In the area of options trading, understanding the extrinsic value of an option contract is crucial for making informed investment decisions. The extrinsic value, also known as the time value, represents the portion of an option’s premium that is not accounted for by its intrinsic value. It reflects the probability that the option will become profitable before expiration, taking into account factors such as time remaining until expiration and the volatility of the underlying asset.

💡 Discover Powerful Investing Tools

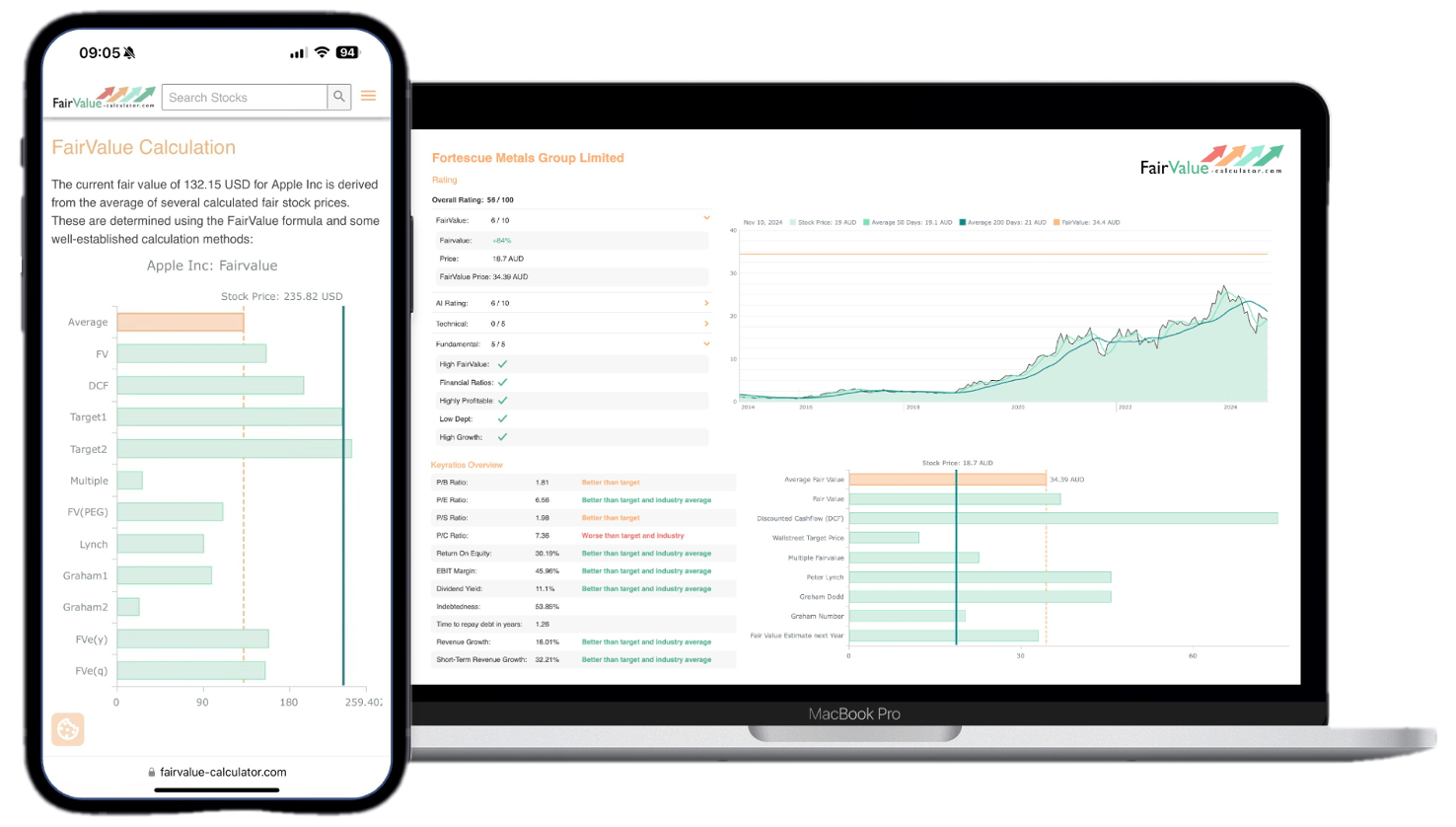

Stop guessing – start investing with confidence. Our Fair Value Stock Calculators help you uncover hidden value in stocks using time-tested methods like Discounted Cash Flow (DCF), Benjamin Graham’s valuation principles, Peter Lynch’s PEG ratio, and our own AI-powered Super Fair Value formula. Designed for clarity, speed, and precision, these tools turn complex valuation models into simple, actionable insights – even for beginners.

Learn More About the Tools →Calculating the extrinsic value manually can be a complex and time-consuming process, involving various formulas and calculations. Fortunately, there are extrinsic value calculators available that simplify this task, making it accessible to traders of all skill levels. In this article, we will explore the concept of extrinsic value, its importance in options trading, and how to use an extrinsic value calculator effectively.

🚀 Test the Fair Value Calculator Now!

Find out in seconds whether your stock is truly undervalued or overpriced – based on fundamentals and future growth.

Try it for Free →Understanding Extrinsic Value

Before diving into the extrinsic value calculator, it is essential to understand the fundamental components of an option’s premium. The premium is the price an investor pays to purchase an option contract, and it consists of two parts: intrinsic value and extrinsic value.

Explore our most popular stock fair value calculators to find opportunities where the market price is lower than the true value.

- Peter Lynch Fair Value – Combines growth with valuation using the PEG ratio. A favorite among growth investors.

- Buffett Intrinsic Value Calculator – Based on Warren Buffett’s long-term DCF approach to determine business value.

- Buffett Fair Value Model – Simplified version of his logic with margin of safety baked in.

- Graham & Dodd Fair Value – Uses conservative earnings-based valuation from classic value investing theory.

- Intrinsic vs. Extrinsic Value – Learn the core difference between what a company’s really worth and what others pay.

- Intrinsic Value Calculator – A general tool to estimate the true value of a stock, based on earnings potential.

- Fama-French Model – For advanced users: Quantifies expected return using size, value and market risk.

- Discount Rate Calculator – Helps estimate the proper rate to use in any DCF-based valuation model.

- Intrinsic Value

The intrinsic value is the portion of the premium that represents the option’s current profitability if exercised immediately. For a call option, the intrinsic value is the amount by which the underlying asset’s price exceeds the strike price. For a put option, it is the amount by which the strike price exceeds the underlying asset’s price. - Extrinsic Value

The extrinsic value, or time value, is the remaining portion of the premium that accounts for the possibility of the option becoming profitable before expiration. It is influenced by several factors, including:

- Time remaining until expiration: The longer the time until expiration, the higher the extrinsic value, as there is more time for the underlying asset’s price to move favorably.

- Volatility of the underlying asset: Higher volatility increases the chances of the option becoming profitable, resulting in a higher extrinsic value.

- Interest rates: Higher interest rates can increase the extrinsic value of call options and decrease the extrinsic value of put options.

The extrinsic value is calculated by subtracting the intrinsic value from the option’s premium:

Extrinsic Value = Option Premium – Intrinsic Value

Why is Extrinsic Value Important?

Understanding the extrinsic value of an option is crucial for several reasons:

- Informed Decision-Making

By analyzing the extrinsic value, traders can assess the potential profitability of an option and make more informed decisions about whether to buy, sell, or hold the contract. - Risk Management

Monitoring the extrinsic value can help traders manage their risk exposure. As an option approaches expiration, its extrinsic value decreases, potentially leading to a significant loss if the option expires out-of-the-money. - Pricing and Valuation

The extrinsic value plays a vital role in option pricing models, such as the Black-Scholes model, which are used to determine the fair value of an option contract. - Hedging Strategies

Extrinsic value calculations are essential for implementing hedging strategies, such as covered calls and protective puts, which involve buying or selling options to mitigate risk.

Using an Extrinsic Value Calculator

While it is possible to calculate the extrinsic value manually using formulas, an extrinsic value calculator streamlines the process and eliminates the risk of calculation errors. Most extrinsic value calculators require you to input the following information:

- Option Type (Call or Put)

- Underlying Asset Price

- Strike Price

- Time to Expiration (in days)

- Implied Volatility (if available)

- Interest Rate (if applicable)

Once you have entered the required information, the calculator will provide you with the extrinsic value of the option, along with other relevant metrics such as the intrinsic value and the option’s premium.

It’s important to note that some extrinsic value calculators may require additional inputs, such as the dividend yield for stock options or the futures price for futures options. Always refer to the calculator’s instructions to ensure you are providing the correct information.

Interpreting the Results

After using an extrinsic value calculator, you will receive the extrinsic value of the option. Here’s how you can interpret the results:

- High Extrinsic Value

A high extrinsic value indicates that the option has a significant time value component, suggesting a higher probability of the option becoming profitable before expiration. This could be due to factors such as a longer time to expiration, high volatility, or favorable interest rates. - Low Extrinsic Value

A low extrinsic value means that the option’s premium is primarily composed of intrinsic value, with little time value remaining. This could indicate that the option is nearing expiration or that the underlying asset has low volatility, reducing the chances of the option becoming profitable. - Zero Extrinsic Value

If the extrinsic value is zero, it means that the option’s premium is entirely composed of intrinsic value. This situation typically occurs when an option is deep in the money and has little time remaining until expiration.

By interpreting the extrinsic value, traders can make more informed decisions about whether to hold, sell, or adjust their option positions.

Advanced Strategies and Considerations

While an extrinsic value calculator is a valuable tool, it is essential to remember that it provides a snapshot of the option’s value at a specific point in time. Effective options trading requires a comprehensive understanding of various strategies and considerations, such as:

- Implied Volatility

Implied volatility is a crucial factor in determining the extrinsic value of an option. It represents the market’s expectation of the underlying asset’s future volatility. Higher implied volatility generally leads to higher extrinsic values, as there is a greater chance of the option becoming profitable. - Time Decay

As an option approaches expiration, its extrinsic value decreases at an accelerating rate, a phenomenon known as time decay. Traders must be aware of this effect and adjust their positions accordingly to manage risk and potential losses. - Hedging Strategies

Extrinsic value calculations are essential for implementing hedging strategies, such as covered calls and protective puts. These strategies involve buying or selling options to mitigate the risk associated with holding the underlying asset. - Spreads and Combinations

Advanced traders may employ option spreads and combinations, which involve simultaneously buying and selling multiple options with different strike prices and expiration dates. Extrinsic value calculations play a crucial role in analyzing the risk and potential returns of these strategies. - Implied Volatility Skew

The implied volatility skew refers to the phenomenon where options with different strike prices can have varying implied volatilities, even if they have the same underlying asset and expiration date. This can impact the extrinsic value calculations and should be considered when trading options.

By incorporating these advanced concepts and strategies, traders can further refine their options trading approach and make more informed decisions based on extrinsic value calculations.

The extrinsic value calculator is an invaluable tool for options traders, simplifying the process of calculating the time value component of an option’s premium. By understanding and effectively utilizing this calculator, traders can gain deeper insights into the potential profitability of their option positions, manage risk more effectively, and make more informed investment decisions.

However, it is essential to remember that the extrinsic value calculator is just one piece of the puzzle in options trading. Successful trading requires a comprehensive understanding of various strategies, risk management techniques, and market dynamics. By combining the insights provided by the extrinsic value calculator with advanced concepts and continuous learning, traders can navigate the complex world of options trading with confidence and achieve their investment goals.