How to Integrate Sustainability into Your Investment Decisions

In recent years, the investment landscape has undergone a significant transformation. No longer are financial metrics the sole determinants of a company’s worth or an investment’s potential. A new paradigm has emerged, one that recognizes the critical importance of environmental, social, and governance (ESG) factors in shaping the long-term success and sustainability of businesses and investment portfolios.

💡 Discover Powerful Investing Tools

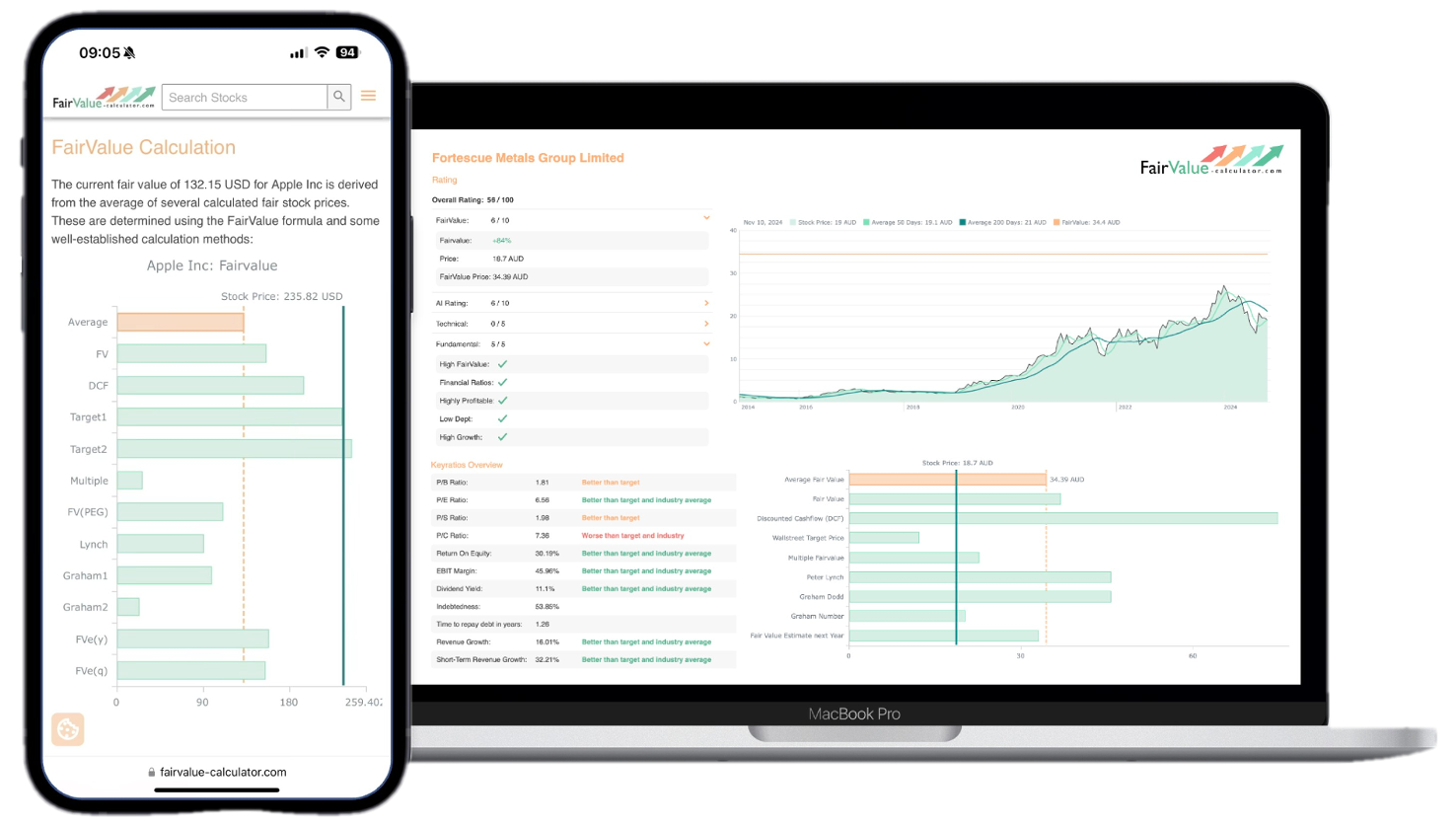

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →This shift towards ESG considerations is not merely a passing trend but a fundamental reimagining of how we assess value in the financial markets. As climate change, social inequality, and corporate governance issues increasingly impact business operations and financial performance, investors are compelled to broaden their analytical framework beyond traditional financial statements.

🚀 Test the Fair Value Calculator Now!

Find out in seconds whether your stock is truly undervalued or overpriced – based on fundamentals and future growth.

Try it for Free →At the heart of investment analysis lies the concept of fair value – the estimated price at which an asset would change hands in a transaction between willing parties. Traditionally, fair value calculations have focused on financial metrics such as cash flows, growth rates, and risk factors. However, this conventional approach is increasingly viewed as incomplete in a world where non-financial factors can significantly influence a company’s long-term viability and performance.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

The integration of ESG factors into fair value analysis represents a more holistic approach to valuation. It acknowledges that a company’s environmental impact, social responsibility, and governance practices are not just ethical considerations but material factors that can affect financial performance, risk profiles, and ultimately, investment returns.

This article aims to explore the intricate relationship between fair value and ESG, providing investors with a comprehensive guide on how to incorporate sustainability considerations into their investment decisions. We will delve into the methodologies for integrating ESG factors into traditional valuation models, examine the challenges and opportunities this integration presents, and offer practical steps for investors looking to adopt a more sustainable approach to their investment strategies.

By the end of this exploration, it will become clear that the integration of ESG factors into fair value analysis is not just a moral imperative but a financial necessity in today’s complex and interconnected global economy. Investors who successfully navigate this integration stand to benefit from more robust risk management, potentially enhanced returns, and the satisfaction of contributing to a more sustainable future.

As we embark on this journey through the realms of fair value and ESG, we invite you to reconsider your approach to investment analysis and decision-making. The fusion of these two concepts offers a powerful framework for understanding the true value of investments in a world where sustainability is no longer optional but essential for long-term success.

2. Understanding Fair Value

Fair value is a fundamental concept in finance and accounting, serving as a cornerstone for investment decisions and financial reporting. At its core, fair value represents the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This concept is crucial for investors as it provides a standardized way to assess the worth of assets and companies, enabling more informed decision-making.

The Importance of Fair Value

The significance of fair value in the investment world cannot be overstated. It serves several critical functions:

- Transparency: Fair value provides a clear picture of an asset’s or company’s worth, enhancing transparency in financial markets.

- Comparability: It allows for easier comparison between different investments, helping investors allocate their resources more effectively.

- Risk Assessment: Accurate fair value measurements enable better risk assessment, a crucial aspect of investment management.

- Market Efficiency: By reflecting the most current market conditions, fair value contributes to more efficient markets.

Traditional Methods of Calculating Fair Value

Several established methods are used to calculate fair value, each with its own strengths and applications:

- Market Approach: This method uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities.

- Income Approach: This approach converts future amounts (e.g., cash flows or earnings) to a single current (discounted) amount, often using techniques such as the Discounted Cash Flow (DCF) model.

- Cost Approach: This method reflects the amount that would be required currently to replace the service capacity of an asset (often referred to as current replacement cost).

- Asset-Based Approach: This involves calculating the fair value of a company by summing up the fair values of its individual assets and subtracting its liabilities.

Each of these methods has its place in fair value analysis, and the choice often depends on the nature of the asset, available information, and specific circumstances of the valuation.

Limitations of Conventional Fair Value Analysis

While traditional fair value analysis has served investors well for decades, it is not without its limitations, particularly in the context of today’s complex business environment:

- Short-Term Focus: Conventional valuation methods often emphasize short-term financial performance, potentially overlooking long-term value creation or destruction.

- Intangible Asset Valuation: Traditional models struggle to accurately value intangible assets such as brand value, intellectual property, and human capital, which are increasingly important in the modern economy.

- Externality Exclusion: Conventional fair value analysis typically does not account for externalities – the positive or negative impacts a company has on society and the environment that are not reflected in its financial statements.

- Assumption Sensitivity: Fair value calculations can be highly sensitive to assumptions about future growth rates, discount rates, and market conditions, leading to potential inaccuracies.

- Lack of Sustainability Considerations: Traditional methods do not explicitly incorporate sustainability factors, which can significantly impact a company’s long-term viability and value.

These limitations highlight the need for a more comprehensive approach to valuation – one that incorporates a broader range of factors affecting a company’s long-term value. This is where the integration of ESG factors into fair value analysis becomes crucial, providing a more holistic view of an investment’s true worth and potential.

3. The ESG Framework

The ESG framework has emerged as a powerful tool for assessing the sustainability and ethical impact of investments. By considering Environmental, Social, and Governance factors alongside traditional financial metrics, investors can gain a more comprehensive understanding of a company’s risks, opportunities, and long-term viability.

Defining Environmental, Social, and Governance Factors

- Environmental Factors: These relate to a company’s impact on the natural world and its ability to manage environmental risks and opportunities. Key considerations include:

- Climate change impact and mitigation strategies

- Resource management and efficiency

- Pollution and waste management

- Biodiversity conservation

- Renewable energy adoption

- Social Factors: These encompass a company’s relationships with its employees, customers, suppliers, and the communities in which it operates. Important aspects include:

- Labor practices and working conditions

- Diversity and inclusion

- Human rights policies

- Customer satisfaction and product safety

- Data privacy and security

- Community engagement and impact

- Governance Factors: These involve the internal systems of practices, controls, and procedures a company adopts to govern itself, make effective decisions, comply with the law, and meet the needs of external stakeholders. Key elements include:

- Board structure, diversity, and independence

- Executive compensation

- Shareholder rights

- Corporate ethics and transparency

- Anti-corruption measures

- Risk management practices

The Rise of ESG Investing

ESG investing has seen exponential growth in recent years, driven by several factors:

- Increased Awareness: Growing public consciousness about climate change, social inequalities, and corporate scandals has led to heightened investor interest in sustainable and ethical investments.

- Regulatory Pressure: Governments and regulatory bodies worldwide are implementing policies that encourage or mandate ESG considerations in investment processes.

- Performance Potential: A growing body of research suggests that companies with strong ESG profiles may outperform their peers over the long term, attracting investors seeking both financial returns and positive impact.

- Risk Mitigation: ESG analysis helps identify potential risks that might not be captured by traditional financial analysis, such as reputational risks, regulatory risks, and long-term environmental risks.

- Generational Shift: Younger generations, particularly millennials and Gen Z, are increasingly prioritizing sustainability and ethical considerations in their investment decisions.

Key ESG Metrics and Their Significance

While ESG encompasses a wide range of factors, certain key metrics have emerged as particularly significant for investors:

- Carbon Footprint: Measures a company’s total greenhouse gas emissions, crucial for assessing climate-related risks and opportunities.

- Water Usage: Indicates a company’s water management practices, particularly important in water-stressed regions or water-intensive industries.

- Waste Management: Reflects a company’s efficiency in resource use and its approach to circular economy principles.

- Employee Turnover Rate: This can indicate the quality of a company’s labor practices and workplace culture.

- Gender and Ethnic Diversity: Measures representation at various levels of the organization, including board and executive positions.

- Health and Safety Incidents: Reflects the company’s commitment to worker safety and operational risk management.

- Data Breaches: Indicates the strength of a company’s cybersecurity measures and its ability to protect sensitive information.

- Board Independence: The proportion of independent directors on the board, is a key indicator of good governance practices.

- Executive Compensation Structure: Reveals how well executive incentives align with long-term shareholder interests and company performance.

- Sustainability Reporting Quality: The comprehensiveness and transparency of a company’s ESG disclosures.

These metrics provide tangible data points for investors to assess a company’s ESG performance. However, it’s important to note that the relevance and materiality of specific ESG factors can vary significantly across industries and individual companies. Therefore, a nuanced, industry-specific approach to ESG analysis is often necessary for meaningful integration into investment decisions.

As we move forward, we’ll explore how these ESG considerations can be effectively incorporated into fair value analysis, providing a more holistic approach to valuation and investment decision-making.