Dynamic Gearing Ratio

Dynamic Gearing Ratio Calculator and Gearing Ratio Formula.

Insert the company’s total liabilities and the cashflow into this Dynamic Gearing Calculator and receive the Dynamic Gearing.

To find other useful fundamental analysis ratios, use the other free online calculators. The metrics for this calculator can be found via a Google search, in the annual report on the company’s website under “Investors Relations” or on financial websites.

In our Premium Tool we load fundamental data to more than 45.000 stocks and display the best stocks within seconds.

What is Dynamic Gearing?

Dynamic Gearing Ratio or simply Dynamic Gearing is a niche financial metric that indicates the time period (usually years) that a company will take to pay off its liabilities completely.

It is a relatively unknown financial ratio yet a provider of valuable information on a company’s ability to keep its debt under control as well as any existing problems in business operations.

It is a deceptively simple formula, but hides within itself certain complexities based on different investors’ perception of liabilities and cash flow. Unlike other financial ratios like P/E or P/B, Dynamic Gearing is not used for direct valuation of companies but more of a consensus builder to help judge the company’s health is in line with what the aforementioned ratios indicate.

Let us have a look at this ratio with examples while we try to understand what makes this simple looking ratio so challenging yet valuable once the challenge has been surpassed.

Gearing Ratio Formula: Total Liabilities / Total Cash Flow

The formula is pretty straightforward to understand and calculate at first glance, however there are a few challenges and complexities when we breakdown its inputs i.e. Liabilities and Cash Flow. Liabilities tend to vary in nature based on their duration to payment. Short term liabilities by their nature tend to be on the books for short duration and are cleared out within a year of their records on financial statements.

Considering them into Dynamic Gearing makes no sense as the company keeps on rolling short term debt (working capital) or pays them outright (trade payables) within the year. For the purposes of Dynamic Gearing, long term liabilities make the most sense as by nature these tend to have a higher cost and thus a higher burden on company finances and at the same time can often bring the company down.

Even contingent liabilities can be excluded from total liabilities calculation as these are contingent on various conditions occurring which may or may not. The challenges with cash flow are much more subtle. Ideally you want to measure the time it will take for a company to pay off its debt from cash coming in from business operations. Markets are often not ideal. Companies often come out with equity issues, proceeds of which are then utilized to retire long term debt.

This occurs around the time of repayment of a major debt. For e.g. a company has borrowed say $10 million for setting up a factory which is now due in the next year. While interest payments are made regularly, it does not generate enough in annual cash flows to pay the principal amount of $10 million. In such a situation, public companies can often come out with a follow on issue to issue additional shares to its investors which it will then use to pay that debt.

In such a scenario, it makes sense to consider cash flow from financing activities as well in the calculations. However additional share issue comes at the cost of diluting the stakes of the existing shareholders. For an investor, the concern should be the duration in which the company can pay off the debt without raising finance from equity and thus cash flow from operations makes more sense.

Example:

Dynamic Gearing tends to be industry specific as different industries have different liabilities burden as well as cash flows. Comparing a company in manufacturing with that in services will not yield the appropriate comparison. Capital Intensive industries tend to have higher Dynamic Gearing ratios than those that are less capital intensive. On a standalone basis, dynamic gearing can provide very little information.

However too long a period needs to be looked at. Anything longer than a decade is a serious concern. Issues could be with liabilities (Huge debt with high interest) or underperforming business operations (bad cash flow). Some investors prefer their companies to be debt free in which case Dynamic Gearing will be very low.

However as explained in the Debt to Equity calculator, companies on an average will tend to do better with some debt which will act as leverage. However a company with low dynamic gearing within the industry or when compared with its peers may not simply be considered good at face value.

A deeper analysis will be required to see whether its low dynamic gearing is attributed to a strong cash flow or just low leverage. Let us look at some of the companies in various industries and try to understand this ratio and its impact:

Retail as a sector tends to have a lot more short term liabilities than long term liabilities as their trade payables tend to be high. Long term liabilities are mostly concentrated in acquiring properties or long term leases for their stores. Thus a high debt to equity ratio or indebtedness is preferred along with lower dynamic gearing which will signify strong cash flows.

As can be seen, Walmart has low debt as compared to its peers but has a higher dynamic gearing signifying relatively lower cash flows. Target on the other hand not only has a higher debt i.e. higher leverage but also a lower dynamic gearing than the industry average. It also helps that its debt is within control when looking at the industry average of indebtedness.

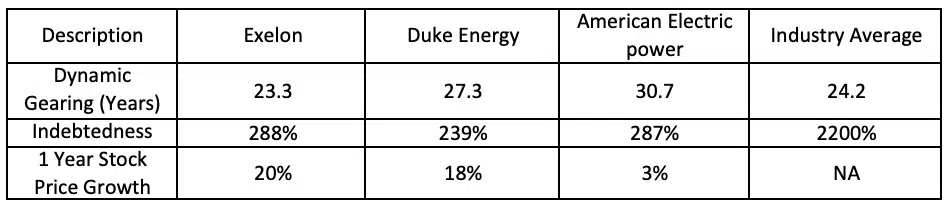

Costco on the other hand has the lowest dynamic gearing ratio but it also has the lowest debt and the stock performance reflects that. Now we look at an industry which tends to not only be monopolistic but also capital intensive: utilities. Cash flows tend to be predictable and constant and hence the only influencing factor is liabilities. A low dynamic gearing is preferred but debt has to be within control as well and that control will be reflected in the dynamic gearing ratio.

While almost all the companies under consideration have above average dynamic gearing and below average indebtedness, a common pattern underlines them all. Exelon, the best of the lot has the lowest dynamic gearing and slightly below industry as well. It has a higher indebtedness than its peers but its strong cash flows make up for it as is visible in the dynamic gearing.

American Electric while having the same level of indebtedness as Exelon has a much higher dynamic gearing which is a red flag and an investor should dig deep into its business operations as this shows a cash flow issue. Duke Energy has a relatively lower level of indebtedness and yet a higher dynamic gearing than its peers and industry average which again points towards certain inefficiencies. Finally let’s have a look at global popular names and see if we can identify what makes them tick in their respective segment.

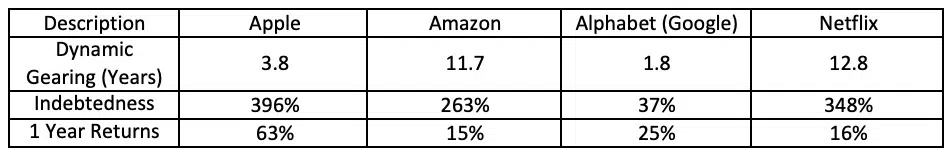

Apple is primarily into smartphone manufacturing and has a strong demand for its product. It needs debt to finance its growth and tap into new markets and its indebtedness is adequately backed by a low dynamic gearing ratio. Amazon on the other hand is primarily into ecommerce and online retail. It does not have the same requirements as physical retail stores that we saw earlier.

Its primary cost is in warehousing which can be leased as well. With its primary role as a marketplace, a high debt to finance growth involves using that cash to give discounts and attract customers, which hits the bottom line and thus is viewed negatively. It does not help that it has a pretty high dynamic gearing ratio which when combined with its indebtedness points towards cash flow issues from its operations.

Google being a search engine requires no such cash to grow and thus its indebtedness is pretty low and at the same time a low dynamic gearing means that the company has not taken on the needed leverage which accounts for its subpar performance as well. Finally Netflix has been borrowing greatly to create new and original content but the same has not been reflected in its subscription growth which has also affected its cash flows and thus led to a high dynamic gearing prompting the markets to rate the stock poorly.

What you should be looking for:

The first step is to look for the lowest dynamic gearing ratio in the industry. Prepare a shortlist of those that are in the bottom of the industry in terms of number of years to repay that debt. The real challenge is to identify whether that low dynamic gearing is due to strong cash flows or low debt. Measure their indebtedness and compare the same with the industry. A combination of high indebtedness (but not exceeding industry average by much) and low dynamic gearing is preferred.

Any cash flow issues need to be filtered out or need to be look at for historical trend as well as any future scope of improvement. A sufficiently high cash flow can mitigate effects of debt so a low dynamic gearing with sufficiently high debt is the right way to go. Excess debt however has to be avoided especially in cyclical industries like metals or commodities as that debt is often taken at the peak of the cycle and repayment issues tend to crop up once the cycle turns.

Conclusion:

Dynamic Gearing is a relatively niche and unknown yet useful valuation metric to eke out valuable information about company’s indebtedness and strength of its business operations. It is also a pretty good indicator of a company’s survival during bad times as a lower dynamic gearing ratio means that the company will be able to get out of bad times faster on the back of its cash flows.

That being said, an industry comparison is a must as different industries operate on different terms and are influenced by different factors. Always remember that no single ratio is the holy grail of investment selection. One must build a consensus of various financial ratios like P/E, P/B, and ROE etc. alongside indebtedness in order to arrive at an investment decision. Alternatively, join our premium membership and we will do all of this work for you, providing you various fair values right on your very own premium dashboard.

In my experience a combination of long term liabilities and cash flow from operations is the best way to use this ratio. Comparing leaders of each sector using these two parameters will throw up the strongest business in that sector. While others may hide behind recording revenues in advance or repay debt via equity or other financial shenanigans, this two remain powerful and difficult to manipulate and a company having the best ratio tends to have the best operations as well.

As an investor, this translates to cost and price leadership and this leadership translates into survival and profitability when the economic cycle turns for the worse. I will then evaluate the leader with other ratios to build a consensus and eliminate any errors that might have crept in or a bias that might have colored my vision and determine my investment decision from there.