Fama-French Three-Factor Model Calculator

Calculate the market return, SMB factor, HML factor, and stock return.

Fama–French 3-Factor – Simple Calculator

Calculate a stock’s expected return / cost of equity using the Fama–French model. Use the 3 sliders below — realistic annual defaults are prefilled.

Advanced settings (optional)

Formula: E[R] = Rf + β·(Rm−Rf) + s·SMB + h·HML. Positive s ⇒ Small exposure, negative s ⇒ Large. Positive h ⇒ Value, negative h ⇒ Growth.

Top 10 Stocks: Fama French Strategy

This list is updated daily by our Stock Screener Tool, covering more than 60,000 stocks worldwide. Discover this and many other Top-Lists inside the Fairvalue Calculator Premium Tool – try it now for free!

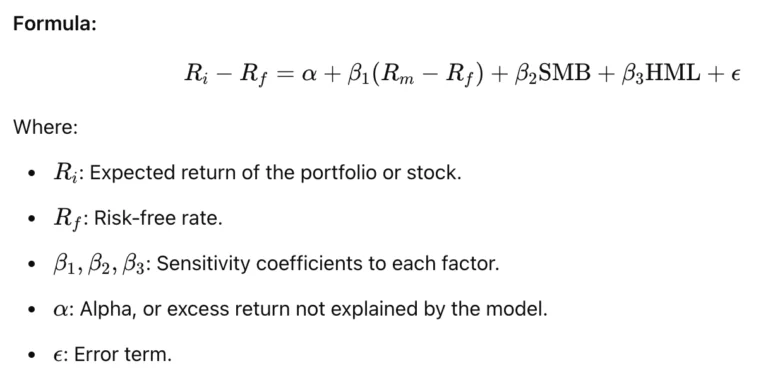

This calculator estimates a stock’s expected return (cost of equity) using the Fama–French 3-factor model from market beta plus size and value exposures:

The Fama-French Three-Factor Model Calculator is a professional calculator tool designed to evaluate stock returns based on the influential factors outlined by Eugene Fama and Kenneth French.

Users input the market return, SMB (Small Minus Big) factor, HML (High Minus Low) factor, and the actual stock return.

It estimates the stock’s return adjusted for market conditions and size and value factors. This calculator provides valuable insights for investors seeking a more nuanced understanding of stock performance within the context of these key financial factors.

Understanding the Fama and French Three-Factor Model

The Fama and French Three-Factor Model is one of the most widely recognized frameworks in finance, offering a more nuanced approach to explaining stock returns than the traditional Capital Asset Pricing Model (CAPM). Developed by Eugene Fama and Kenneth French in 1992, the model extends CAPM by adding two additional factors: size (SMB) and value (HML). This innovation has profoundly impacted investment strategies and asset pricing. The model has been praised for its ability to capture more of the variability in stock returns than CAPM, making it a valuable tool for both academic research and practical investment.

The implications of the Fama and French Three-Factor Model have sparked a significant shift in how investors approach portfolio construction and risk management. By incorporating factors such as size and value alongside market risk, the model provides a more comprehensive understanding of stock returns and helps investors make more informed decisions. Researchers and practitioners alike have embraced this framework for its ability to enhance the accuracy of pricing assets and evaluating investment strategies in today’s dynamic financial markets. This model continues to shape the way finance professionals analyze and optimize their portfolios, underscoring its enduring relevance and impact on the field of finance.

Components of the Three-Factor Model:

- Market Risk Premium:

Similar to CAPM, this represents the excess return of the market over the risk-free rate. It captures the systematic risk affecting all investments.

- SMB (Small Minus Big):

The SMB factor accounts for the size effect, which reflects the tendency of small-cap stocks to outperform large-cap stocks over time. It measures the return differential between small and large companies.

- HML (High Minus Low):

The HML factor captures the value effect, representing the difference in returns between high book-to-market (value) stocks and low book-to-market (growth) stocks. Value stocks tend to outperform growth stocks over the long term.

What the Fama-French Calculator Does:

The provided Fama-French Calculator allows users to estimate stock returns based on the three-factor model. By inputting the relevant factors, market return, SMB, HML, and the stock’s actual return, the calculator computes the adjusted return using the Fama-French framework. This output provides insights into how much of the stock’s return is influenced by these three factors and can help assess its performance relative to the model.

The Fama French Calculator is a powerful tool used in finance to analyze and evaluate investment portfolios. This calculator is based on the Fama-French three-factor model, developed by Eugene Fama and Kenneth French, which takes into account market risk, size risk, and value risk when assessing the performance of investment strategies.

Investors use the Fama French Calculator to determine the expected returns of their portfolios based on these three factors, allowing them to make informed decisions about asset allocation and risk management. By inputting relevant data such as stock returns, market returns, and other factors, the calculator provides valuable insights into how different investments may perform under various market conditions.

The calculator is handy for both professional investors and individual traders looking to optimize their portfolios and maximize returns while managing risk effectively. Its ability to incorporate multiple factors into the analysis makes it a versatile tool for assessing the performance of diverse investment strategies and making data-driven investment decisions.

How to Use the Calculator:

- Input Market Return (%):

The overall return of the market portfolio. - Enter SMB (Small Minus Big) Factor (%):

The size premium, reflecting the return differential between small and large-cap stocks. - Enter HML (High Minus Low) Factor (%):

The value premium, indicating the difference between value and growth stock returns. - Input Stock Return (%):

The actual return of the stock or portfolio being analyzed.

How the Calculator works:

- The calculator subtracts the sum of the market return, SMB, and HML from the stock’s return to isolate the excess return explained by the Fama-French model.

- The result helps investors evaluate whether a stock’s performance aligns with the model or if other unexplained factors might be at play.

This tool is particularly useful for quantitatively inclined investors aiming to implement evidence-based strategies aligned with academic research.

Fairvalue-Calculator Premium Tools Complement Fama-French

Fairvalue-Calculator enhances the practical application of models like Fama and French by providing advanced tools that align with their strategies. These premium tools are indispensable for investors who value precision and depth in financial analysis.

Comprehensive Valuation Models:

- Fama and French highlight the importance of small-cap and value stocks. The premium tools on FairValue-Calculator.com offer advanced valuation models like Discounted Cash Flow (DCF) and Intrinsic Value Analysis to identify undervalued opportunities.

- These models help pinpoint stocks with high potential returns, particularly among small-cap and value stocks, in line with Fama-French findings.

Risk and Factor Sensitivity Analysis:

- Fairvalue-Calculator tools include detailed risk assessments, enabling investors to analyze factor sensitivities such as size (SMB) and value (HML). This aligns closely with the Fama-French framework, allowing users to construct portfolios that optimize exposure to these factors.

- Fairvalue-Calculator tools include detailed risk assessments, enabling investors to analyze factor sensitivities such as size (SMB) and value (HML). This aligns closely with the Fama-French framework, allowing users to construct portfolios that optimize exposure to these factors.

Portfolio Optimization:

- By combining factor analysis with valuation metrics, the premium tools guide users in constructing diversified portfolios that balance growth, value, and size factors, effectively implementing Fama-French strategies.

- By combining factor analysis with valuation metrics, the premium tools guide users in constructing diversified portfolios that balance growth, value, and size factors, effectively implementing Fama-French strategies.

Customization for Factor Investing:

- The platform’s premium tools allow investors to input their specific assumptions, such as expected market returns, SMB, and HML factors, enabling tailored analyses aligned with personal investment strategies.

- The platform’s premium tools allow investors to input their specific assumptions, such as expected market returns, SMB, and HML factors, enabling tailored analyses aligned with personal investment strategies.

Educational Resources and Insights:

- Understanding Fama-French strategies requires a solid grasp of financial theory. FairValue-Calculator.com includes rich educational content to empower users with the knowledge needed to apply these principles effectively.

Investing in line with Fama-French strategies involves identifying stocks with characteristics that align with the model’s factors. For example:

- Small-cap value stocks often outperform the market over time, but they also require diligent research to assess intrinsic value and risks.

- Tools from Fairvalue-Calculator help investors balance these factors by providing actionable insights and simplifying complex analyses.

By leveraging these premium tools, investors can not only evaluate stocks based on the Fama-French model but also enhance their ability to implement effective, research-backed investment strategies.

Conclusion:

The Fama and French Three-Factor Model remains a cornerstone of modern finance, providing deeper insights into stock returns through its incorporation of size and value factors. Tools like the Fama-French Calculator simplify its application, offering practical insights for investors aiming to understand and optimize portfolio performance.

Fairvalue-Calculator, with its premium tools, complements this approach by offering comprehensive valuation models, risk assessments, and portfolio optimization features. Together, these tools and strategies empower investors to make data-driven decisions that align with the Fama-French framework, ensuring a more informed and strategic approach to building wealth.

Unleash Your Stock Data Instantly.

100% Satisfaction - 0% Risk - Cancel Anytime.