Calculating the Fair Value of a Company

Determining the fair value of a company is an important part of fundamental analysis for investors. The fair value represents the true intrinsic worth of a business based on its financials, growth prospects, and risk factors. By comparing a stock’s...

Navigating the Financial Landscape with Equity Research Reports

In the dynamic and ever-evolving world of finance, investors seek to make informed decisions that can yield profitable returns. One powerful tool at the disposal of investors is Equity Research Reports. These comprehensive documents, crafted by financial analysts, serve as...

What is the Average Investment Return at Berkshire Hathaway?

Berkshire Hathaway, led by legendary investor Warren Buffett, is one of the most successful investment firms in history. Since Buffett took control of the struggling textile company in 1965, Berkshire’s investing acumen has turned it into one of the largest...

20 Golden Investment Rules

Investing can seem daunting, but following some fundamental principles can help guide you toward building wealth over time. Here are 20 golden rules for investing that every investor should know: Successful investing requires discipline, patience, and sticking to proven principles....

Magnificent 7 Stocks Valuation

The “Magnificent Seven” stocks also “Magnificent 7 Stocks” are a group of seven high-growth technology companies that are considered to be leaders in their respective industries. The term was originally coined by CNBC personality Jim Cramer in 2013 and included...

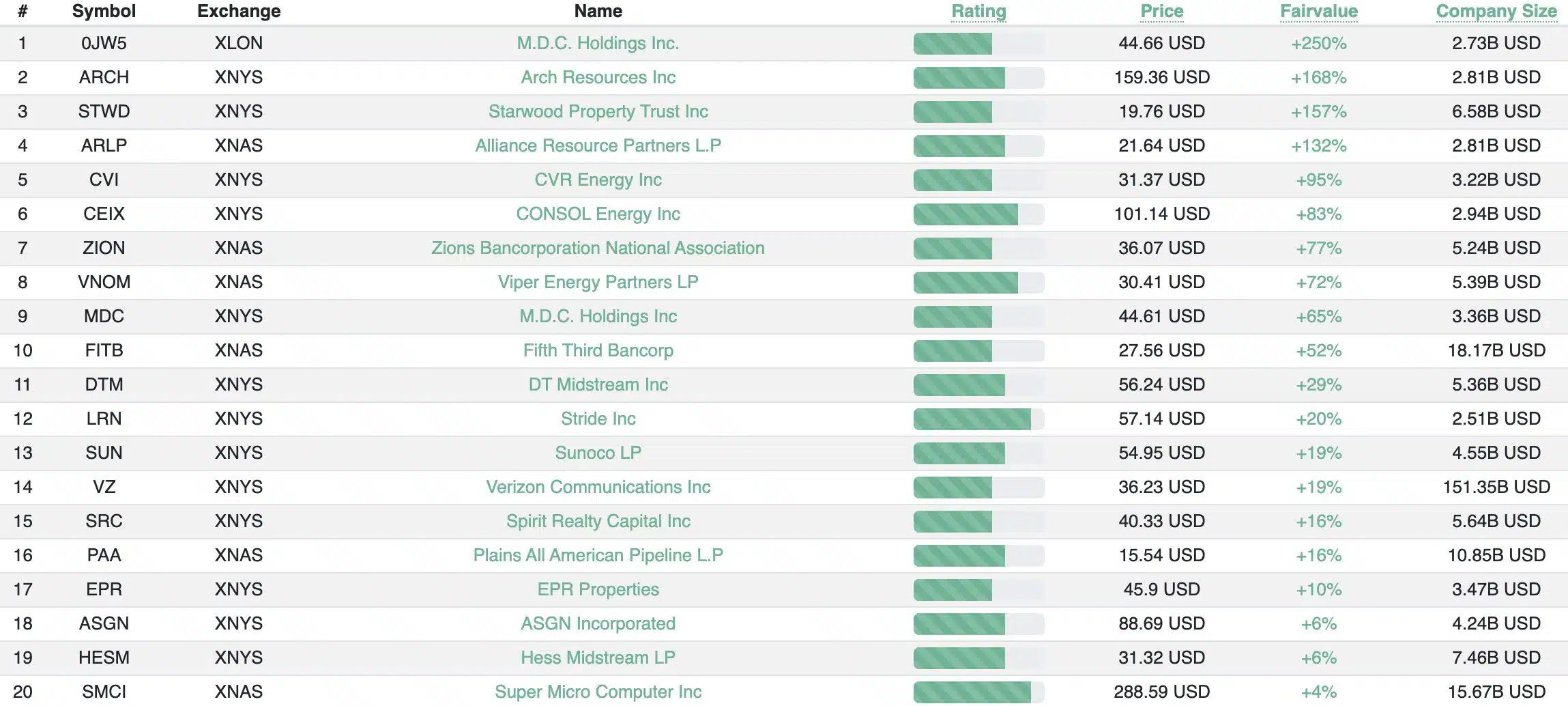

5 Dividend Stocks to Buy Now!

Investing in Dividend Stocks: 5 High-Yield Options for Steady Income Investing in dividend stocks can be a lucrative strategy for investors seeking a steady income stream. In this blog post, we will explore five high-yield options that offer attractive returns...

3 Methods of Stock Valuation for Informed Investment Decisions

Stock valuation is a critical aspect of investment analysis that enables investors to assess the intrinsic value of a company’s shares. By employing various methods, investors can make more informed decisions regarding buying, selling, or holding stocks. We will delve...

What is Lynch’s rule of 20?

A Guide to Valuing Stocks with Precision In the world of finance and investment, understanding the metrics and methodologies for valuing stocks is crucial. Investors often rely on various rules and strategies to make informed decisions about their investments. One...

Legends of Fair Value Investing – Part 6

“The single biggest advantage a value investor has is not IQ. It’s patience and waiting. Waiting for the right pitch and waiting for many years for the right pitch” – Mohnish Pabrai Successful investors over the years have achieved that...

Legends of Fair Value Investing – Part 5

“As an investor, my job is to figure out what will happen rather than what should happen” – David Einhorn Markets are a fickle being. The only constant is change. Strategies rise and fall with spectacular speed and efficiency and...

Proudly powered by WordPress Theme: Essentials Child.