Fair Value and ESG

How to Integrate Sustainability into Your Investment Decisions In recent years, the investment landscape has undergone a significant transformation. No longer are financial metrics the sole determinants of a company’s worth or an investment’s potential. A new paradigm has emerged,...

Understanding Fair Value – What It Means for Investors

In the complex world of finance and investment, understanding the concept of fair value is crucial for making informed decisions. Fair value is a fundamental principle that helps investors, analysts, and financial professionals assess the true worth of assets, securities,...

The Importance of Fair Value in Portfolio Management

Fair value is a critical concept in modern portfolio management that plays a vital role in asset valuation, risk assessment, and investment decision-making. Understanding and accurately calculating fair values allows portfolio managers to make more informed choices about asset allocation,...

How to Utilize a Fair Value Calculator to Determine the True Worth of Stocks

Investing in stocks can be a rewarding endeavor, but it also carries inherent risks. One of the biggest challenges for investors is determining the true worth or fair value of a stock before making an investment decision. Overpaying for a...

Value of Stock

A Key Metric for Smart Investing In the dynamic world of finance and investing, one concept stands out as a fundamental principle for valuing stocks: intrinsic value. This metric goes beyond the surface-level fluctuations of stock prices and dives deep...

How to Calculate the Piotroski F-Score

Introduction to the Piotroski F-Score The Piotroski F-Score is a relatively simple quantitative scoring system used to evaluate the financial strength of a company. Developed by accounting professor Joseph Piotroski in 2000, the F-Score aims to identify firms with strong...

Extrinsic Value Calculator Made Simple

In the area of options trading, understanding the extrinsic value of an option contract is crucial for making informed investment decisions. The extrinsic value, also known as the time value, represents the portion of an option’s premium that is not...

What is the Difference Between Intrinsic and Extrinsic Value?

Value is a complex and multifaceted concept that has been the subject of intense philosophical and economic debate for centuries. At the heart of this debate is the fundamental distinction between intrinsic value and extrinsic value. Understanding this distinction is...

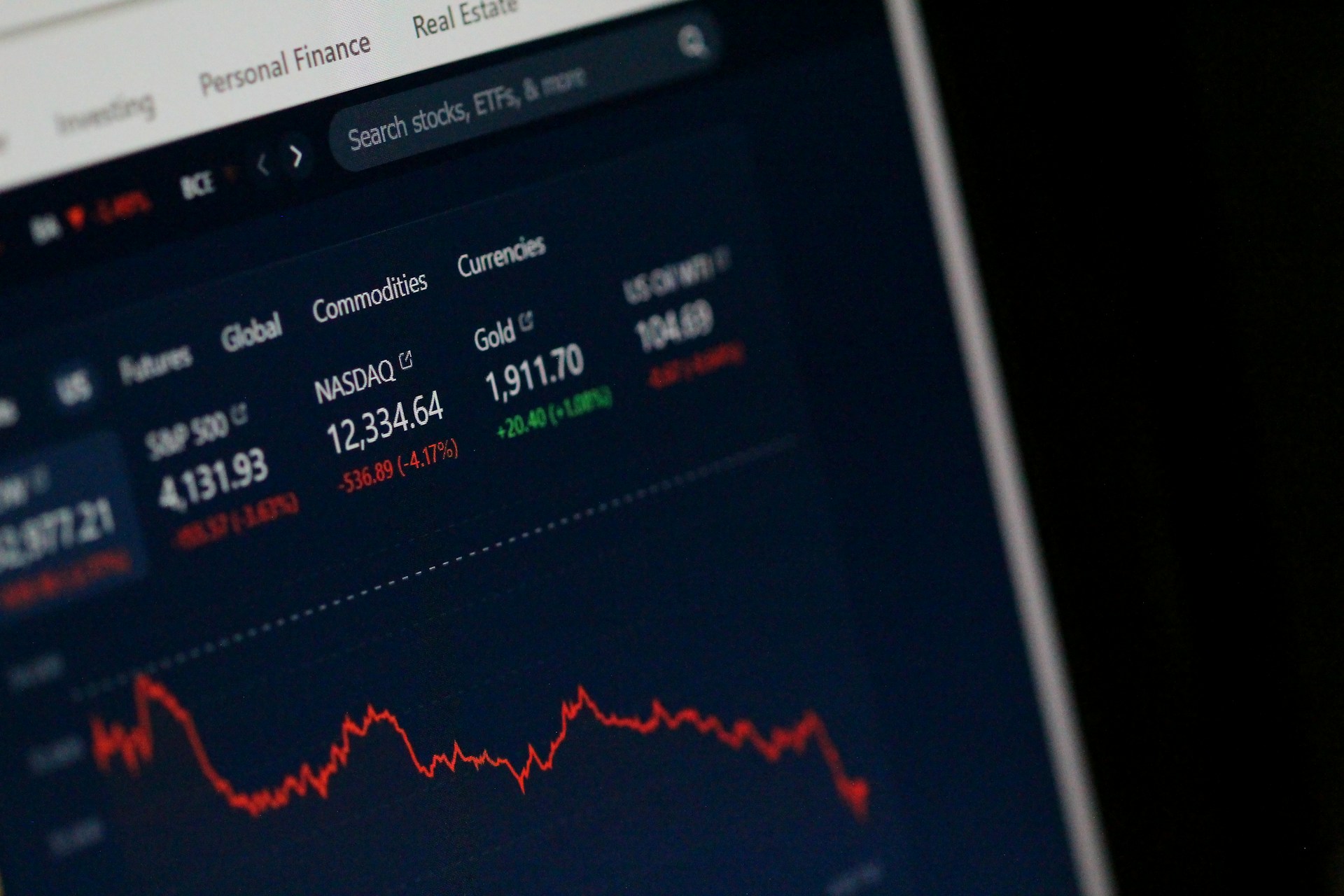

How to Calculate the Fair Value of a Stock in 2024

In today’s fast-paced and volatile global markets, determining the fair value of a stock has become more crucial than ever for investors. As we navigate through 2024, the process of stock valuation remains a critical aspect of fundamental analysis, enabling...

EAF Fair Value

An In-Depth Analysis Enterprise Application Framing (EAF) fair value is an important concept for investors to understand when evaluating technology companies. EAF refers to proprietary software platforms and applications developed by a company for use in its operations. Determining the...

Proudly powered by WordPress Theme: Essentials Child.