Inflation can alter spending patterns, affecting revenue projections and, consequently, fair value estimates.

- Working Capital Requirements: Higher inflation typically necessitates larger working capital investments, affecting free cash flow projections.

Interest Rates and Fair Value

Cost of Capital Considerations

Interest rates, whether set by central banks or determined by market forces, play a crucial role in fair value calculations through their impact on the cost of capital.

The relationship manifests in several ways:

- Risk-Free Rate: Changes in interest rates directly affect the risk-free rate component of cost of capital calculations.

- Equity Risk Premium: Interest rate levels influence investor risk preferences and, consequently, the equity risk premium demanded by investors.

- Cost of Debt: Variable interest rates affect borrowing costs, impacting weighted average cost of capital (WACC) calculations.

Market Value of Fixed Income Securities

For fixed-income instruments, the relationship between interest rates and fair value is particularly direct:

- Bond Prices: An inverse relationship exists between interest rates and bond prices, affecting fair value calculations for fixed-income portfolios.

- Duration Risk: The sensitivity of fair value to interest rate changes varies based on the duration of fixed-income securities.

GDP Growth and Economic Activity

Growth Expectations and Valuation Multiples

Gross Domestic Product (GDP) growth rates significantly influence fair value calculations through their impact on:

- Revenue Growth Projections: Overall economic growth often correlates with company-specific growth expectations.

- Valuation Multiples: Market participants typically assign higher multiples during periods of strong economic growth.

- Risk Assessment: Economic growth patterns affect risk perceptions and, consequently, risk premiums used in valuation.

Sector-Specific Implications

The impact of GDP growth on fair value varies considerably across sectors:

- Cyclical Industries: Companies in cyclical sectors show higher sensitivity to GDP growth in their fair value calculations.

- Defensive Sectors: Businesses in defensive industries may demonstrate more stable fair values across economic cycles.

- Growth Sectors: High-growth sectors might show less correlation with immediate GDP trends but remain influenced by long-term growth expectations.

Currency Exchange Rates

International Operations and Fair Value

For companies with significant international operations, currency exchange rates affect fair value through:

- Cash Flow Translation: Exchange rate fluctuations impact the value of foreign cash flows when converted to reporting currency.

- Balance Sheet Effects: Changes in exchange rates affect the fair value of assets and liabilities denominated in foreign currencies.

- Competitive Position: Currency movements can affect a company’s competitive position in international markets.

Risk Assessment and Hedging Costs

Currency considerations in fair value calculations must account for:

- Exchange Rate Risk Premiums: Additional risk factors in discount rates for international operations.

- Hedging Costs: The expense of managing currency risk affects cash flow projections.

Employment and Labor Market Indicators

Cost Structure Implications

Employment indicators influence fair value through their impact on:

- Labor Costs: Wage pressure affects operating margins and cash flow projections.

- Consumer Spending: Employment levels influence revenue projections for consumer-facing businesses.

- Productivity Metrics: Labor market efficiency affects return on capital calculations.

Industry-Specific Considerations

The impact of employment indicators varies by:

- Labor Intensity: Industries with high labor costs show greater sensitivity to employment metrics.

- Skill Requirements: Sectors requiring specialized skills may face different fair value impacts from labor market changes.

Commodity Prices

Direct Cost Impacts

Commodity price movements affect fair value through:

- Input Costs: Changes in raw material prices affect margin projections.

- Capital Expenditure Requirements: Commodity prices influence investment costs and replacement values.

- Revenue Effects: For commodity producers, price changes directly impact revenue projections.

Indirect Effects

Secondary effects of commodity prices include:

- Consumer Behavior: Energy and food prices affect disposable income and spending patterns.

- Investment Patterns: Commodity price trends influence capital allocation decisions.

Market Sentiment and Behavioral Factors

Risk Appetite and Valuation Metrics

While not strictly economic indicators, market sentiment factors interact with economic data to influence fair value:

- Risk Premiums: Market sentiment affects risk premiums used in valuation calculations.

- Liquidity Preferences: Risk appetite influences liquidity premiums in fair value calculations.

- Multiple Expansion/Contraction: Sentiment shifts can lead to changes in acceptable valuation multiples.

Integration with Economic Indicators

The interaction between sentiment and economic indicators affects:

- Timing of Value Recognition: Market sentiment can accelerate or delay the incorporation of economic data into fair values.

- The Magnitude of Impact: Sentiment can amplify or dampen the effect of economic indicators on fair value.

Practical Applications and Challenges

Valuation Model Adjustments

Incorporating economic indicators into fair value calculations requires:

- Dynamic Modeling: Regular updates to valuation models reflecting changing economic conditions.

- Scenario Analysis: Development of multiple scenarios based on different economic indicator trajectories.

- Sensitivity Testing: Regular assessment of fair value sensitivity to changes in key economic indicators.

Implementation Challenges

Practitioners face several challenges:

- Data Quality: Ensuring reliable economic indicator data for fair value calculations.

- Timing Issues: Addressing lags between economic indicator changes and their impact on fair value.

- Model Complexity: Balancing comprehensive economic factor inclusion with model usability.

Regulatory and Compliance Considerations

Fair Value Measurement Standards

Economic indicator integration must comply with:

- Accounting Standards: IFRS 13 and ASC 820 requirements for fair value measurement.

- Regulatory Guidelines: Industry-specific regulations affecting fair value calculations.

- Documentation Requirements: Evidence supporting economic indicator adjustments in fair value calculations.

Audit and Review Processes

Proper consideration includes:

- Documentation: Clear recording of economic indicator impacts on fair value calculations.

- Validation: Regular review and testing of economic indicator relationships.

- Update Procedures: Processes for incorporating new economic data into fair value assessments.

Final Words

The relationship between economic indicators and fair value calculations is complex and multifaceted.

Success in fair value determination requires:

- Comprehensive Understanding: Recognition of both direct and indirect effects of economic indicators.

- Dynamic Approach: Regular updates to valuation methodologies reflecting changing economic conditions.

- Rigorous Analysis: Careful consideration of interaction effects between different economic indicators.

As markets continue to evolve and become more interconnected, the importance of understanding these relationships will only increase. Practitioners must maintain current knowledge of economic trends and their implications for fair value calculations while developing robust methodologies for incorporating this information into their valuation processes.