Kostenlos testen. Ohne Kreditkarte.

Was eine Aktie wirklich wert ist

Der Fairvalue Calculator analysiert über 45.000 Aktien mit mehr als 15 bewährten Bewertungsmodellen und zeigt dir in Sekunden, was eine Aktie wirklich wert ist. Liegt der Börsenpreis unter dem Fair Value, kann das auf langfristige Rendite-Chancen hindeuten.

"Du hast wirklich ein großartiges Tool geschaffen. Mach weiter so! Ich bin gespannt, was als Nächstes kommt!"

Sara S.

Feedback via Email aus Australien (übersetzt)"Ich bin sehr begeistert von Eurem Tool. Damals bin ich einer Empfehlung von Euch gefolgt und konnte innerhalb weniger Wochen Renditen im dreistelligen Prozentbereich erzielen."

Lutz S.

Feedback via Email aus Deutschland"Ich hoffe, diese Nachricht erreicht Sie wohlauf. Ich bin ein neuer Benutzer Ihres Dienstes und finde großen Nutzen darin, insbesondere für Aktien, die an der Börse Istanbul gehandelt werden."

Kafkas S.

Email Feedback aus der Türkei (übersetzt)"Vielen Dank für den schnellen Service. Ich finde der Calculator ist eine sehr gute Idee und auch gut umgesetzt! Ein gutes Tool mit viel Potential!"

Frank K.

Feedback via Email aus DeutschlandAktienpreis: 144€ < Fair Value: 207€

Alphabet Inc.

Im Beispiel Alphabet lag der Aktienpreis bei 144 €, der Fair Value bei 207 €. Solche Abweichungen zeigen dir, wo sich genaueres Hinsehen lohnen kann. Genau diese Art Analyse bekommst du für jede Aktie in deinem Depot - mit wenigen Klicks im Fairvalue Calculator.

Markt → Branchen → Aktien → Portfolio Analyse

Markt, Branchen, Aktien & Portfolio in einem Tool

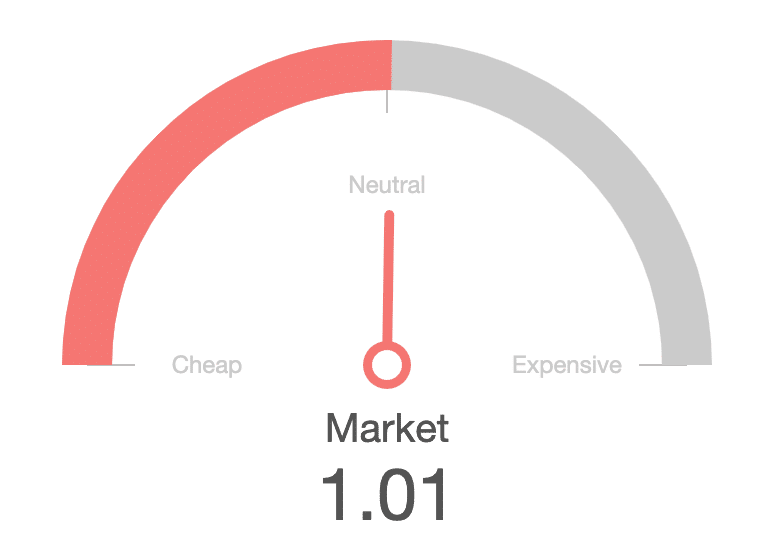

Der Fairvalue Calculator zeigt, wann der Gesamtmarkt attraktiv bewertet ist, welche Branchen besonders günstig sind und welche Aktien sich für ein ausgewogenes Portfolio eignen.

Markt Bewertung

Aktien Statistik

Cash Reserve

Erleben Sie den Fair Value Faktor

Ihre Strategie + Fair Value Faktor

Kombinieren Sie Ihre Strategie mit dem Fair Value Faktor und steigern Sie Ihre Rendite.

Hohe Dividendenrendite:

Hohes Wachstum:

Hohe Rendite:

Die besten Strategien!

Vorgefertigte Aktienlisten, die zu Ihren Anlagekriterien passen, plus ein vollwertiger Aktienscreener für eigene Strategien und alle gängigen Filter.

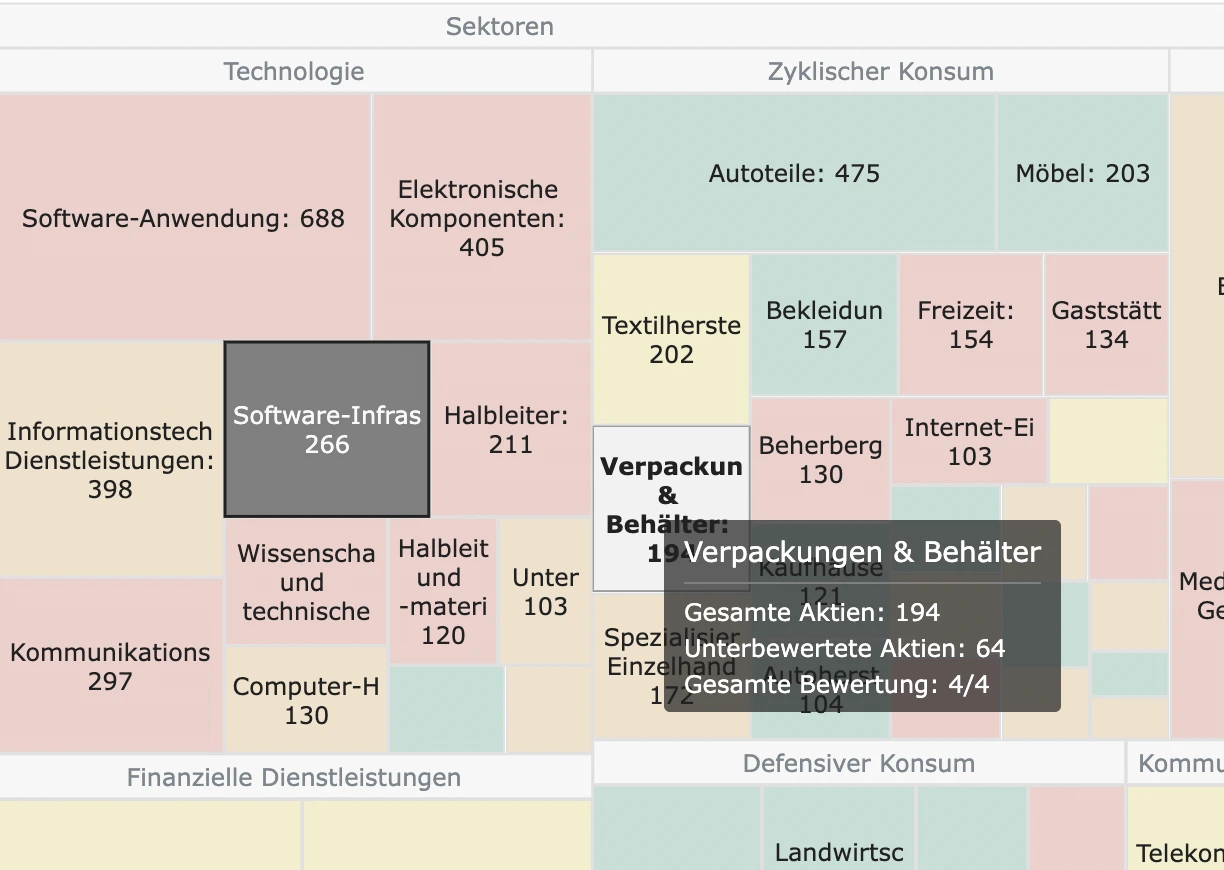

Branchen Analyse

Sehen Sie die lukrativsten Branchen auf einen Blick.

So einfach finden Sie die besten Branchen: Je mehr grün, desto besser. Branchenlisten enthalten die Fair Value Aktien.

Fair Value, Kennzahlen und relative Performance zum Markt.

Mit dem Sektoranalyse-Tool stellen wir einen neuen Weg vor, um großartige Sektoren zu finden, in die investiert werden kann. Die Kombination aus Kennzahlen wie KGV oder PEG und der relativen Performance zur Marktentwicklung zeigt unterbewertete Sektoren, die sich gegen einen allgemeinen Trend stemmen können oder besonders von einem Trend profitieren.

Kennzahlen und Multiple Vergleich

Entdecken Sie den neuen Weg Ihrer Analyse.

Aktiendaten entdecken, interpretieren und vergleichen. Vergleichen Sie einfach die Finanzdaten der Aktie mit ihren Konkurrenten und mit den durchschnittlichen Zielen, die allgemein als gut für die zukünftige Aktienentwicklung angesehen werden. Jede Box ist wie immer farbcodiert, je grüner, desto besser. Aus diesen Daten wird mit 15 verschiedenen Bewertungsmodellen der Fair Value geschätzt und das Fundamentalrating erstellt. Zusätzlich ist das Gewinn- und Umsatzwachstum in unseren Algorithmus und KI integriert.

Jetzt kostenlos testen

5 Aktien gratis im Trial analysieren - ohne Kreditkarte, ohne Risiko. Upgrade auf die uneingeschränkte Vollversion ist jederzeit möglich.

KOSTENLOS TESTEN

6 Monate

14 Tage Free

- 5 kostenlose Aktienanalysen

- Alle Fair Value-Modelle testen

- Aktiensuche & Watchlist

- Einblick in Screener & Ratings

- Ohne Kreditkarte, ohne Risiko

UNLIMITIERT - JÄHRLICH

12 Monate

30 Tage Free

- Unbegrenzte Aktienanalysen

- Fair Value-Modelle & AI-Ratings

- Über 50.000 Aktien weltweit

- Aktien-Screener mit Strategien

- Portfolio Manager

- KI-Copilot mit fertigen Prompts

- Markt- & Branchenanalyse

- Jährliche Abrechnung

- Vollversion - bester Preis

UNLIMITIERT - MONATLICH

1 Monat

7 Tage free

- Unbegrenzte Aktienanalysen

- Fair Value-Modelle & AI-Ratings

- Über 50.000 Aktien weltweit

- Aktien-Screener mit Strategien

- Portfolio Manager

- KI-Copilot mit fertigen Prompts

- Markt- & Branchenanalyse

- Monatliche Abrechnung

- Vollversion - beste Flexibilität

Sicherer Checkout.

Sicherer Checkout

mit PayPal, Amazon Pay oder Kreditkarte.

Jederzeit kündbar.

Kündigen Sie Ihr Abo wann immer

Sie möchten via Konto, PayPal oder Mail.

Sofortiger Zugang.

Sie erhalten Ihre Premium Tool

Zugangsdaten sofort.

Dr. Peter Klein, BA

#1 Google Ranked Fair Value Rechner. International gelistet und tausendfach genutzt.

"So weit sind wir bereits gekommen! Ursprünglich wollte ich dieses Tool nur für mich selbst entwickeln, um die Märkte besser zu verstehen und Unternehmen zu finden, die abseits des Rampenlichts oft übersehen werden. Von Beginn an steckte viel Herzblut in diesem Projekt. Doch das unerwartet starke Feedback hat mich motiviert, den Fairvalue Calculator für alle zugänglich zu machen, die Wert auf fundierte Analysen legen. Seitdem arbeite ich mit großer Leidenschaft daran, das Tool kontinuierlich weiterzuentwickeln. Denn am Ende geht es darum, echten Mehrwert zu schaffen - nicht nur für mich, sondern für alle, die diese Leidenschaft teilen."

"Du hast wirklich ein großartiges Tool geschaffen. Mach weiter so! Ich bin gespannt, was als Nächstes kommt!"

Sara S.

Feedback via Email aus Australien (übersetzt)"Ich bin sehr begeistert von Eurem Tool. Damals bin ich einer Empfehlung von Euch gefolgt und konnte innerhalb weniger Wochen Renditen im dreistelligen Prozentbereich erzielen."

Lutz S.

Feedback via Email aus Deutschland"Ich hoffe, diese Nachricht erreicht Sie wohlauf. Ich bin ein neuer Benutzer Ihres Dienstes und finde großen Nutzen darin, insbesondere für Aktien, die an der Börse Istanbul gehandelt werden."

Kafkas S.

Email Feedback aus der Türkei (übersetzt)Vielen Dank für den schnellen Service. Ich finde der Calculator ist eine sehr gute Idee und auch gut umgesetzt! Ein gutes Tool mit viel Potential!