Stock Decision Tool: Buy or Sell?

Stock Decision Tool: Unleashing the Power of 8 Essential Factors for Informed Buy and Sell Decisions!

Introducing “Investor’s Insight: Should I Buy or Sell the Stock?” – Your Guide to Informed Investing Decisions!

Welcome to Investor’s Insight, a powerful tool designed to help you make sound investment choices. With our carefully curated set of questions inspired by Warren Buffett, you’ll gain valuable insights into whether you should buy or sell a stock. Our intuitive survey format will empower you to navigate the world of investing with confidence!

Discover the secrets of successful investing with “Investor’s Insight: Should I Buy the Stock?” Begin the survey now and unlock the knowledge you need to make informed financial decisions. Let’s dive in and uncover the path to potential profitability together!

Investor's Insight: Should I Buy or Sell?"

Explore the Survey: Below the heading, you will find a series of ten thought-provoking questions related to investing in stocks. Each question focuses on a critical aspect that Warren Buffett considers when evaluating potential investments.

Answer the Questions: For each question, you will see two buttons: “Yes” and “No.” Carefully analyze each question and click the button that best reflects your assessment or belief. When you click an answer, it will be visually marked, allowing you to keep track of your responses.

Track your Responses: As you progress through the survey, the tool will tally your “Yes” and “No” answers. The count of your responses will be used to determine the final recommendation.

Get the Recommendation: Once you have answered all the questions, the tool will calculate your responses and provide a clear recommendation. The result will be prominently displayed, indicating whether you should “Buy the stock” or “Sell the stock.”

How the Result is Calculated: The calculation of the recommendation is based on the proportion of “Yes” and “No” answers you provided. If more than two-thirds of your answers are “Yes,” the tool will recommend buying the stock. Conversely, if there are more “No” answers, it will suggest selling the stock.

Interpret the Recommendation: The recommendation is derived from the principles Warren Buffett follows when making investment decisions. However, please note that the recommendation is not a guarantee of success or failure. It serves as a guideline and starting point for further analysis and due diligence.

Utilize the Insight: The recommendation generated by the survey can serve as valuable input in your investment decision-making process. It is important to complement this insight with comprehensive research, analysis of financial indicators, and evaluation of market conditions to make well-informed investment choices.

By leveraging the power of this survey tool, you can gain valuable insights and make informed financial decisions. Start the survey now and unlock the secrets to successful investing!

Buy or Sell? - Decision Tool:

Should I Buy the Stock?

When it comes to investing in stocks, there are certain key factors that investors often consider to assess the potential for future price appreciation. This list highlights eight important characteristics that are commonly associated with stocks that have a higher likelihood of experiencing positive price movements.

These factors include solid financial metrics, growth potential, strong market position, innovation capability, experienced management, positive market trends, dividend policy, and attractive valuation.

By evaluating these attributes, investors can gain valuable insights into the potential for a stock to rise in value. However, it’s important to conduct thorough research and analysis to make informed investment decisions.

8 Crucial Factors for Making Buy or Sell Decisions:

- Solid Financial Metrics: Strong financial indicators such as revenue, profits, margins, low debt, and positive cash flow.

- Growth Potential: The likelihood of future growth in terms of revenue, profits, market share, or expansion into new markets.

- Strong Market Position: A favorable competitive position, market share, and ability to maintain or strengthen its position.

- Innovation Capability: The ability to introduce new and innovative products, services, or technologies to meet evolving market demands.

- Experienced Management: A competent and knowledgeable management team with a track record of successful decision-making and strategic leadership.

- Positive Market Trends: Benefitting from favorable industry or market trends, such as increasing demand, regulatory support, or technological advancements.

- Dividend Policy: Regular dividend payments or a sustainable dividend policy that provides income to shareholders.

- Attractive Valuation: A favorable valuation relative to peers or historical data, suggesting the stock may be undervalued.

Unlocking Investment Success with Investor's Insight and the Fair Value Calculator!

Investor’s Insight, in combination with the powerful Fair Value Calculator, offers you a comprehensive toolkit to enhance your investment decision-making process. Together, these tools can provide valuable insights and guide you toward making informed investment choices.

Leveraging Investor’s Insight: The Investor’s Insight survey acts as a valuable starting point, allowing you to assess key investment factors inspired by the wisdom of Warren Buffett. By answering a set of carefully curated questions, you gain a deeper understanding of the company’s fundamentals and its potential as an investment opportunity.

Identify Buy or Sell Opportunities: The survey’s recommendation to “Buy the stock” or “Sell the stock” provides a valuable initial assessment based on your responses. This recommendation serves as a guiding principle in your investment journey, helping you determine whether to pursue an investment or explore alternative options.

Complementing with the Fair Value Calculator: The Fair Value Calculator is a premium tool designed to assess a stock’s intrinsic value based on fundamental analysis. By considering financial indicators, growth prospects, industry trends, and other relevant factors, the Fair Value Calculator provides you with an estimate of the stock’s fair value.

The Synergy: Combining the insights gained from Investor’s Insight with the results from the Fair Value Calculator enhances your decision-making process. By understanding the potential of a stock through the survey and assessing its fair value with the calculator, you gain a well-rounded perspective that helps you make more informed and rational investment decisions.

Uncovering Opportunities: Investor’s Insight and the Fair Value Calculator work together synergistically, empowering you to uncover hidden investment opportunities. The survey guides you to evaluate the qualitative aspects of a stock, while the calculator provides a quantitative assessment. Together, they enable you to identify stocks that align with your investment goals and have the potential to generate favorable returns.

A Holistic Approach: Successful investing requires a holistic approach that considers both qualitative and quantitative factors. Investor’s Insight and the Fair Value Calculator offer a comprehensive toolkit that caters to different aspects of investment analysis. By utilizing these tools, you can gain a competitive edge and make informed decisions based on a robust investment strategy.

Remember, while this survey and the Fair Value Calculator provide valuable guidance, they should be used as part of a broader investment strategy. It’s essential to conduct thorough research, stay updated on market trends, and consult with financial professionals when necessary. By leveraging these tools and adopting a disciplined approach, you can navigate the dynamic world of investing with confidence and increase your chances of achieving long-term success.

Experience the power of Investor’s Insight and the Fair Value Calculator today, and embark on a journey towards intelligent and profitable investment decisions.

Unleash Your Investing Potential: Discover Our Premium Buy and Sell Decision Tool with Advanced Quality Testing!

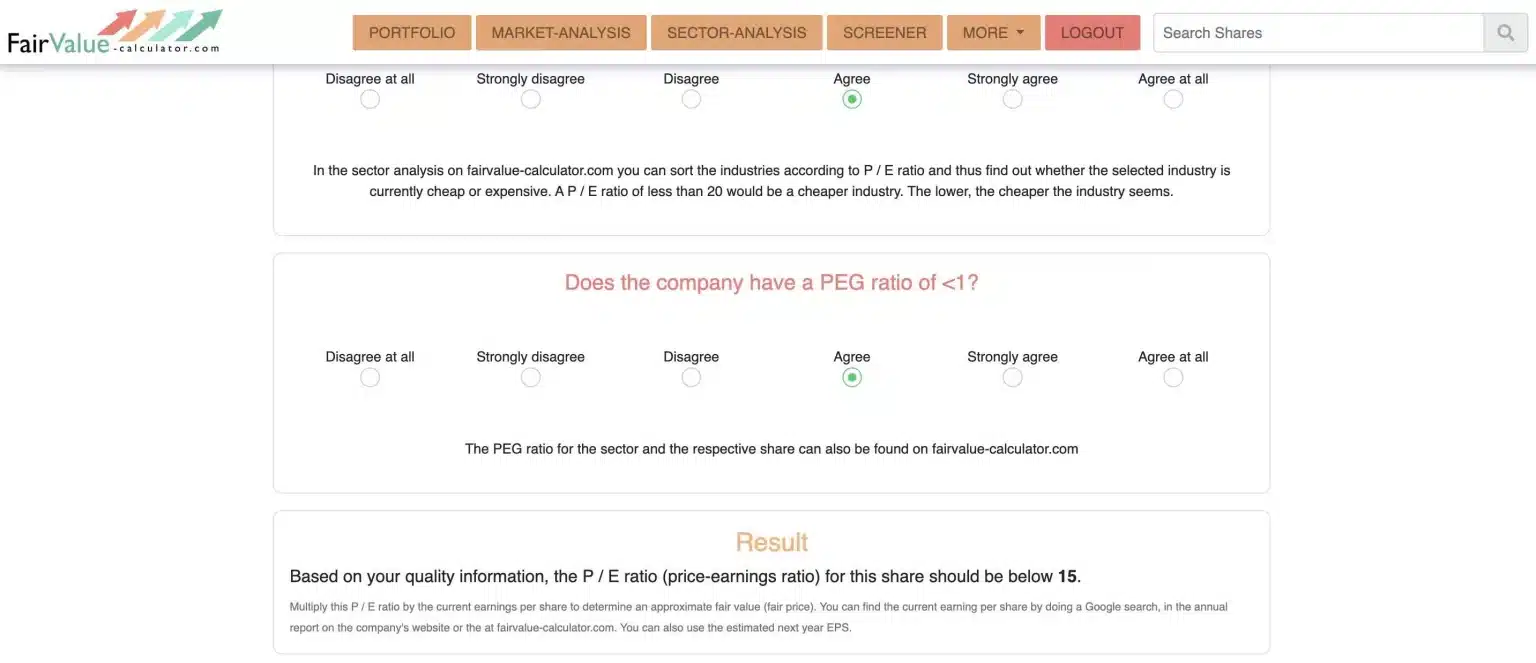

In our Premium Tools, we offer an enhanced version of the buy-and-sell decision tool. The quality test conducted on our premium tools yields a favorable P/E ratio that can be compared to the actual P/E of the stock. If the actual P/E is lower than the result of the premium tool’s quality test, it suggests that the stock may be a compelling investment opportunity.

Explore these exceptional tools and more within our premium area, where a wealth of resources awaits you.

Unleash Your Stock Data Instantly.

100% Satisfaction - 0% Risk - Cancel Anytime.