Altman Z-Score Calculator

Analyze a Company's Financial Stability and Bankruptcy Risk with the Altman Z-Score Model

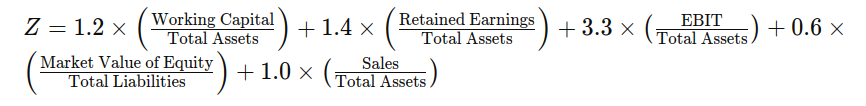

How to Calculate the Altman Z-Score

The Altman Z-score is a financial formula used to predict the likelihood of a company going bankrupt within two years. It is based on five key financial ratios derived from a company’s income statement and balance sheet. These ratios are weighted and combined to produce a single score, which can indicate the financial health of a company.

The formula was developed by Edward I. Altman in 1968 by analyzing a sample of companies that had gone bankrupt and comparing them to companies that had survived, matched by industry and size. The weights for each ratio in the formula were derived from this analysis.

Original Public Firms Altman Z-Score Formula

- Working Capital / Total Assets: This ratio measures the company’s ability to cover its short-term obligations with its short-term assets.

- Retained Earnings / Total Assets: This ratio indicates how much of the company’s profits are reinvested in the company rather than paid out as dividends.

- EBIT / Total Assets: This ratio measures the company’s profitability relative to its total assets.

- Market Value of Equity / Total Liabilities: This ratio assesses the company’s leverage by comparing the market value of its equity to its liabilities.

- Sales / Total Assets: This ratio evaluates how efficiently the company uses its assets to generate sales.

Interpretation of the Altman Z-Score

Z < 1.8: High risk of bankruptcy

1.8 ≤ Z ≤ 2.7: Likely risk of bankruptcy within the next two years

2.7 < Z ≤ 2.99: Some caution needed

Z ≥ 3: Low risk of bankruptcy; healthy financial condition

Important Considerations

- Not Suitable for Financial Companies: The Altman Z-score is not recommended for financial firms due to the complexity and opacity of their balance sheets and the frequent use of off-balance sheet items.

- Market-Based Models: For financial firms, market-based models like the Merton Model can be used, though they have limited predictive value as they rely on market data.

What is the Altman Z-Score?

The Altman Z-score was developed by Edward I. Altman in 1968 as a method to evaluate the financial performance and bankruptcy risk of companies, particularly public manufacturing firms with assets over $1 million. It has since been adapted for use with private companies and non-manufacturing firms. The Z-score is widely used globally by firms and investors to assess financial health and credit risk.

Benefits of the Altman Z-Score

- Bankruptcy Prediction: It provides a quantifiable measure to predict the likelihood of a company going bankrupt.

- Credit Risk Assessment: Useful for assessing the credit risk of a company.

- Investment Decisions: Helps investors decide whether to buy or sell a company’s stock based on its financial strength.

- Corporate Planning: Assists companies in making strategic decisions to improve financial health and avoid bankruptcy.

By providing a clear and quantifiable measure of a company’s financial health, the Altman Z-score is an invaluable tool for investors, creditors, and company managers alike.

Global Solvency Stock Analysis

45,000 Stocks Assessed for Key Financial Ratios: