Fair Value and Cryptocurrency: Evaluating Digital Assets

In the rapidly evolving digital finance landscape, cryptocurrencies have emerged as a transformative force that challenges traditional notions of value and valuation. Bitcoin, Ethereum, and other digital assets have disrupted conventional financial paradigms, presenting unprecedented opportunities and complex challenges for...

Intrinsic Value vs. Discounted Cash Flow Analysis

Valuation is a cornerstone of investment decision-making, helping investors assess whether an asset is overvalued, undervalued, or fairly priced. Among the various valuation methodologies, intrinsic value and discounted cash flow (DCF) analysis stand out for their focus on the underlying...

What is the intrinsic value of an asset?

In the intricate realm of investing and financial analysis, the concept of intrinsic value emerges as a cornerstone of informed decision-making. It serves as a distinguishing factor between strategic, long-term investors and speculative traders who rely on short-term market fluctuations....

Warren Buffett’s Investment Philosophy and Practice

Warren Buffett, often hailed as the “Oracle of Omaha,” is widely regarded as one of the most successful investors in history. His approach to investing has not only made him one of the wealthiest individuals in the world but has...

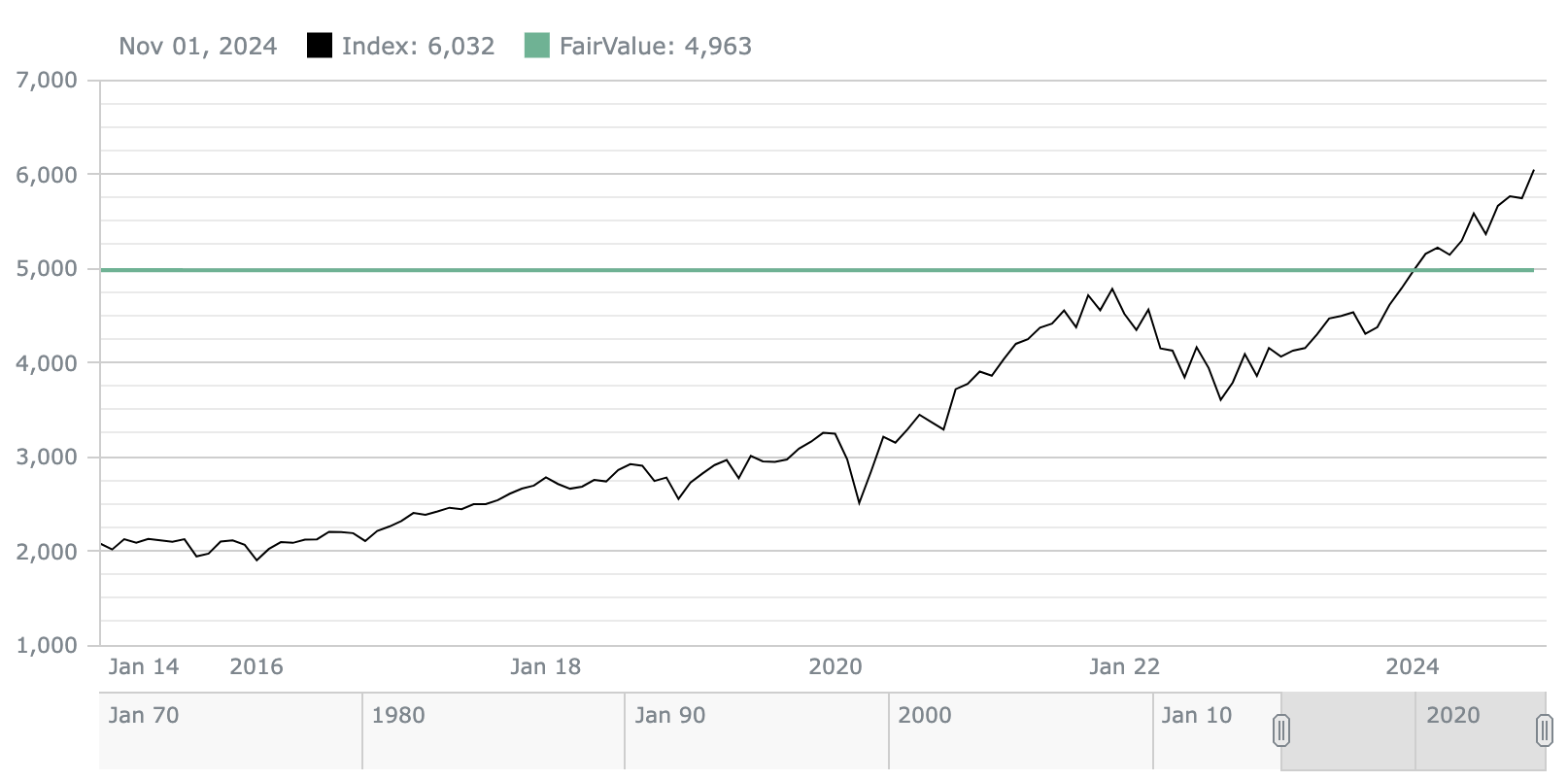

Understanding Fair Value – What It Means for Investors

In the complex world of finance and investment, understanding the concept of fair value is crucial for making informed decisions. Fair value is a fundamental principle that helps investors, analysts, and financial professionals assess the true worth of assets, securities,...

How to Utilize a Fair Value Calculator to Determine the True Worth of Stocks

Investing in stocks can be a rewarding endeavor, but it also carries inherent risks. One of the biggest challenges for investors is determining the true worth or fair value of a stock before making an investment decision. Overpaying for a...

How to Calculate the Piotroski F-Score

Introduction to the Piotroski F-Score The Piotroski F-Score is a relatively simple quantitative scoring system used to evaluate the financial strength of a company. Developed by accounting professor Joseph Piotroski in 2000, the F-Score aims to identify firms with strong...

What is the Difference Between Intrinsic and Extrinsic Value?

Value is a complex and multifaceted concept that has been the subject of intense philosophical and economic debate for centuries. At the heart of this debate is the fundamental distinction between intrinsic value and extrinsic value. Understanding this distinction is...

The Monaco Method Fair Value Calculator

A Revolutionary Approach to Business Valuation In the dynamic world of business, accurate valuation is paramount for strategic decision-making, mergers and acquisitions, and investment planning. Traditional valuation methods often rely on complex financial models and subjective assumptions, leading to potential...

EAF Fair Value

An In-Depth Analysis Enterprise Application Framing (EAF) fair value is an important concept for investors to understand when evaluating technology companies. EAF refers to proprietary software platforms and applications developed by a company for use in its operations. Determining the...