Investing in Dividend Stocks: 5 High-Yield Options for Steady Income

Investing in dividend stocks can be a lucrative strategy for investors seeking a steady income stream. In this blog post, we will explore five high-yield options that offer attractive returns for general audience investors. With a formal tone, we will delve into the benefits and considerations of each option, providing valuable insights to help you make informed investment decisions. So, without further ado, let’s dive into the world of dividend stocks and discover the potential for steady income.

1. What are dividend stocks?

Investing in dividend stocks can be a reliable strategy for generating a steady income. Here are five high-yield options to consider.

- Blue chip companies: These are well-established, financially stable companies with a history of consistent dividend payments. Examples include companies like Coca-Cola, Procter & Gamble, and Johnson & Johnson. These companies often have a strong market presence and solid track records of generating profits, making them attractive options for investors seeking steady income.

- Real estate investment trusts (REITs): REITs are companies that own and operate income-generating real estate properties such as office buildings, shopping malls, and apartment complexes. They are required to distribute a significant portion of their earnings to shareholders in the form of dividends. Investing in REITs can provide investors with exposure to the real estate market and a consistent income stream.

- Utility stocks: Utility companies, such as electric and gas providers, are known for their stable and predictable cash flows. These companies often have regulated operations and enjoy a monopoly or near-monopoly status in their respective markets. As a result, they tend to offer attractive dividend yields and can be a reliable source of income for investors.

- Dividend-focused mutual funds or exchange-traded funds (ETFs): Investing in dividend-focused mutual funds or ETFs can provide investors with diversification and professional management. These funds typically invest in a portfolio of dividend-paying stocks, allowing investors to benefit from a broad range of high-yield options. They can be a convenient way for investors to gain exposure to dividend stocks without the need for extensive research and individual stock selection.

- Dividend aristocrats: Dividend aristocrats are companies that have consistently increased their dividends for at least 25 consecutive years. These companies demonstrate a strong commitment to returning value to shareholders and often have a long history of stable earnings growth. Investing in dividend aristocrats can provide investors with a combination of steady income and the potential for capital appreciation.

By considering these high-yield options and understanding the benefits and considerations of each, investors can make informed decisions when investing in dividend stocks. It is important to conduct thorough research, assess risk tolerance, and consult with a financial advisor before making any investment decisions. Happy investing!

2. Benefits of investing in dividend stocks

Investing in dividend stocks offers several benefits. Firstly, dividend stocks provide a consistent stream of income through regular dividend payments. Secondly, they have the potential for long-term capital appreciation, allowing investors to benefit from both income and growth. Lastly, dividend stocks tend to be less volatile compared to non-dividend-paying stocks, offering a level of stability in an investment portfolio.

Key Considerations for Investing in Dividend Stocks

Investors should consider several key factors when investing in dividend stocks. Firstly, they should assess the company’s dividend history and track record of consistent dividend payments. Secondly, they should evaluate the company’s financial health and stability to ensure it can sustain dividend payments. Additionally, investors should analyze the dividend yield, which indicates the annual dividend income relative to the stock price. Lastly, it is important to diversify the dividend stock portfolio to mitigate risk and maximize potential returns.

1. Understanding dividend yield and payout ratio

Dividend yield is a key metric that investors should understand when investing in dividend stocks. It represents the annual dividend income as a percentage of the stock price. A higher dividend yield indicates a higher return on investment. On the other hand, the payout ratio is the percentage of a company’s earnings that is paid out as dividends. It helps investors gauge the sustainability of dividend payments and whether the company is retaining enough earnings for future growth.

2. Evaluating the company’s financial stability

When evaluating the company’s financial stability, investors should consider key factors such as the company’s revenue growth, profitability, and debt levels. Additionally, analyzing the company’s cash flow and liquidity position is crucial to determine its ability to sustain dividend payments. By assessing these financial indicators, investors can make informed decisions about the company’s stability and its potential to generate consistent dividend income.

3. Historical dividend growth and consistency

Historical dividend growth and consistency are important factors to consider when selecting dividend stocks. Investors should look for companies that have a track record of consistently increasing their dividends over time. This demonstrates a commitment to rewarding shareholders and can be an indication of a company’s financial strength and stability. By analyzing historical dividend growth, investors can assess the company’s ability to generate consistent returns and potentially provide a reliable income stream.

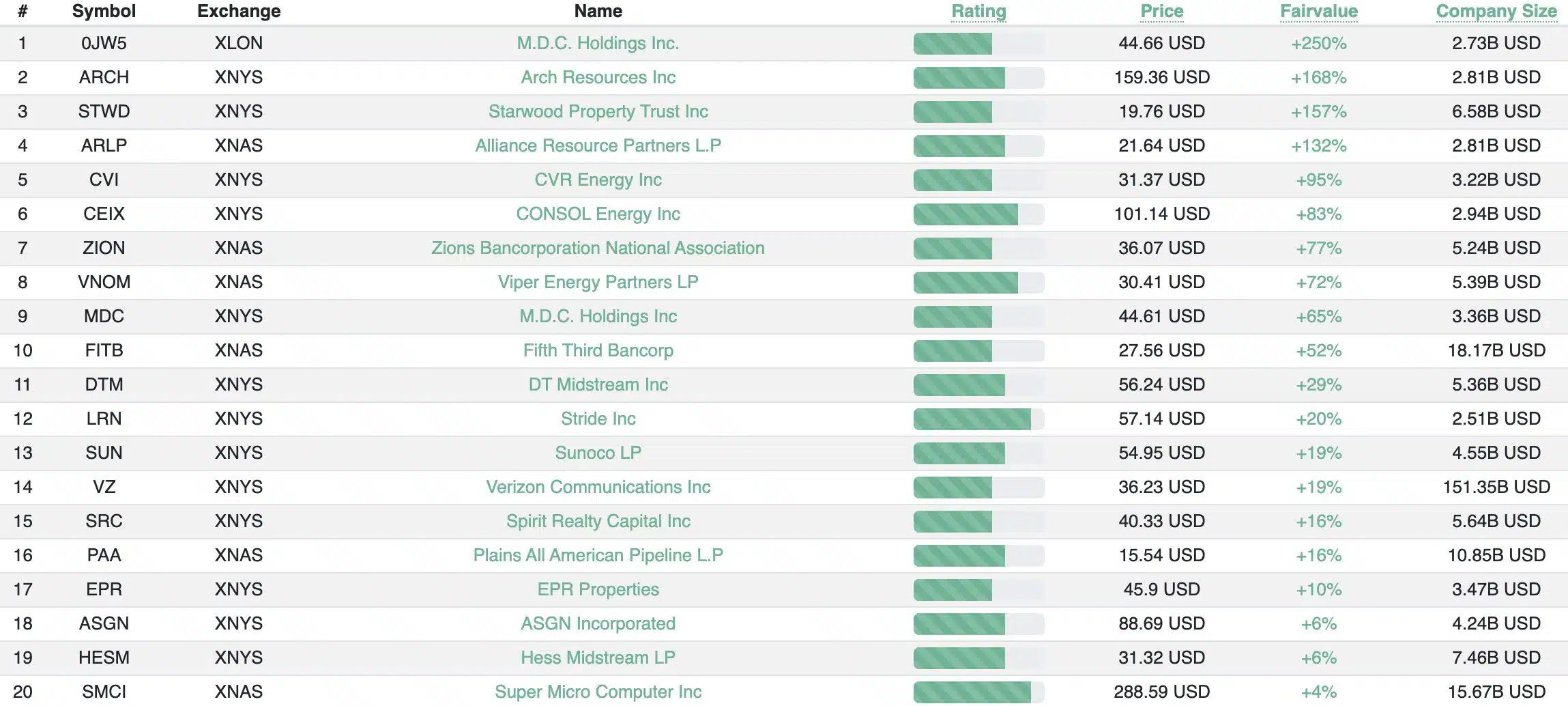

5 High-Yield Dividend Stocks for Steady Income

1. M.D.C. Holdings Inc

2. Arch Resources

3. CVR Energy

4. Verizon Communications

5. Fifth Third Bancorp

Investing in dividend stocks offers a reliable and steady income stream for investors. With careful consideration and research, there are five high-yield options that can provide substantial returns. By diversifying your portfolio with these dividend stocks, you can not only enjoy a consistent income but also benefit from potential capital appreciation. Don’t miss out on the opportunity to enhance your investment strategy and secure a stable financial future with these top high-yield options.