How To Find Undervalued Stocks

Let our tools do the work and find undervalued stocks for you the easy way.

Undervalued stocks show a higher value than current market price. This website is all about finding those undervalued stocks. But how can you quickly identify and find undervalued stocks? You can either use your own financial data through internet search and paste the financial data into our free Fair Value Online Calculators or use our Premium Tool to automatically screen for more than 45.000 stocks worldwide and see instantly their valuation to easily compare them to their current market price.

Google - Search

Financial Reports

Browse the PDF

How to Find Undervalued Stocks

In this article we show you how to find cheap and undervalued stocks easily and quickly. With the following tools and metrics everyone can find good undervalued stocks. We also give you instructions on how to find undervalued stocks yourself. In addition, we will show you abnormalities that also promise more returns on undervalued stocks.

Actually, we all want the same: Find undervalued stocks that are in itself worth more than it currently costs and then ignites a price firework. How nice would the feeling of predicting this firework be?

Not only the financial gain, but also the “right” gives us satisfaction. At least I feel that way! Unfortunately, I cannot show you the magic glass ball, which is always right. But there are certain properties that give us clues as to whether a stock is currently undervalued, i.e. cheap or overvalued expensive. In addition, there are long studies on different key figures and how they affect future share prices. We have done great statistics and research to define which aspects of fundamental criteria leads to more return in fundamental stock analysis.

Fundamental Stock Analysis

In order to find undervalued stocks, you have to take a look at the books and fundamental data of the stock companies. Each public company publishes quarterly reports and once at the end of the year, reports that convey the course of business. These reports include the balance sheet, the income statement and a management report. Most of the annual reports can be found on the homepage of the stock corporation under the tab “Investors Relations”.

“But don’t worry! You don’t have to complete a full business degree to identify and find undervalued stocks!” The information from the annual reports is processed in the “fundamental stock analysis” to draw conclusions from whether a stock is undervalued or too expensive. The key figures and data of the annual reports, which are used in the fundamental stock analysis, can be found clearly on financial portals on the Internet.

Yahoo finance is one of these financial portals, where you can either search for the name of the share or directly for the share by its number (WKN / ISIN number). Then you should look for a tab “Fundamental Analysis”, “Fundamental Key Figures” or “GUV”. On this subpage of the stocks you can find all the data we need to find undervalued stocks. The most important key figures and ratios have already been calculated on Yahoo finance.

How to Identify Undervalued Stocks

Fundamental data and key figures can be used to estimate whether a stock is undervalued or expensive. In the following you will find the most important key figures and ratio numbers. Each of these key figures has advantages and disadvantages and a joint assessment of the respective key figures makes sense. In order to show you which key figures are really meaningful in order to find undervalued stocks and achieve more returns, we have examined each key figure and summarized the resulting excess returns for you. We already compiled a collection of calculators for the most important key ratios. Be sure to check the overview of all our free key ratio calculators.

P/E Ratio

P/E ratio: Ratio between the current stock price and the profit of the company.

Calculation P/E ratio: Share price / (Profit / Number of shares issued)

Target value / average value P/E ratio: The average P/E ratio for the largest shares from Germany and the USA is between 15 and 20 on average over 30 years. The lower the P/E ratio of a share, the more likely the share is undervalued.

Scientific evidence: Shiller shows that the lower the P/E ratio, the higher the expected return on shares. Since 1890, stocks with lower P/E ratios have had higher returns. (Robert Shiller, John Campbell 1988)

Note: The profit of a stock corporation can fluctuate greatly and can be distorted by accounting tricks. Therefore, one should use averages and longer observation periods.

P/B Ratio

P/B Ratio: Ratio of the stock exchange price of a share to its book value.

Calculation P/B Ratio: (Share price * Number of shares issued) / Equity

Target value / average value P/B Ratio: A P/B of less than 1-3 indicates an undervalued company.

Scientific evidence: Shares with a low price to book ratio beat shares with a high price to book ratio by an average of 7% per year and the overall market by 2.7% annually. (Further: Fama and French, Cross Section of expected Returns, 1992 “The P/B ratio is the best key figure to explain future stock returns”.)

Tip: You receive these and other key figures for countless stocks within the Premium Tools in the Fair Value Calculator. With just a few clicks, you can find undervalued stocks on the respective stock subpages and create your own sample portfolio in accordance with the fair value strategy.

P/CF Ratio

P/CF: This Ratio compares the market price of a stock to its cash flow.

Calculation P/CF: Share price / (Cash flow / Number of shares issued)

Target value / average value: The average P/CF, like the P / E ratio, is between 15 and 20. The lower the P/CF of the share, the better.

Scientific evidence: Stocks with low P/CF can outperform stocks with high P/CF by an average of 13%. Low P/CF stocks beat the market on average by approximately 4% annually. (Barclays Research)

Note: Cash flow is the cash that the company actually has from profit to work and invest. Compared to looking at earnings, the cash flow is more meaningful.

Characteristics of Undervalued Stocks

In addition to the P/E, P/CF and P/B Ratio, there are other scientifically documented characteristics in undervalued shares. The following “abnormalities” in stocks promise long-term stock investors so-called “return premiums”. Here is a list of the properties of stocks that promise more returns over decades:

Small Cap Premium

The Small Cap Premium is a well-documented phenomenon in the field of finance, where small cap stocks tend to outperform large cap stocks over the long term.

In fundamental stock analysis, the small cap premium is often used as a basis for investment decisions, as it suggests that small cap stocks may offer higher returns than large cap stocks. There are several reasons why the small cap premium exists. One of the main reasons is that small cap companies have more room for growth, as they are less mature and have a smaller market share.

Additionally, small cap stocks are often less well-known and less widely followed by analysts, which can lead to inefficiencies in the market that can be exploited by informed investors. However, it’s worth noting that the small cap premium is not a guarantee and that investing in small cap stocks comes with its own set of risks. Small cap companies may be more susceptible to financial, operational, and market risks, and they may have more limited financial resources compared to larger companies.

Buy Past Winners Momentum Premium

Stocks that have performed well in the past will continue to do well in the future. (Returns to Buying Winners and Selling Losers, Tobias Thejll and References in this Thesis.)

That sounds a bit banal at first and is actually exactly what is being warned, according to the motto: “Just because the stock has risen does not mean that that this continues to rise!” But exactly that does not seem to be true, because studies show that the historical price has an effect on the future price.

It is therefore worth taking a look at the historical price trend to see whether a share is developing positively. It should be noted here that shares that have risen particularly sharply may also fall sharply during recession as a result.

Value Premium

By combining the fundamental key figures, an approximate true value of a company can be determined. You can use the Fair Value Calculator to determine the approximate true value of a share. The value premium is based on the assumption that the market “overlooks” certain stocks.

Due to distortions and exaggerations there are constant price fluctuations on the stock exchange, which can be exploited by the intelligent investor through the value premium.

In order to benefit from the value premium, you have to find undervalued stocks that are actually worth more than they currently cost.

Use our Tools to Find Undervalued Stocks the Easy Way

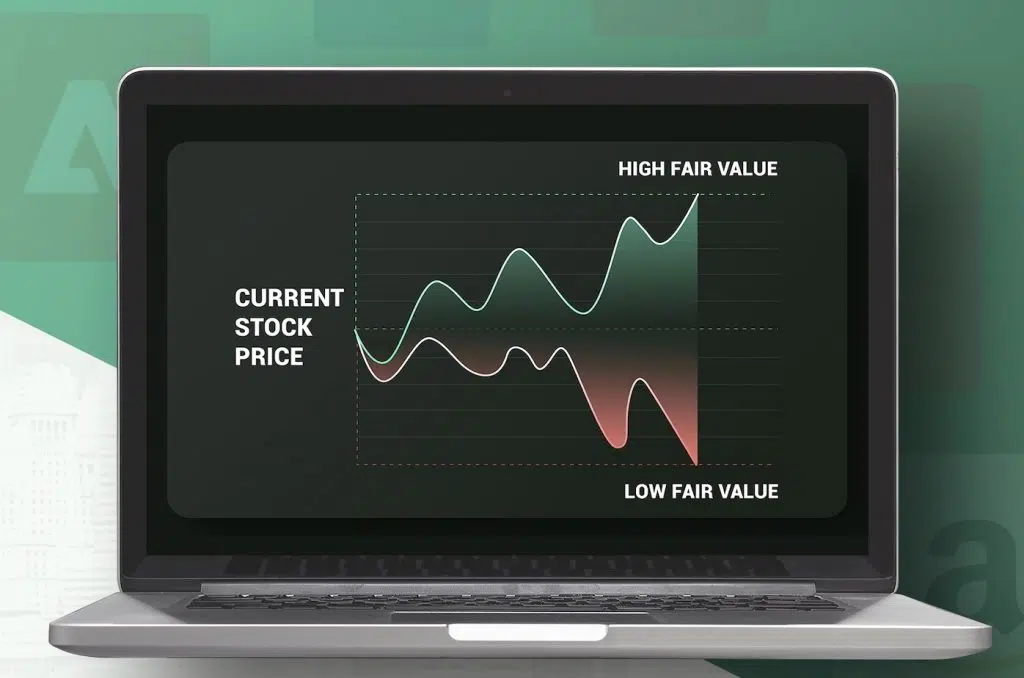

Easily list undervalued stocks: The Fair Value Calculator is a fundamental analysis tool that, by combining the most important fundamental indicators, calculates an approximate true value of the stock and by that finds undervalued stocks for you. All the user then has to do is look for shares whose intrinsic true value (fair value) is higher than the current market price.

A long holding period shows that such fair value stocks bring more returns than the market or overvalued stocks. The Fair Value Calculator is a simple but effective way to find undervalued stocks. Of course, the fair value calculator does not replace a full professional analysis of a stock. But the chances are high that you will come across an undervalued bargain. Once you have found a share, you can see all the key figures that we have presented to you on the underside of that share.

In addition, the targets can be found directly next to the key figures and a comparison of industries is also possible. After selecting the relevant industries, the key figures turn green or red, depending on whether the company is doing better or worse than the industry average. In addition to the Premium Tool, free calculators are also available, which can be used to calculate an approximate fair value of the share using the corresponding fundamental key figures. Let our tool do the work and find undervalued stocks for you the easy way.

Find Undervalued Stocks the Easy Way.

100% Satisfaction - 0% Risk - Cancel Anytime.